Tom Lee’s BitMine Adds $417M in Ethereum, Aiming to Control 5% of ETH Supply

- Tom Lee’s BitMine Immersion Technologies acquired 104,336 ETH worth US$417 million, increasing total holdings to 3.03 million ETH.

- Lee maintains his prediction that ETH will reach US$10k by end of 2025, despite a broader crypto market crash.

- Meanwhile, US spot Ethereum ETFs have shown mixed performance recently with three days of outflows followed by two days of inflows, with Thursday seeing US$56.8 million in net outflows.

Tom Lee’s BitMine Immersion Technologies has expanded its Ethereum holdings by 104,336 ETH worth US$417 million (AU$643 million), bringing its total to about 3.03 million ETH valued at US$12.2 billion (AU$18.8 billion).

The firm’s aggressive accumulation shows it’s still on track with the goal of controlling 5% of Ethereum’s supply and its belief in ETH’s growing role in global finance and institutional adoption. Lookonchain reported that several wallets received the funds from exchanges Kraken and BitGo.

Related: Ripple Makes $1B Move: Acquires GTreasury to Supercharge Blockchain Treasury Management

High Hopes For $10k ETH Despite Market Crash

Lee still believes ETH could reach US$10k (AU$15.4k) by the end of 2025 – an ambitious goal, considering the recent crypto market crash.

Ethereum is down 12% on the month and 9% on the week, currently trading at US$3,914 (AU$6,054) at the time of writing. The crypto market crashed last Friday and continues its downward trend, triggered by Trump’s tweets and excessive leverage.

Some coins dropped as much as 80–90% briefly, while even Bitcoin lost 10% week-on-week. Some Crypto Twitter users said that BitMine’s purchase was the only thing keeping Ethereum’s price from sliding below US$2k (AU$3.08k), while others argued the acquisition happened over-the-counter and wouldn’t affect the spot market.

In reality, the latter view is probably more accurate — OTC transactions don’t directly influence exchange prices, though large corporate accumulations can still lift sentiment and reinforce long-term confidence in the asset.

Related: Australia Targets Crypto ATMs in New Crackdown on Money Laundering and Scams

Ether ETFs With Mixed Results

Another important point of support is the US spot Ethereum exchange-traded funds (ETFs), which have seen record inflows since launching in 2024.

Looking at data from Farside, we can see that the past few trading days have been mixed. After eight days of net inflows, ETH funds saw three days of net outflows, followed by two days of inflows.

The most recent data shows net outflows on Thursday, when US$56.8 million (AU$87.7 million) left these ETFs.

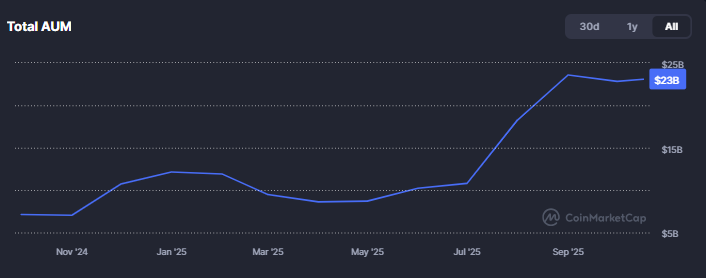

Data from CoinMarketCap shows the ETFs currently hold a combined US$23 billion (AU$35.5 billion) in assets under management (AUM). Although the short-term trend is down, zooming out to the bigger picture since trading began shows solid growth.