How Smart Contracts Can Improve Security For Online Payments

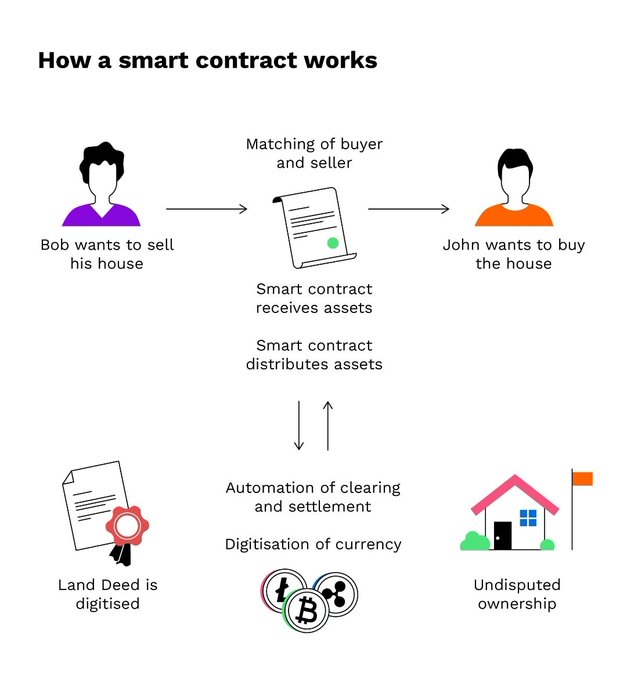

Smart contracts are self-executing agreements with predefined terms and conditions written directly into code. They operate on blockchain platforms, typically Ethereum, and enable the automation of transactions, eliminating the need for intermediaries and enhancing security, efficiency, and transparency in digital banking.

Traditional contracts involve parties agreeing upon terms, and if one party fails to fulfill its obligations, the dispute resolution process may be lengthy and expensive. Smart contracts aim to solve these issues by automating contract execution, enforcement, and fulfillment.

Smart contracts consist of three main components: the agreement’s terms and conditions, the code that executes the terms, and the decentralized blockchain network that validates and records the transactions. Once the contract is deployed, it becomes immutable and tamper-proof, ensuring trust among the parties involved.

The automation capabilities of smart contracts offer several benefits to the digital banking industry:

1. Efficiency: Smart contracts automate processes such as verifying identities, assessing creditworthiness, and executing transactions. This automation reduces manual intervention, paperwork, and the associated time delays, leading to faster and more efficient banking operations.

2. Cost Reduction: By eliminating intermediaries, smart contracts reduce transactional costs. Parties involved in the contract interact directly, removing the need for brokers, lawyers, or other intermediaries, resulting in cost savings.

3. Transparency: Smart contracts operate on public or permissioned blockchains, enabling transparent and auditable transactions. All participants can view the contract’s terms, its execution, and the associated data. This transparency fosters trust and helps prevent fraud.

4. Security: Smart contracts leverage blockchain’s decentralized and cryptographic features, making them highly secure. Once a smart contract is deployed, it becomes nearly impossible to alter the code or tamper with the transaction records. This immutability safeguards against fraudulent activities and enhances the security of digital banking operations.

5. Programmability: Smart contracts can be programmed to trigger actions automatically based on predefined conditions. For example, a smart contract can release funds to a borrower when specific criteria are met, such as timely repayment or collateral value. This programmability enhances the efficiency and accuracy of financial processes.

6. Accessibility: Smart contracts are accessible 24/7, removing time and location constraints. Users can interact with smart contracts using compatible applications, wallets, or interfaces, enabling convenient access to financial services from anywhere in the world.

Smart contracts revolutionize digital banking by streamlining operations, reducing costs, improving security, and providing greater accessibility. They have the potential to transform various banking processes, such as payments, lending, trade finance, insurance, and compliance. However, it is important to note that while smart contracts offer numerous advantages, they also require careful coding, rigorous testing, and proper legal considerations to ensure the execution aligns with the intended outcomes and complies with applicable regulations.

Also read: Top 10 Examples Of Smart Contracts In The Real World

How do smart contracts work?

Smart contracts are self-executing agreements with the terms of the contract written directly into lines of code. These contracts are implemented on blockchain platforms, such as Ethereum, and leverage the decentralized and transparent nature of the blockchain to ensure their integrity and immutability.

Here’s a detailed explanation of how smart contracts work:

1. Code Execution: Smart contracts are written in programming languages specifically designed for the blockchain, such as Solidity for Ethereum. The contract code contains the rules, conditions, and logic that govern the agreement between parties. It can encompass a wide range of functions, including calculations, data storage, and interactions with other contracts or external systems.

2. Deployment: Once the contract code is written, it is compiled into bytecode, which can be executed by the underlying blockchain platform. The contract is then deployed to the blockchain, creating a new instance of the contract on the network.

3. Contract Invocation: Smart contracts can be invoked by anyone who interacts with them. This interaction is typically triggered by a transaction sent to the contract’s address on the blockchain. The transaction contains the necessary data and instructions to execute a specific function within the contract.

4. Validation: When a smart contract is invoked, the nodes participating in the blockchain network validate the transaction and execute the corresponding code. The nodes verify that the transaction adheres to the predefined rules and conditions specified in the contract. This validation process ensures that the contract is executed correctly and without any malicious intent.

5. State Changes: Smart contracts can modify the state of their internal variables or trigger state changes in other contracts or systems. For example, a smart contract representing a digital asset transfer would update the ownership records or balances of the involved parties. These state changes are permanently recorded on the blockchain and are visible to all participants.

6. Consensus Mechanism: Smart contracts rely on the consensus mechanism of the underlying blockchain to ensure agreement among network participants. In most cases, blockchain networks employ a consensus algorithm, such as proof-of-work or proof-of-stake, to validate transactions and add new blocks to the chain. The consensus mechanism prevents fraudulent or conflicting transactions from being executed and maintains the overall integrity of the contract.

7. Immutability: Once a smart contract is deployed and its code is executed, it becomes immutable. This means that the contract cannot be altered or tampered with, providing a high level of security and trust. The contract’s code and its associated state are stored on multiple nodes across the blockchain network, making it highly resistant to censorship or modification.

8. Automatic Execution: One of the key features of smart contracts is their ability to self-execute based on predefined conditions. These conditions, also known as “if-then” statements or clauses, are embedded in the contract’s code. For instance, a smart contract could specify that if a certain payment is received, a specific action should be triggered automatically. This automation eliminates the need for intermediaries and ensures that the contract is executed exactly as intended.

9. Event Notifications: Smart contracts can emit events during their execution, which can be monitored and observed by external systems or other contracts. These events serve as notifications, providing information about specific actions or state changes within the contract. External applications can listen to these events and respond accordingly, enabling the integration of smart contracts with off-chain systems.

10. Trust and Transparency: Smart contracts enhance trust and transparency by eliminating the need to rely on intermediaries and providing a verifiable record of all contract interactions. The terms and conditions of the contract are transparently defined in the code, and the execution and state changes are recorded on the blockchain for public scrutiny. This transparency reduces the potential for fraud, disputes, or misunderstandings, as all parties can independently verify the contract’s execution and outcome.

Overall, smart contracts leverage blockchain technology to create self-executing agreements with predefined rules and conditions. They automate contract execution, enhance security and transparency, and enable trustless interactions between parties, making them an essential component of decentralized applications and blockchain-based ecosystems.

Also read: How Are Smart Contracts Implemented In DApps Games? Is It Relevant?

Benefits of using smart contracts for online payments

Using smart contracts for online payments offers several benefits, revolutionizing the traditional payment systems. Here are the key advantages:

1. Automation and Efficiency: Smart contracts automate the entire payment process, eliminating the need for manual intervention or intermediaries. Once the conditions defined in the contract are met, the payment is automatically executed. This automation reduces human error, speeds up transactions, and enhances overall efficiency.

2. Cost Savings: By removing intermediaries such as banks or payment processors, smart contracts reduce transaction costs associated with online payments. There are no fees for intermediaries’ services, and the elimination of manual processes reduces administrative expenses. This cost-saving feature is especially beneficial for microtransactions or cross-border payments, where traditional systems may be expensive or inefficient.

3. Security and Trust: Smart contracts are built on the foundation of blockchain technology, which provides robust security and immutability. The decentralized nature of blockchain ensures that transactions are verified by multiple nodes, making it extremely difficult for malicious actors to tamper with payment records. The transparent and auditable nature of the blockchain enhances trust among parties involved in the payment process.

4. Elimination of Disputes and Fraud: Smart contracts operate based on predefined rules and conditions, leaving no room for ambiguity or misinterpretation. Payment terms and conditions are explicitly written into the code, and the contract self-executes when those conditions are met. This feature reduces the possibility of payment disputes and minimizes fraudulent activities, as transactions are executed securely and transparently.

5. Real-Time Settlement: Traditional payment systems often involve delays in settlement, requiring additional time for verification and clearance. In contrast, smart contracts enable near-instantaneous settlement of payments. Once the contract conditions are met, the payment is immediately executed, providing real-time settlement and reducing the time and complexity associated with traditional payment processes.

6. Global Accessibility: Smart contracts are not bound by geographical limitations, enabling seamless online payments across borders. As long as participants have access to the blockchain network, they can engage in transactions using smart contracts. This feature opens up new opportunities for businesses and individuals, particularly in underserved regions with limited access to traditional financial services.

7. Programmability and Flexibility: Smart contracts offer a high degree of programmability and customization. The contract code can be tailored to meet specific payment requirements, allowing for complex payment scenarios. For instance, contracts can include multi-signature requirements, escrow arrangements, or conditional payments based on external data sources. This programmability enables the implementation of sophisticated payment workflows and enhances flexibility.

8. Integration with Other Systems: Smart contracts can seamlessly integrate with other decentralized applications and systems. This interoperability allows for the development of comprehensive ecosystems where payments can be linked to other functionalities, such as supply chain management, identity verification, or decentralized finance (DeFi) applications. This integration capability opens up new possibilities for innovative payment solutions.

9. Auditability and Compliance: Smart contracts provide a transparent and auditable record of all payment transactions. The blockchain stores a permanent and immutable history of payments, enabling easy auditing and compliance verification. This feature is particularly valuable in industries with stringent regulatory requirements, as it simplifies compliance processes and reduces the risk of non-compliance.

By harnessing the power of blockchain and automation, smart contracts transform online payments by offering speed, security, transparency, and cost savings. These benefits make smart contracts a compelling alternative to traditional payment systems, paving the way for the future of digital transactions.