How to Prepare Your Crypto Tax Return Data Using Crypto.com Software

In this guide we will show you how to get your crypto data imported and organised all in one place ready to send to your accountant to help with your tax return.

Firstly, go to Crypto.com Tax webpage and sign up for free.

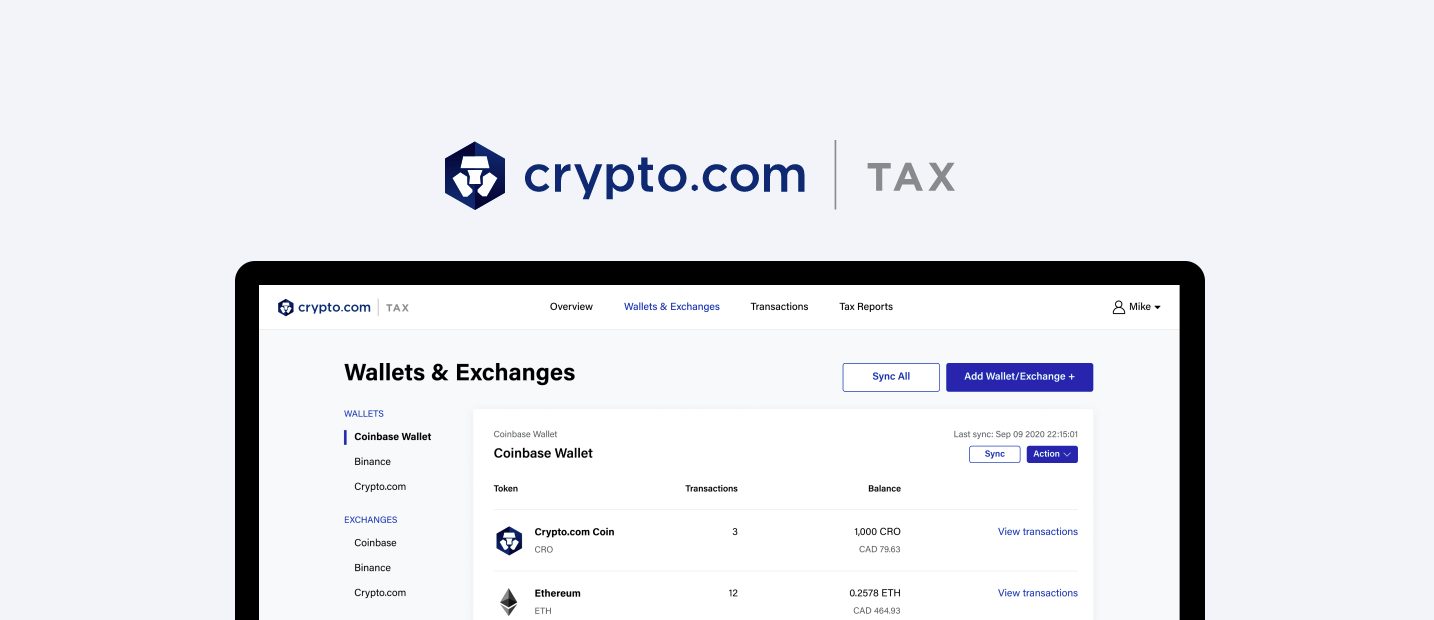

Once you’ve signed up and logged in, you’ll need to add the crypto exchanges & wallets that you use. In this example, we’ll use Coinjar exchange.

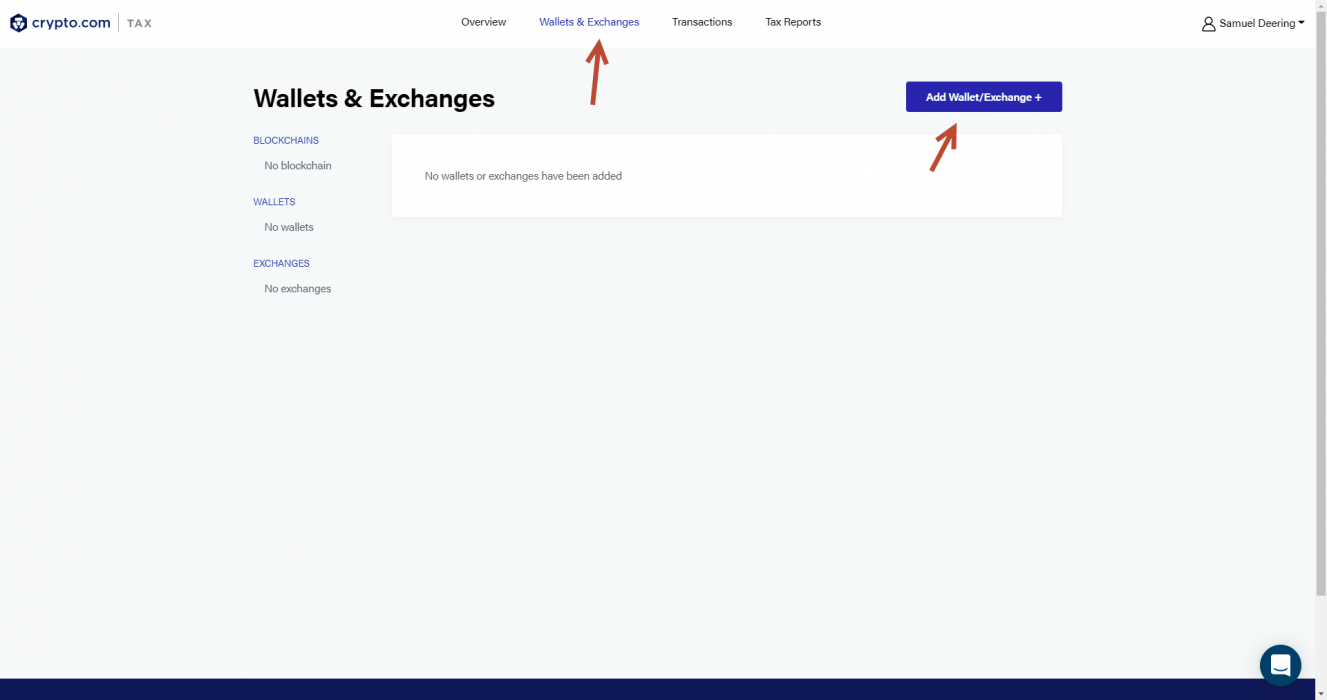

Click Wallets & Exchanges and then Add Wallet/Exchange +.

Select CoinJar, enter a name for your exchange ie CoinJar Personal Account, then select API Sync and confirm.

You’ll be prompted to login into CoinJar to give read only access and then it will redirect you back to crypto.com website.

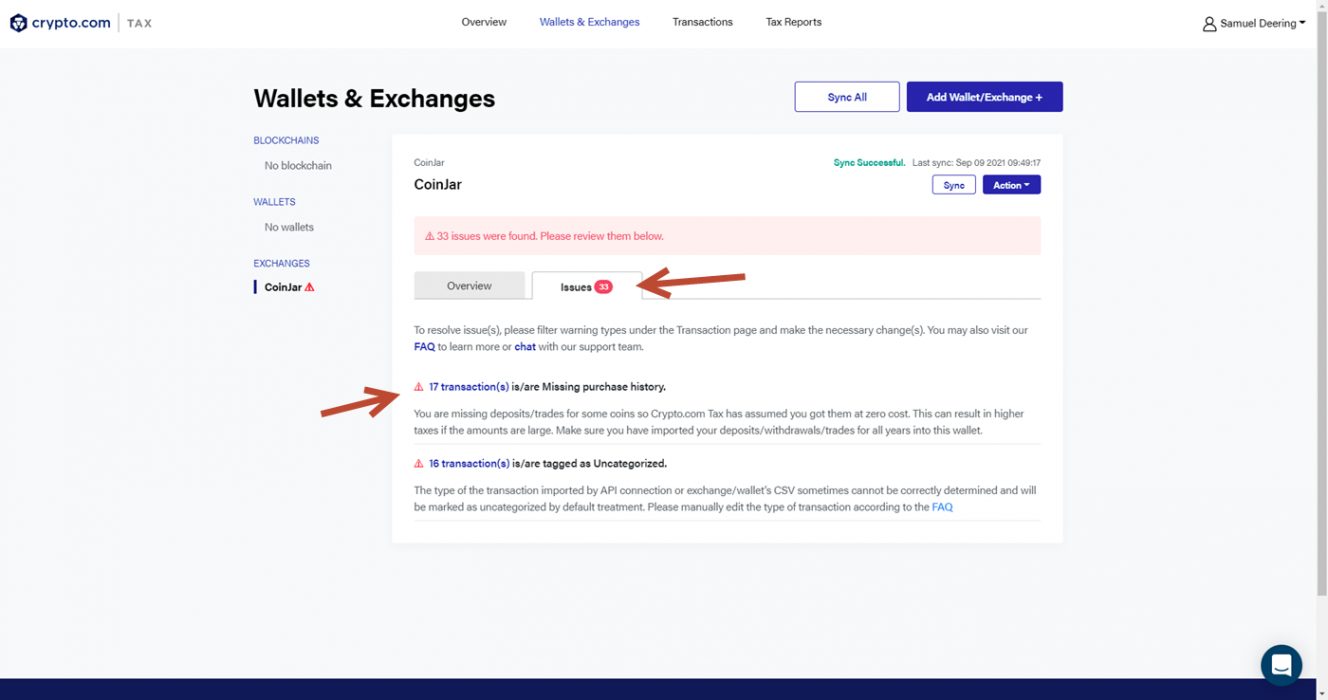

The data sync could take a couple of minutes to complete. Once it’s done you might see that there are transaction issues that need fixing. To fix these click the Issues tab and then purchase history transactions or uncategorised.

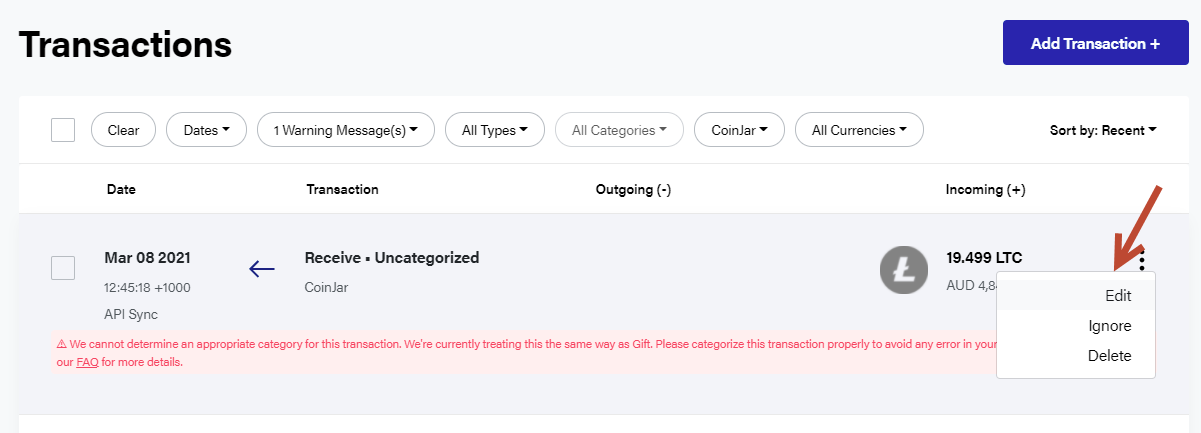

Click Edit to update the details of the transactions to fix any issues.

In the case of missing purchase history errors (in red), this could be that the fee isn’t being picked up. In this case, the BTC was purchased with a fee included in the amount.

In this case, you can just ignore this error. We’ll confirm with Crypto.com but it seems this error is incorrect.

Fixing transaction issues

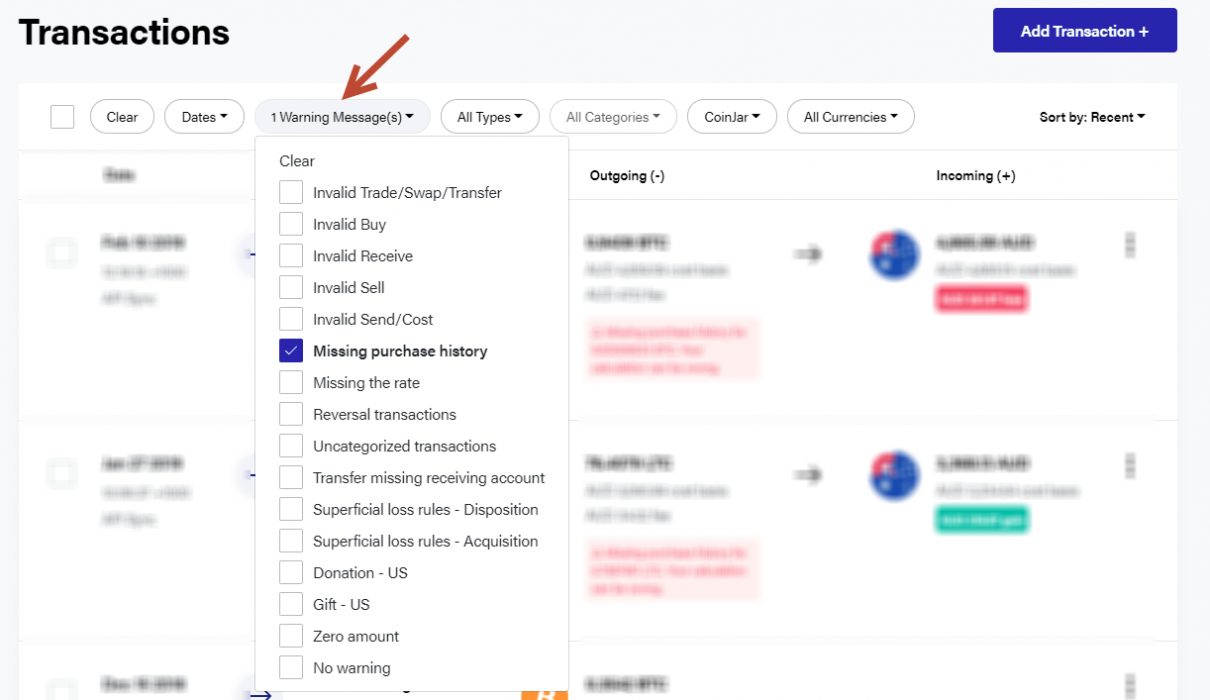

To fix any outstanding issues with the transactions you can filter them by date or issue type.

An important one to do is the Uncategorised transactions. Use the filter to show them, and then click Edit.

Then enter the details for the transaction. In this example, it was a transfer from one exchange to another. If the other exchange is not added, then you’ll need to add it to select it. If you don’t know what the fees were then you’ll need to find the blockchain transaction; you can find the transaction id on your Coinjar history.

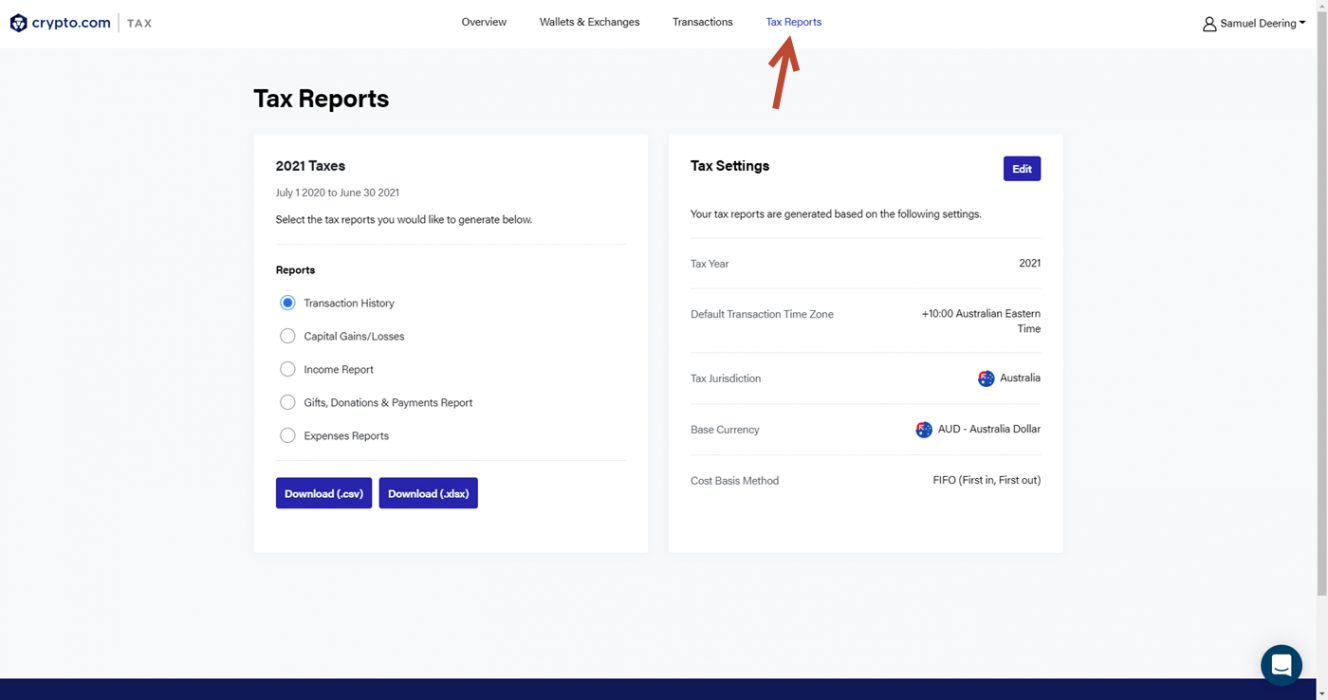

Generating tax reports

Once you’ve fixed up all the outstanding issues you can generate your tax reports by clicking Tax Reports.

This will export your tax reports into CSV format, which you can then send to your accountant to help prepare your tax return.

If you don’t have an accountant, then check out our guide on the Top 10 Crypto Tax Accountants in Australia.

If you need help using the Crypto.com tax software, then check out our troubleshooting section below or use the following links.

Troubleshooting

Tax software is an extremely hard thing to build as there are so many moving parts, and you may encounter errors when importing from different exchanges and wallets. We will try to update the section below to help diagnose and fix these errors.

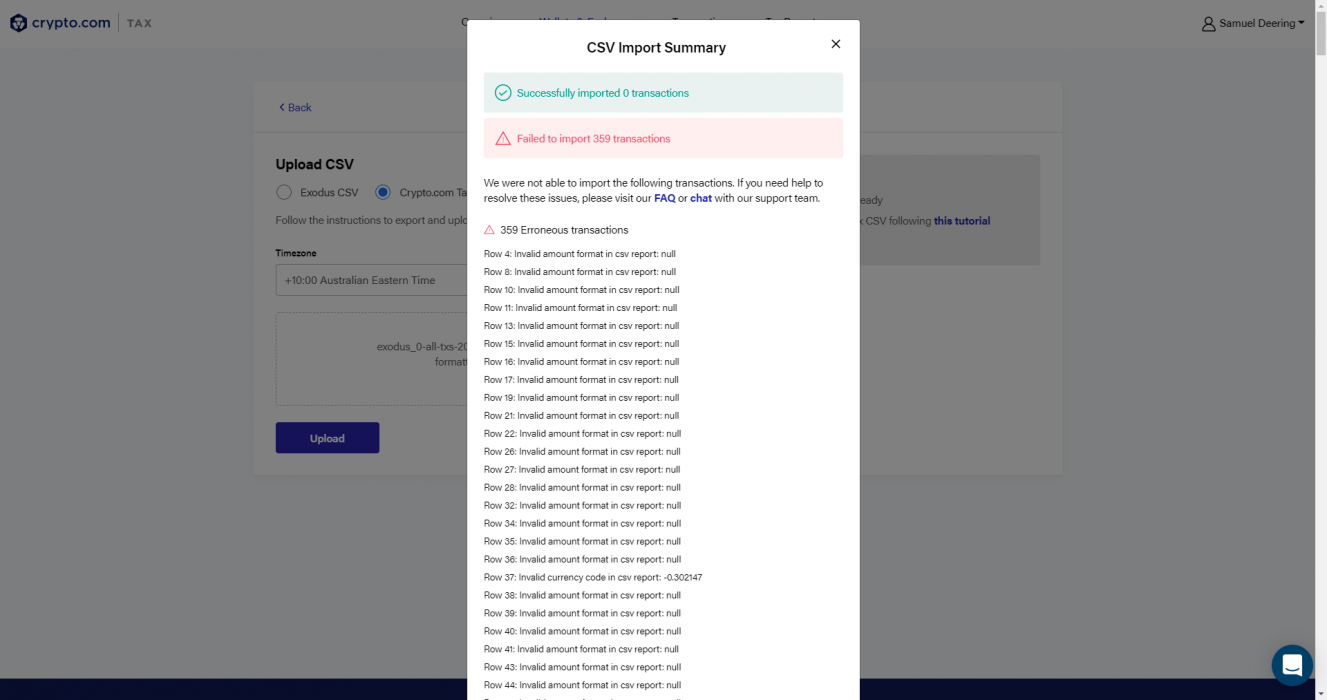

Custom Data Import Error

When importing custom data (Crypto.com Tax CSV), we encountered this error.

“Invalid amount format in csv report: null”

If you’re using the Crypto.com Tax CSV format, then use the sample template CSV and check the supported values for each column are correct as per the instructions on the Data Import help article.

Failed API Sync Error

When connecting CoinJar we encountered this error:

“Sync failed. Please try again”

To fix this simply click the Sync button. After clicking it, wait a minute or so and if it fails, repeat the click and wait again until it works.