P2P Drives Africa’s Soaring Crypto Adoption, Up 1200% Since 2020

Whether one is a sceptic or proponent, this past year has undoubtedly been crypto’s breakout year. Global adoption is up some 880 percent, but it is the African continent that has seen the most dramatic increase, according to a recent blogpost by Chainalysis.

According to Chainalysis, the African crypto market has grown by 1,200 percent (in value received) over the past year. Estimates put these figures at approximately US$105.6 billion between July 2020 and June 2021.

Africans Use Crypto Differently

As noted by Chainalysis’ report, emerging markets tend to turn to crypto to preserve their savings in the face of currency devaluation, send and receive remittances, and carry out business transactions. By contrast, in developed markets it is driven more by institutional investment.

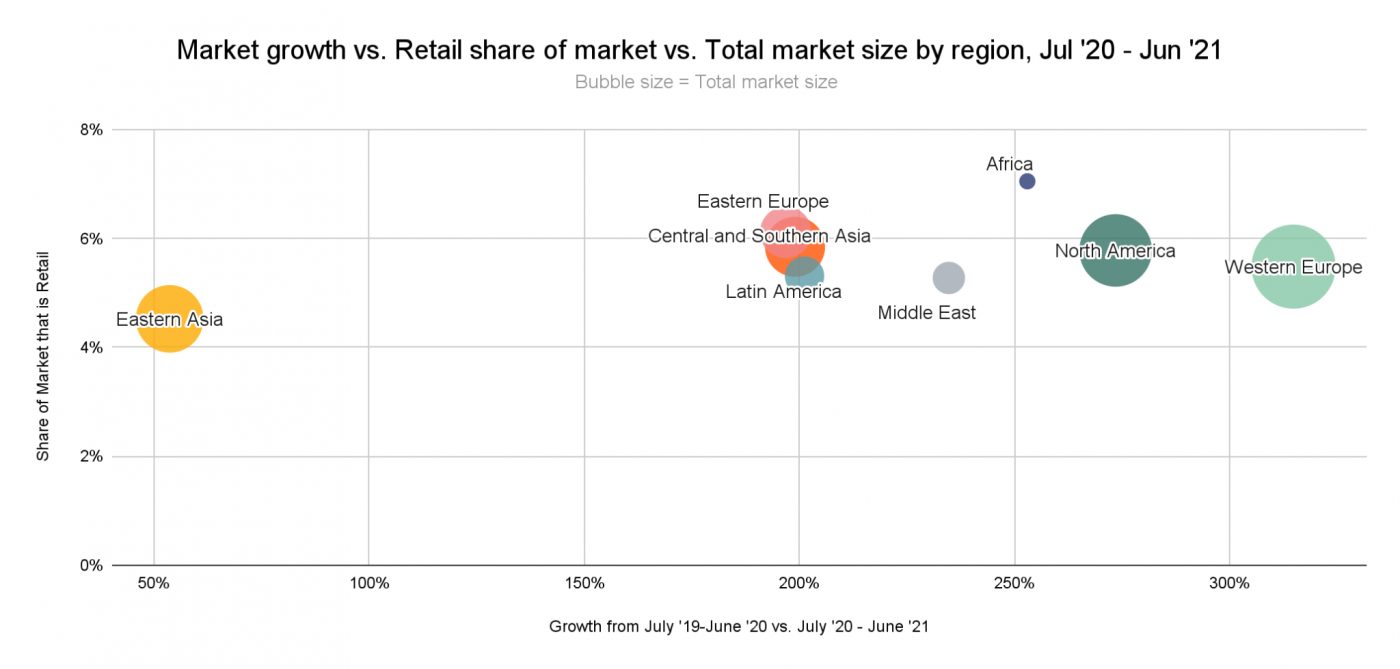

Despite being the smallest market by a long way, Africa enjoys some of the highest grassroots adoption in the world with Nigeria, Kenya, South Africa and Tanzania ranking within the top 20 of Chainalysis’ Global Crypto Adoption Index.

Supporting the notion of grassroots adoption, retail-sized transfers comprised 7 percent of transaction volume, compared to the global average of 5.5 percent.

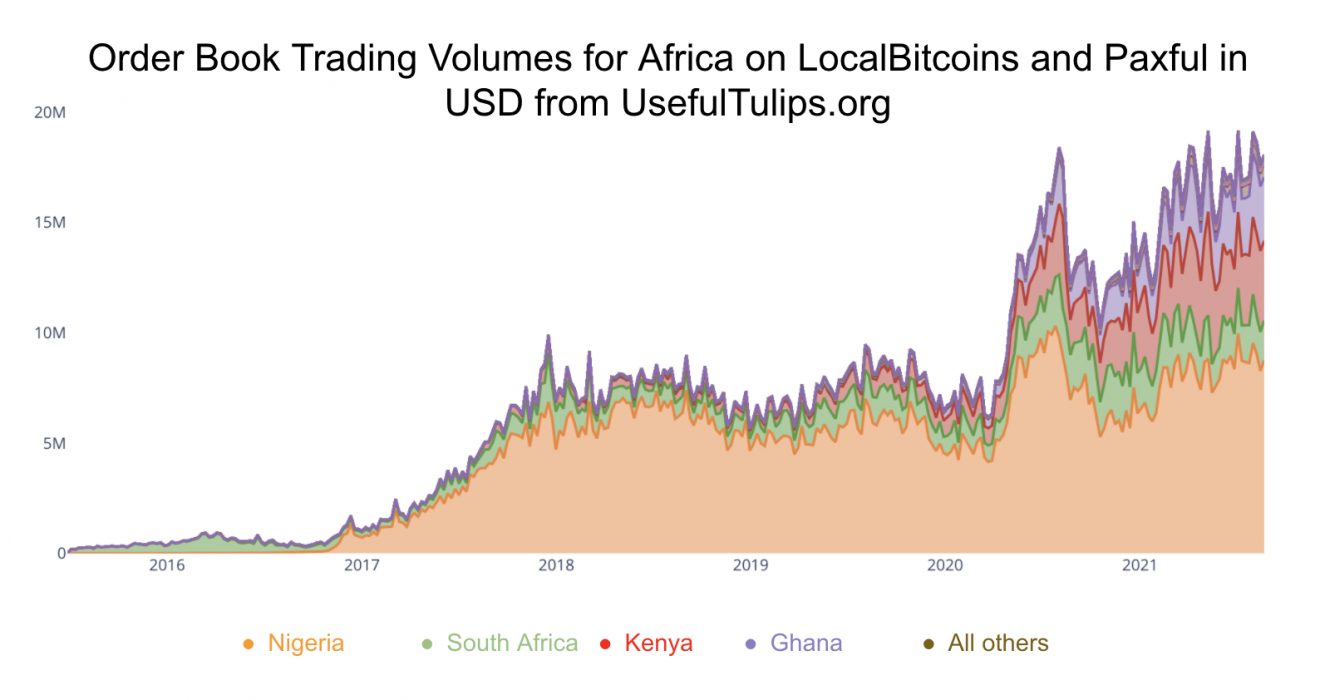

Growing Popularity of P2P (Peer-to-Peer) Platforms

One of the important trends in the African crypto adoption story is the enormous growth in transaction volumes on P2P platforms (adjusted for purchasing power per capita and internet-using population). One of the main reasons for this is the lack of access to trusted, centralised exchanges. In other instances, central banks (such as in Nigeria) and retail banks often have made it difficult for customers to transfer funds across to centralised exchanges. The chart below illustrates growth in two of the more popular P2P exchanges:

Compared to other regions, Africa’s P2P bitcoin volume is a lot higher, particularly in developed regions. Importantly, since so much trade is done informally, the figures below are probably lower than reality:

Remittances Play a Big Role

Crypto-based remittances are also increasing in Africa. Some of that is attributed to the growth in international commercial transactions as Africans use crypto to pay for goods to import and sell at home.

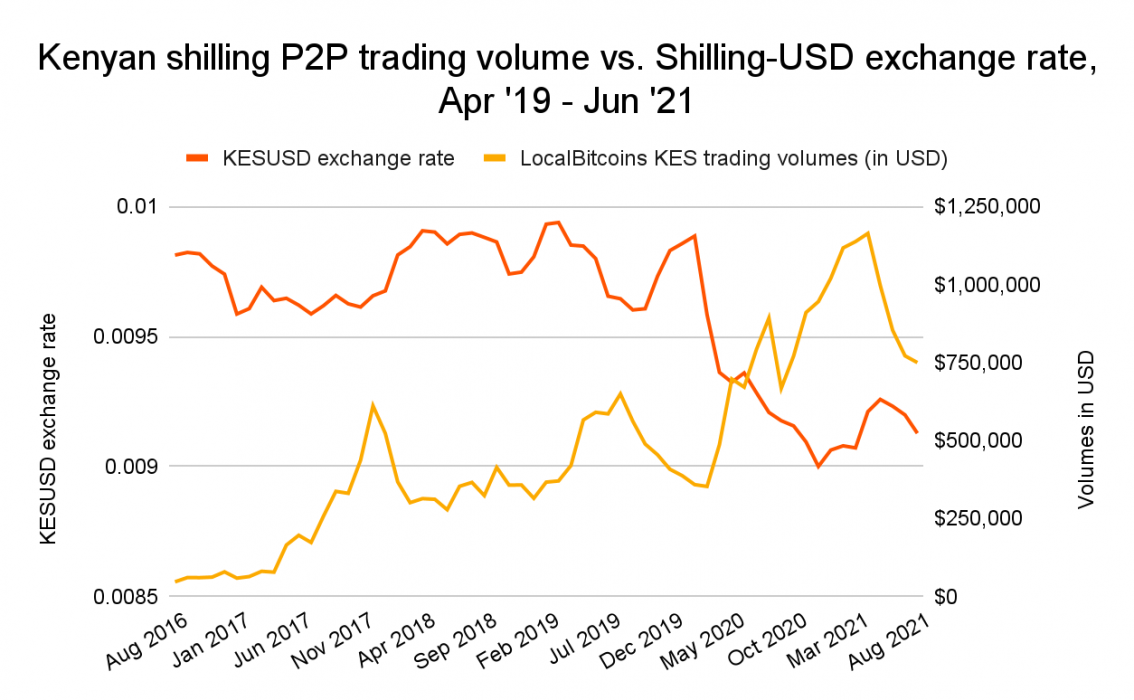

Wealth Preservation a Natural Consequence

In general, African countries tend to suffer from relative high levels of economic instability and currency depreciation. As the phrase goes: “bitcoin fixes this”. Africans would appear to have taken heed. Note the inverse correlation since May 2020 between P2P trading volume and currency depreciation in the Kenyan shilling. The case couldn’t be any clearer: