Report Highlights US, India and UK as Leading Crypto Economies

- The United States’ crypto transaction volume is four times larger than next in line India.

- The UK is one of the fastest-growing digital asset nations in the world, Chainalysis reports.

- The Central, Northern and Western Europe (CNWE) region saw an influx of DeFi expenditure over the past 12 months.

Leading crypto and blockchain analysts, Chainalysis, have released an excerpt of their 2023 Geography of Cryptocurrency Report, scheduled for a full release later this month. The key takeaway from the data is uncovering the three biggest crypto nations in the world (based on raw transaction volume) – the US, India and the UK.

The United States Leads Competition

The United States is by far the biggest market for crypto in the world, more than 4x larger than its nearest competitor, India. Between Jul 2022 and Jun 2023, over US $1 trillion ($1.58 trillion) in crypto transactions were sent/received in the country. In contrast, India barely ticked over US $250 billion ($395 billion).

Although the United States stood head and shoulders above the rest, the United Kingdom’s performance came as a pleasant surprise to the British crypto community. According to Jamie McNaught, the CEO of UK exchange Solidi, the heightened interest in digital currencies comes due to poor savings products and underperforming investment portfolios in traditional markets.

Central, Northern, and Western Europe Now Second-Largest Crypto Economy

Thanks in large part to the UK’s rising interest in the digital assets sector, Chainalysis has reported that Central, Northern and Western Europe (CNWE) is now the world’s second-biggest crypto consumer. The region, which encompasses growing crypto nations like Luxembourg, Albania, Spain and the UK, comprised 17.6% of all digital currency transactions over the past 12 months. This puts it behind only North America in terms of recent activity.

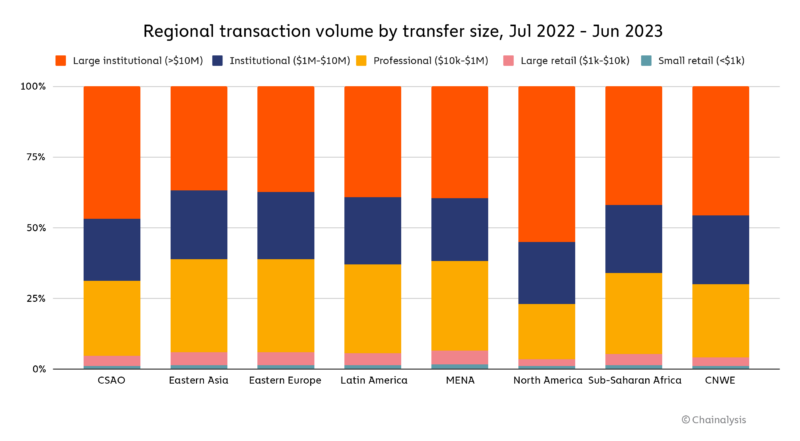

Of particular note is the CNWE region’s focus on decentralised finance (DeFi). The region had the highest proportion of DeFi inflow, with 54.8% of crypto value received coming from products like decentralised exchanges (DEXs) and yield farming platforms. Like most developed regions, the vast proportion of money changing hands came from institutional investors, who were responsible for nearly 75% of all crypto trading activity.

The data demonstrates an appetite for crypto among high-profile financial institutions in spite of the long-running bear market. In addition, the heightened DeFi activity suggests that investors are becoming a bit savvier and are starting to optimise their assets, rather than letting them sit idly in a wallet.