Stablecoins Held on Exchanges Hit All-Time High – Are They Getting Ready?

The number of stablecoins on all crypto exchanges has reached a record peak, which signals a likelihood of incoming buying pressure on the market again.

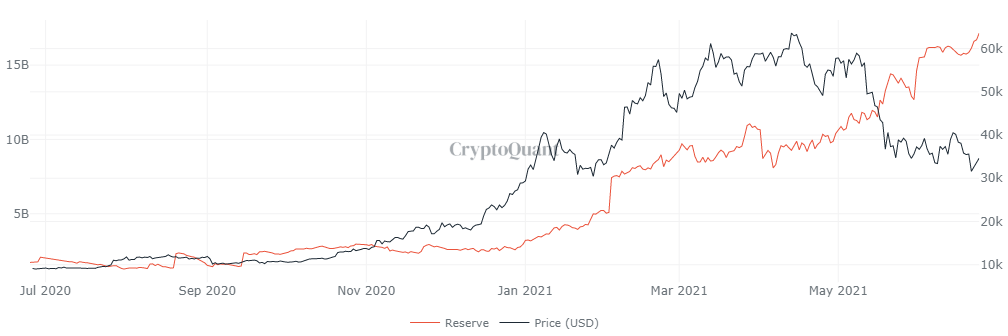

All Exchange Stablecoin Reserve Exceeds $16 Billion

Following the on-chain data from CryptoQuant, there is currently more than US$16 billion worth of stablecoin held in all cryptocurrency exchanges.

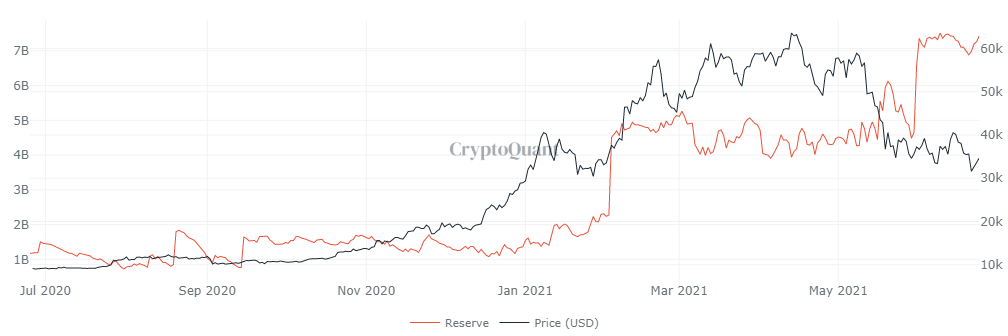

Although USDC supply has been growing faster than Tether (USDT) since the beginning of this year, there’s a much higher number of USDT in exchange reserves than USDC. Over US$7 billion worth of Tether (USDT) is held in crypto exchanges.

At the same time, over US$6 billion BUSD and US$2 billion USDC are held in exchanges’ reserves, according to CryptoQuant.

Stablecoin reserves often serve as an indication for some analysts and traders to position themselves for market pumps. Thus, this latest massive increase in stablecoin reserve suggests the bulls are prepping for a comeback if these coins are being stored for buys.

Bitcoin Liquid Supply is Declining

Bitcoin has been trading below US$35,000 over the past few days due to the bearish state of the market. However, Bitcoin’s liquid supply has been dropping for quite some time, which serves as another indicator that BTC is likely to resume an upward curve, especially in the presence of demand.

Bitcoin’s liquid supply simply refers to the availability of Bitcoin on exchanges for easy buying and selling. A decrease in Bitcoin liquidity indicates that people are starting to move their coins off exchanges. This can result in a scarcity of BTC, which is probably bullish provided the demand increases.