This Bear Market May Last Longer Than Others, On-Chain Analytics Firm Suggests

The cryptocurrency market has been rocked in the past couple of months due to several key factors within the industry but also by events at a macroeconomic level.

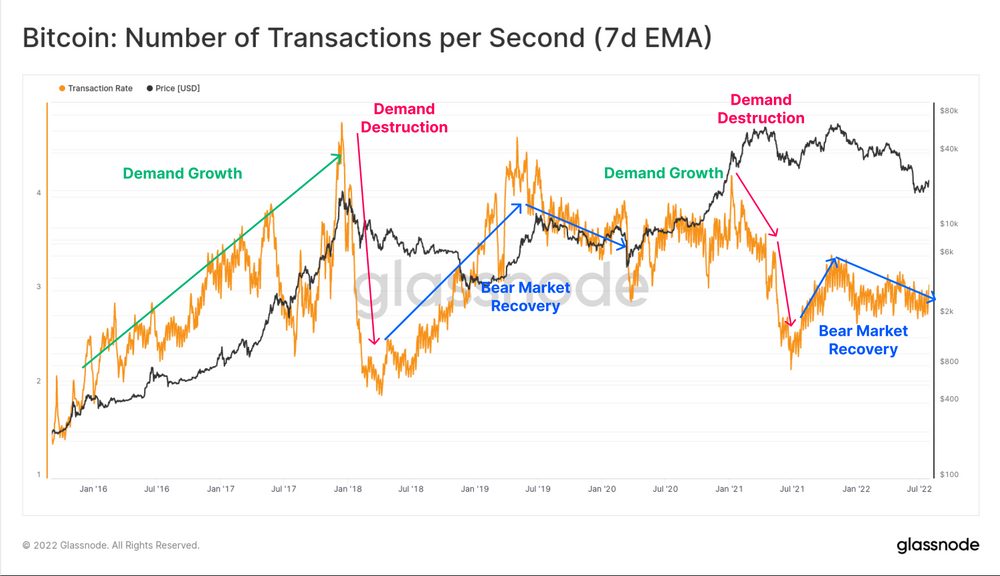

And according to on-chain data from blockchain intelligence firm Glassnode, the current bear market could last longer than others:

Bullish Weeks Not Strong Enough

As per the Glassnode report, Bitcoin and other cryptocurrencies failed to reaffirm a bullish retracement last week, and the market is instead heading towards a harsher downturn that could last several months or even years.

Bitcoin, for example, last week hit a high above US$24,000 shortly after the US Federal Reserve increased interest rates by 75 basis points. However, the father of all cryptos lost momentum entering the new week, falling below the US$23k level.

Glassnode’s report notes that BTC’s on-chain demand remains “lacklustre at best”.

With the exception of a few activity spikes higher during major capitulation events, the current network activity suggests that there remains little influx of new demand as yet.

Glassnode report

The report also observed certain similarities between the current network demand and those from 2018 to 2019. After BTC hit its all-time high in April 2021, the asset has been in a macro-decline despite regaining momentum throughout that year: