Top 3 Coins to Watch Today: NEAR, LINK, ICP – July 11 Trading Analysis

Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Near Protocol (NEAR)

NEAR Protocol is a decentralised application platform designed to make apps usable on the web. The network runs on a Proof-of-Stake (PoS) consensus mechanism called Nightshade, which aims to offer scalability and stable fees. NEAR uses human-readable account names, unlike the cryptographic wallet addresses common to Ethereum. NEAR also introduces unique solutions to scaling problems and has its own consensus mechanism, called “Doomslug”.

NEAR Price Analysis

At the time of writing, NEAR is ranked the 25th cryptocurrency globally and the current price is US$3.57. Let’s take a look at the chart below for price analysis:

During Q2, NEAR retraced 70% from its highs to support at the retracement of around $3.09.

The price shifted market structure to run to the consolidation lows near $3.40, just under the monthly open. A continued bearish trend in the market may create support just below, between $3.00 and $2.76.

On the other hand, if the current resistance breaks, the price may find resistance near $4.23 and $5.14, whereas mid-Q2 buyers might still be trapped in longs.

2. Chainlink (LINK)

The Chainlink Network LINK is driven by a large open-source community of data providers, node operators, smart contract developers, researchers, security auditors, and more. The company focuses on ensuring that decentralised participation is guaranteed for all node operators and users looking to contribute to the network. Chainlink allows blockchains to securely interact with external data feeds, events, and payment methods, providing the critical off-chain information needed by complex smart contracts to become the dominant form of digital agreement.

LINK Price Analysis

At the time of writing, LINK is ranked the 23rd cryptocurrency globally and the current price is US$6.20. Let’s take a look at the chart below for price analysis:

LINK‘s early Q2 trend retraced near $5.80 into the consolidation that began the impulse before bouncing to $8.92. This consolidation could provide support again, although bears would first have to push the price through possible support near $6.10.

The market’s structure may be shifting bearish, with $7.40 likely to provide some resistance if this is the case. A sustained bearish move could reach the swing low near $6.00 before finding support near $5.87.

However, the bullish higher-timeframe trend may prevail, with relatively equal highs near $7.27 potentially giving an attractive target to lure the price over the monthly open. If so, the price could reach for the midpoint of the Q1 wick near $9.18.

3. Internet Computer (ICP)

The Internet Computer ICP is the world’s first blockchain that runs at web speed with unbounded capacity. It also represents the third major blockchain innovation, alongside Bitcoin and Ethereum. The Internet Computer scales smart contract computation and data, runs them at web speed, processes and stores data efficiently, and provides powerful software frameworks to developers. By making this possible, it enables the complete re-imagination of software, providing a revolutionary new way to build tokenised internet services, pan-industry platforms, decentralised financial systems, and even traditional enterprise systems and websites.

ICP Price Analysis

At the time of writing, ICP is ranked the 34th cryptocurrency globally and the current price is US$6.51. Let’s take a look at the chart below for price analysis:

ICP has dropped 53% from its most recent Q2 high as it continues its nine-month downtrend. The edge of the recent swing’s lower candle bodies could provide the closest support, near $5.12. This level overlaps with the 100% extension of June’s opening rally.

Currently, the price is testing possible resistance near $7.00. This level has confluence with the 9 EMA. It is unclear if it will hold as resistance, but it’s reasonable to anticipate a run above bears’ stops at $7.30.

If the price breaks through this resistance, it may find its next resistance near $7.69. This level is near the midpoint of May 12’s swing low and the midpoint of an inefficiently traded area on the weekly chart.

A rally this high may reach slightly higher, near $8.32. This area formed the base of the June opening rally, shows inefficient trading on the daily chart, and is at the low end of May’s accumulation range.

Below, there is no historical price action to suggest possible support. The next downside targets may be near $4.70 and $3.95. These approximate levels are near the 150% and 200% extensions of June’s opening rally.

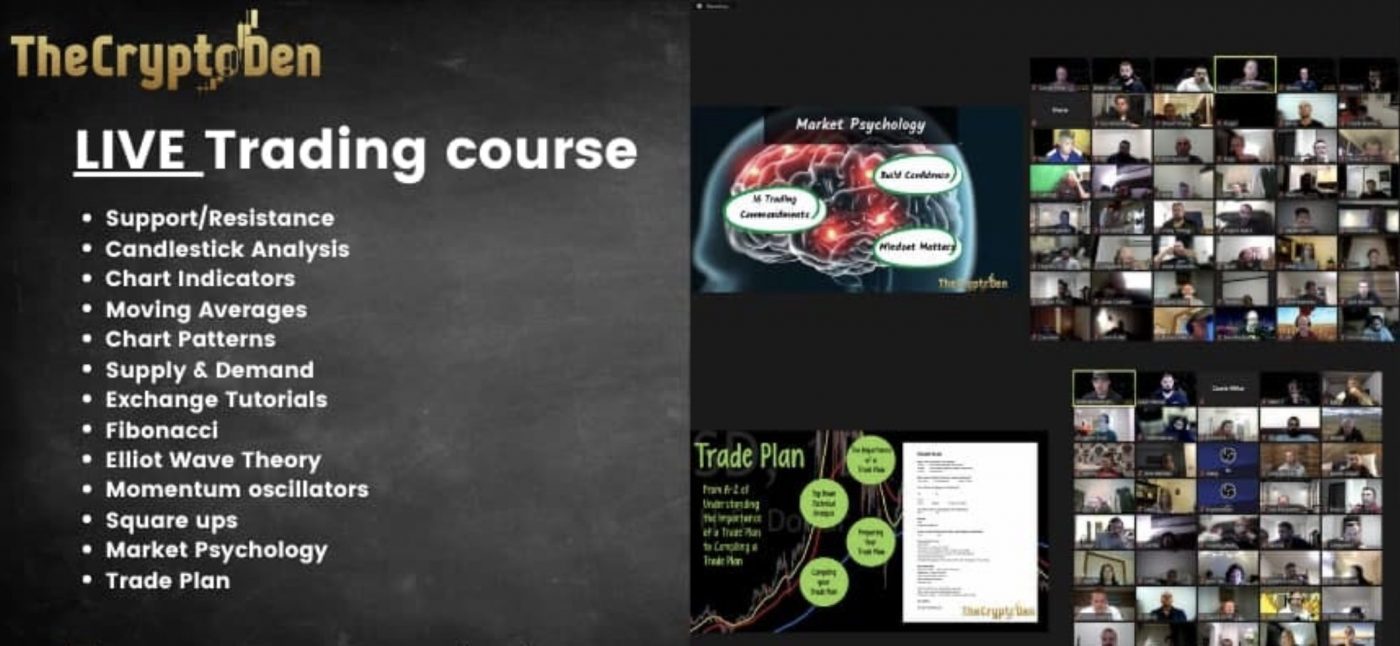

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.