RMIT Data Reveals Aussie Crypto Trading Peaked During COVID-19 Lockdown

What happens when you combine a lot of time at home to contemplate investment options and a growing population of tech-savvy aussies?

Data published by RMIT indicates that the result is a sharp increase in cryptocurrency trading. Australia’s RMIT University insights reveal that during the COVID-19 lockdown instituted between the 23rd of January and the 15th of May, cryptocurrency trading in Australia witnessed an increase in volume.

Data shows there was a 50% spike in home trading volumes, globally, and a 66% jump in Australia.

Angel Zhong – RMIT

Prior to the lockdown, the average daily turnover was only 0.27%, compared to 0.44% during the lockdown.

Whether this skyrocketing investment rate is due to an increase in corporate employees working from home, young entrepreneurs with more funds and options than ever before, or even the closure of casinos, it’s clear that cryptocurrency trading is increasingly considered as a lucrative investment option for investors across Australia.

Cryptocurrency Prices Rise as Australia Locks Down

This increase can be witnessed in the price mark-up since the beginning of the pandemic — Bitcoin is now valued at almost 16,000 AUD, more than twice the value it had in March 2020, where prices hovered near 7000 AUD.

Ethereum currently trades at 500 AUD, far above the price of 200 AUD it held in March, with prices surging by 30% between mid-July and today.

In both cases, the price has more than doubled for both leading cryptocurrencies. Is this a new phenomenon? Yes, but not really. Investing in strong currencies has always been a hallmark of days fraught with economic uncertainty – but now the paradigm has shifted.

In prior times of economic turmoil, the price of gold has increased.The price of gold has also surged during the recent COVID-19 lockdown, but for the first time in history, cryptocurrency has shown its face as an equally, if not superior investment option.

Is decentralization finally catching widespread appeal? Australian trade data appears to indicate that it is. Present data hints towards an economic future that will lean more towards deflationary currency than inflationary, centralized fiat currency.

DeFi is the latest major use case of blockchain technology.

Professor Jason Potts, the Director of the Blockchain Innovation Hub at RMIT University thinks that Decentralised Finance (DeFi) is the latest major use case of blockchain technology and could be the future of financial markets for tokenised assets.

Interest in DeFi – which is the beginnings of a new global digital financial system – is driving this current cryptocurrency price surge.

Jason Potts – RMIT

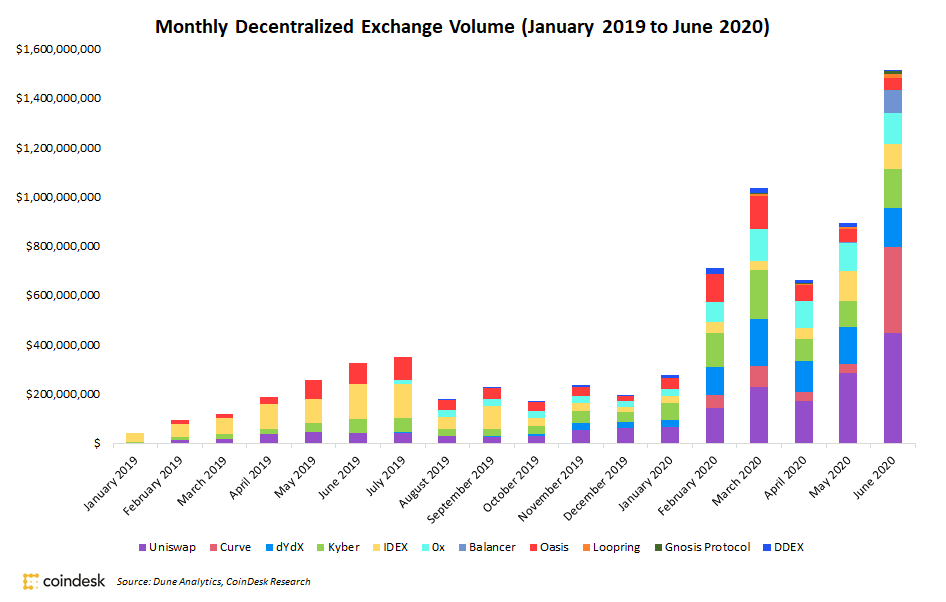

And also we saw that Decentralized Exchange Volumes are up 70% in June, past $1.5 billion according to Jack Purdy, decentralized finance analyst at Messari.

Blockchain networks are also starting to think about DeFi with projects like Qtum announcing a $1 million DeFi development fund.