Open Interest in Bitcoin Drops to $12.9 Billion as BTC Plunged to Almost $30,000 USD

Open interest in Bitcoin (BTC) has dropped significantly following the massive decline in the price of the leading cryptocurrency within the past 24 hours.

Open Interest in BTC Drops Below $13 Billion USD

On Wednesday, the price of Bitcoin dropped to about $32,000 USD as more people sold off their holdings. This drop brought the market capitalisation of the cryptocurrency below $640 billion USD, according to data on CoinMarketCap. BTC’s drop to $32,000 USD also affected many investment products tied to it, including the futures markets.

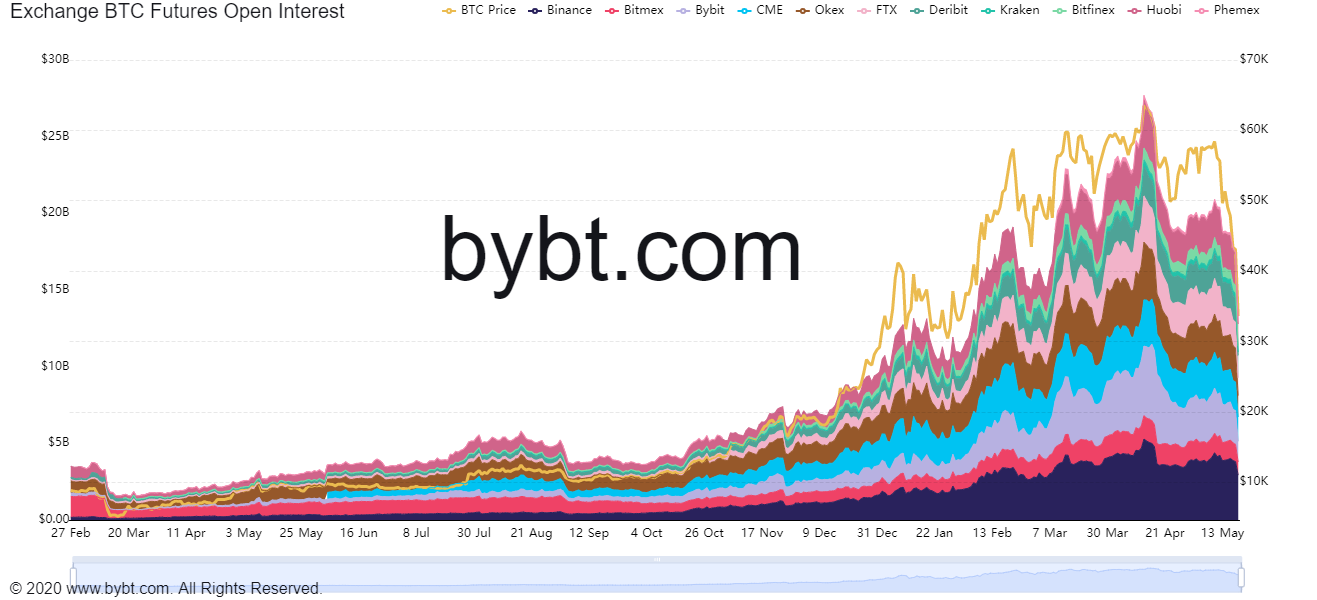

Open interest in Bitcoin futures has dropped to about $12.9 billion USD (about 386k BTC) at the time of writing, amid the declining value of the underlying crypto asset. This represents a -25.89 percent change over the last 24 hours. Binance accounts for $2.93 billion USD of the open interest in BTC, followed by CME ($1.58 billion), and Deribit ($1.46 billion), according to the market data from ByBt.

Over $3 Billion USD in BTC Liquidated

Many Bitcoin traders got over-leveraged as the cryptocurrency dropped to almost $30,000 USD. As per ByBt, about $3.57 billion USD worth of Bitcoin has been liquidated over the past 24 hours. This affected traders on derivatives exchanges with a long position.

While there could have been multiple reasons for BTC price crash, it’s also worth noting that Bitcoin is not the only cryptocurrency affected in this bear market. In fact, the market capitalization of cryptocurrencies dropped further to about $1.5 trillion USD, as Bitcoin tanked, followed by other major altcoins, including Ethereum (ETH), Binance Coin (BNB), Dogecoin (DOGE) and many more.

Open interest in Ethereum also dropped by 30 percent to $6.67 billion USD, during the time of writing.