Terra’s Stablecoin UST Market Cap Rises 700% in Past 6 Months

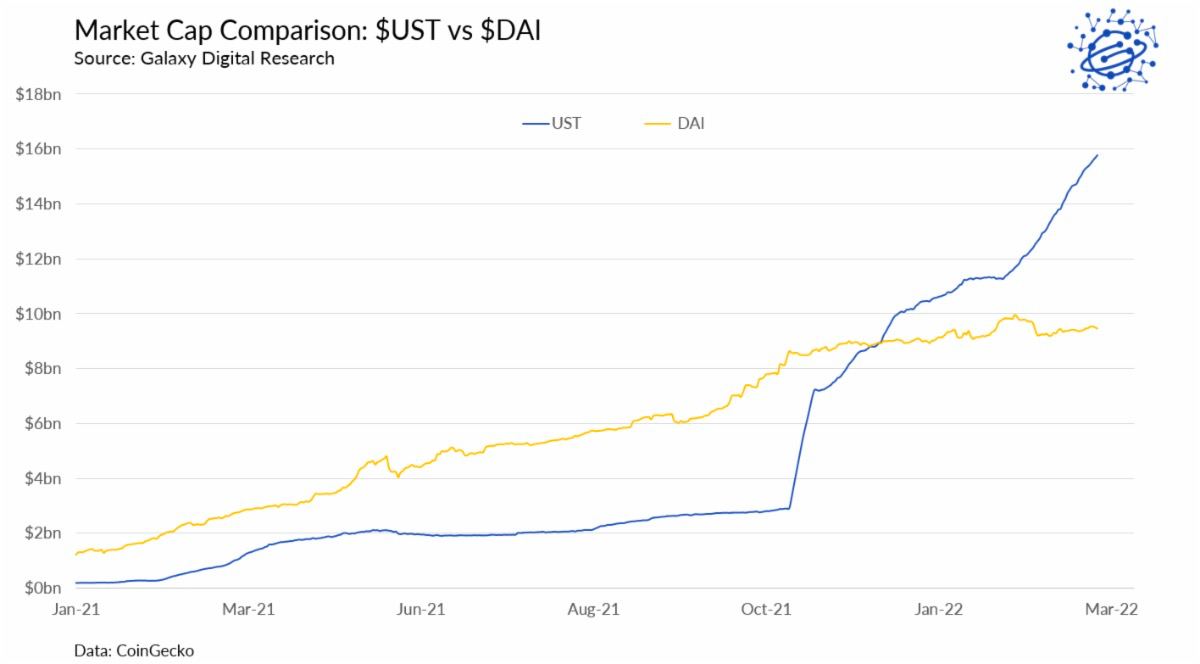

The market capitalisation of the algorithmic stablecoin Terra (UST) has soared in comparison to its longer-running counterpart DAI. Year-to-date, UST’s market cap has increased 700 percent, while DAI’s is up 5.7 percent.

What is Terra?

Terra is a blockchain protocol underpinned by a suite of decentralised stablecoins, the most popular being TerraUSD, or UST, an algorithmic stablecoin that runs on its own Tendermint blockchain. The stablecoins maintain their peg via a coin called LUNA, a volatile cryptocurrency whose elasticity of supply keeps the price of the stablecoin in check.

Voted to Burn

UST trended upwards sharply over the November-December period, starting at under US$3 billion in November. The reason for the major uptake in gains came in mid-November after the Terra community voted to burn 89 million LUNA that had been accumulated in the Terra treasury in exchange for UST. According to the founder of Terra Do Kwon, US$2.7 billion had been minted in this way.

UST Now Interacts With BTC Directly

To understand how Bitcoin links with UST, the Luna Foundation Guard (LFG) announced last week that it would be buying US$10 billion worth of Bitcoin, stating that:

As an algorithmic stablecoin, UST’s peg is maintained by a series of open market operations, arbitrage incentives, and countercyclical levers within the Terra protocol to offset market forces pushing the UST peg above or below one USD. LUNA, Terra’s reserve, staking and governance asset, retains an elastic supply to help neutralise directional market pressures impacting the peg.

LFG announcement

Simply put, Bitcoin is used to restore the UST’s peg parity to the US dollar at times when there are market sell-offs.