Reasons Why Bitcoin Crashed This Week

This week was the rough for Bitcoin, as data shows that over 30,749,89 (around $1,469,578,437.99 AUD) were sold, making it the biggest BTC selloff since March 2020.

The global crypto market has lost approximately $1 trillion USD following Bitcoin and Ethereum massive selloffs across exchanges —which trailed most cryptocurrencies with them, including Dogecoin (DOGE).

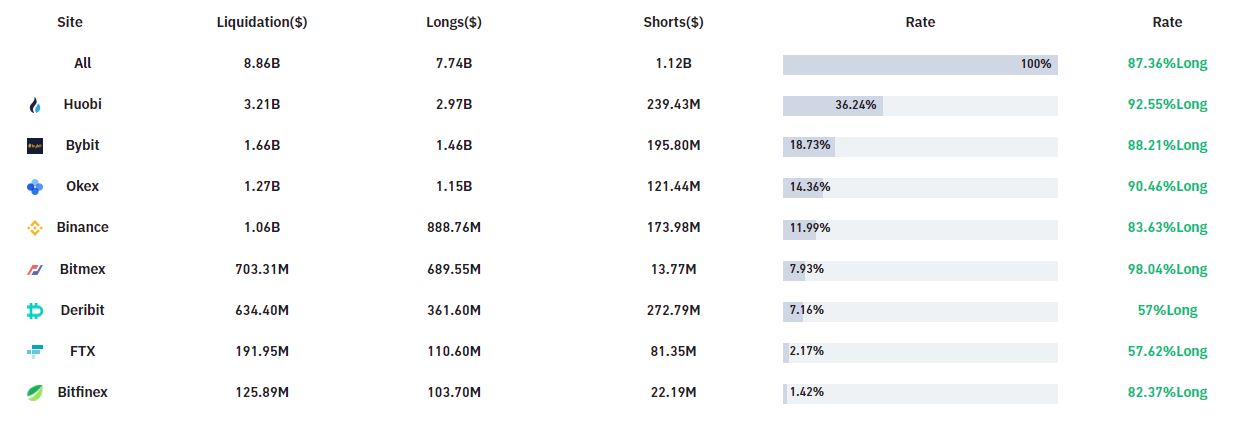

Bitcoin is currently at around $50,000 AUD while Ethereum $3,500 AUD. The market lost around $250 billion USD on Monday, but panic selling seems nowhere to stop as over $8 billion USD liquidations were triggered over the last 24h.

Environmental Concerns

There are many possible reasons as to why the crypto market has plunged this week, starting with Elon Musk backtracking on Bitcoin, announcing Tesla will not accept BTC payments due to “environmental concerns”.

The announcement caused an adverse reaction to most cryptocurrencies in the market. Most altcoins were enjoying a steady altseason as BTC was losing over 60% in market dominance. However, most coins are now in the red.

Polygon (MATIC) is the only coin that survived the crash, which surged 10% in the last 24 hours, reaching a new all-time high at $2.4 USD a few hours ago. However, it did suffer a $46 million USD liquidation.

Blackouts in the Xingjian region caused a hashrate drop of over 45%, producing transaction delays in the Bitcoin network and another adverse price drop. Since then, BTC has struggled to break its previous $60k barrier.

Chinese Crypto Whispers

Another event that propelled the crash was that Chinese regulatory bodies reiterated their stance on banning financial and payment institutions from providing banking services to crypto-related entities and traders alike.

However, most rumours circulated that China had “banned crypto” —which is not exactly true, but that didn’t stop it from causing more damage to the market.

A $60M USD Rekt

Data shows that over 80% of liquidations were leveraged traders, meaning, they borrowed capital to invest in higher prices. In just 24 hours, nearly 1 million traders got liquidated.

The largest liquidation happened on Huobi-BTC. A trade got liquidated with a $67 million USD position.

This is by far the biggest selloff the market has ever experienced. Some analysts call this event a “capitulation”, which means the market could be oversold by now giving institutional capital and large holders the opportunity to buy again.

While many sold their cryptos, others like MicroStrategy did not hesitate to buy the dip whatsoever. As reported, the firm bought an additional $10 million USD worth of BTC.