Top 3 Coins to Watch Today: CRV, XLM, DASH – January 10 Trading Analysis

Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Curve DAO Token (CRV)

Curve CRV is a decentralised exchange for stablecoins that uses an automated market maker (AMM) to manage liquidity. Curve has gained considerable attention by following its remit as an AMM specifically for stablecoin trading. The launch of the DAO and CRV token brought in further profitability, given CRV’s use for governance, as it is awarded to users based on liquidity commitment and length of ownership. The explosion in DeFi trading has ensured Curve’s longevity, with AMMs turning over huge amounts of liquidity and associated user profits.

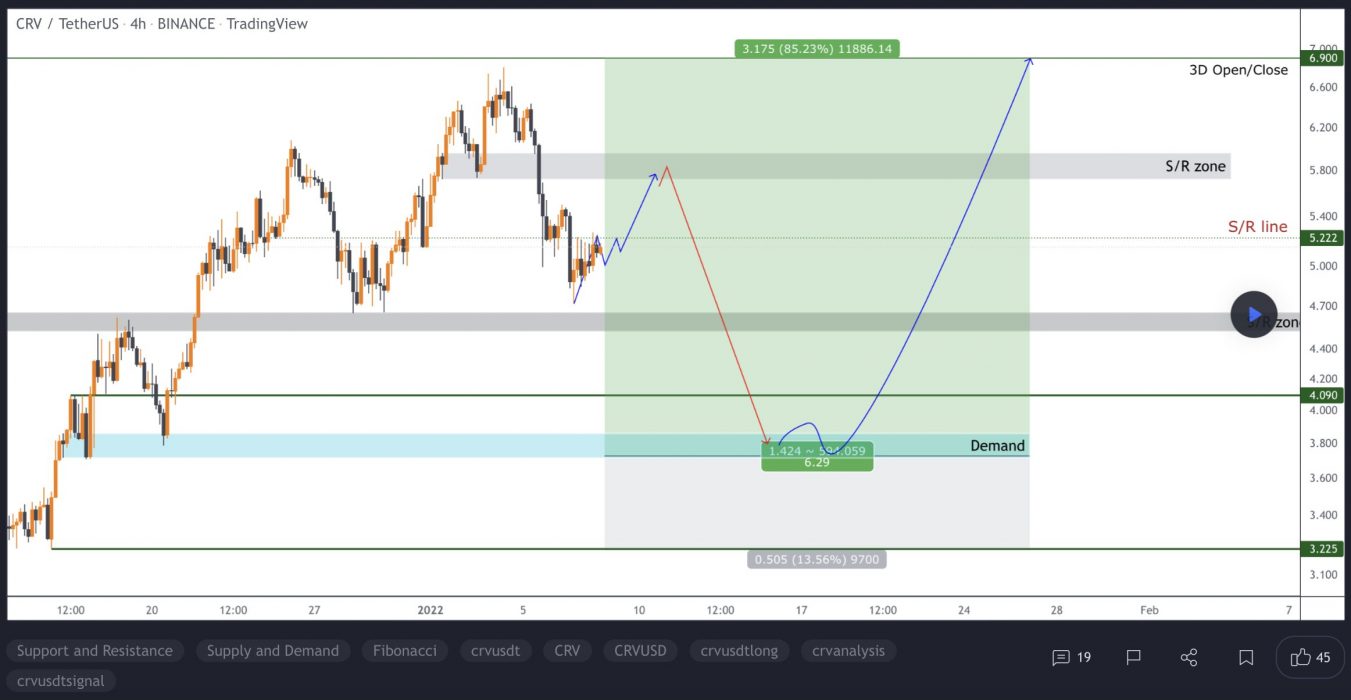

CRV Price Analysis

At the time of writing, CRV is ranked the 59th cryptocurrency globally and the current price is US$4.59. Let’s take a look at the chart below for price analysis:

Last week, bulls enjoyed 65% gains at CRV‘s peak before the price confirmed stiff resistance beginning at $6.58.

The 4-Hour chart shows that support may be forming between $3.86 and $3.75, near the monthly open. Aggressive bulls could enter in this area, although safer entries may be found much further below near $4.29 and $4.05 after a sweep of the current consolidation’s swing lows.

The last swing high near $4.80 provides a likely first target if the price does bounce from this region. Beyond this swing high, the 1.0 extension near $5.26 and the 2.0 extension near $5.72 and $5.94 may provide the next major targets.

2. Stellar (XLM)

Stellar XLM is an open network that allows money to be moved and stored. When it was released, the goal was boosting financial inclusion by reaching the world’s unbanked – but soon after, its priorities shifted to helping financial firms connect with one another through blockchain technology. The network’s native token, lumens, serves as a bridge that makes it less expensive to trade assets across borders. All of this aims to challenge existing payment providers who often charge high fees for a similar service.

XLM Price Analysis

At the time of writing, XLM is ranked the 29th cryptocurrency globally and the current price is US$0.2573. Let’s take a look at the chart below for price analysis:

XLM set a high near $0.4257 in November before retracing nearly 75% to find a low near $0.2380. The price consolidated around this level before the strong bullish impulse during the past several weeks.

Probable resistance near $0.3578 is slowing the bullish advance down. However, another leg might target the last swing high at $0.4022 and relatively equal highs at $0.4336. Resistance near $0.4659 could cap the move before the second swing high. Beyond these levels, little stands in the bulls’ way before reaching the swing high near $0.5149.

A retracement before a move higher might find support in the daily gap near $0.2323, just above the monthly open. Relatively equal lows near $0.2275 could also provide support. A run-on stops at $0.2016 and $0.1931 might find support in the gap beginning near $0.1900 or a high-timeframe level near $0.1723.

3. Dash (DASH)

Dash is an open-source blockchain and cryptocurrency focused on offering a fast, cheap global payments network that is decentralised in nature. According to the project’s white paper, Dash seeks to improve on Bitcoin by providing stronger privacy and faster transactions. Dash’s governance system, or treasury, distributes 10% of the block rewards for the development of the project in a competitive and decentralised way.

DASH Price Analysis

At the time of writing, DASH is ranked the 70th cryptocurrency globally and the current price is US$143.97. Let’s take a look at the chart below for price analysis:

During December, DASH retraced over 63% before finding support near $120. Consolidation above this level has created a series of relatively equal lows, which are likely to be swept before any longer-term bullish trend begins.

In the shorter term, the price might establish support near $138 before running the swing high at $155. If this bullish move occurs, the price could reach resistance near the November monthly open around $175, and may even sweep the swing high near $182.

Some support might exist at the daily gap near $128. A move this low would also fill the monthly gap and set the stage for a possible bullish reversal.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.