Value of Assets in DeFi has Risen by Almost 70% Since 2021

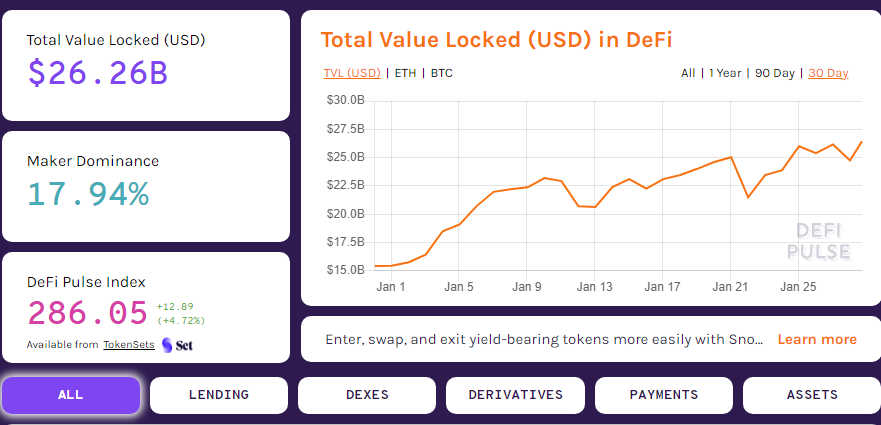

The value of cryptocurrencies locked in decentralized finance (DeFi) has been gradually increasing since the start of the new year. The increase can be attributed to the recent rally in the crypto market that saw Bitcoin and Ether soar to a new record level, although both coins are currently trading below the new all-time high.

However, it’s also worth noting that the number of Bitcoin locked in DeFi protocols also increased within that period, while Ether remained flat, according to the data provided by DeFi Pulse.

DeFi Reaches new High in Asset Valuation

The total cryptocurrencies locked in decentralized finance protocols are worth US$26.26 billion, as per DeFi Pulse. This is quite a significant growth given that there was only US$15.4 billion worth of assets in DeFi on January 1, 2021. So, following the new all-time high, DeFi TVL is currently up by almost 70 percent, and this valuation is dominated by the decentralized Lending platform.

The Lending protocols account for US$12.41 billion of DeFi market valuation, followed by decentralized exchanges with a total asset valuation of US$9.22 billion. The Derivatives protocols see a market valuation of US$2.16 billion, followed by the Payment and Assets protocols with US$199.7 million and US$2.28 million, respectively.

Top DeFi Protocols

The decentralized lending platform, Maker, is the largest protocol on the decentralized. It accounts for 17.97 percent of the entire DeFi market cap with US$4.71 billion. Aave has a market valuation of US$3.83 billion, followed by Compound with US$3.15 billion in TVL.

Other protocols with a valuation greater than US$2 billion are as follows: Uniswap (US$3.15 billion), Curve Finance (US$2.71 billion), and SushiSwap (US$2.04 billion).

DeFi Outlook

The increasing concern with centralized finance platforms regarding censorship and central authority is promoting/emphasizing the need for decentralized finance. Especially, the ongoing case of GameStop is causing many industry players to preach DeFi as a solution, including the co-founder of the Gemini exchange.