Ethereum Whales Buy $425M In ETH Inside 24 Hours, Rebound Soon?

On-chain data shows the Ethereum whales have recently gone on a $425 million shopping spree, a sign that could be positive for the asset.

Ethereum Whales Have Participated In Accumulation Recently

As pointed out by analyst Ali in a post on X, the ETH whales have made some big purchases recently. The relevant indicator here is the “ETH Supply Distribution,” which tracks the total supply amount each investor group holds.

Investors or addresses are divided into these groups based on the total number of tokens they carry in their balance. For instance, the 1 to 10 coins cohort includes all investors holding at least 1 and at most 10 ETH.

In the context of the current discussion, the group of interest is that of the whales. The wallet range of these humongous holders can be assumed to be 10,000 to 100,000 coins.

Since the whales hold significant amounts in their wallets (the range converts to about $16.3 million at the lower end and $163 million at the upper end), they can naturally be influential entities on the network.

Now, here is a chart that shows how the total supply held by the Ethereum whales has changed over the past week:

As displayed in the above graph, the supply held by the Ethereum whales has registered a notable increase recently. During this rise, these humongous holders have bought around 260,000 ETH, worth approximately $423 million at the current exchange rate, within 24 hours.

Related Reading: Bitcoin Mining Hashrate Rebounds As Miners Refuse To Give Up

With this latest buying spree, the total supply of this cohort has reached about 27.03 million ETH, meaning that these investors now carry about 22.5% of the entire circulating supply of the cryptocurrency.

This accumulation from the Ethereum whales is naturally a constructive sign for the coin, as it means that these holders support the current prices, so the probability of a rebound may have become boosted.

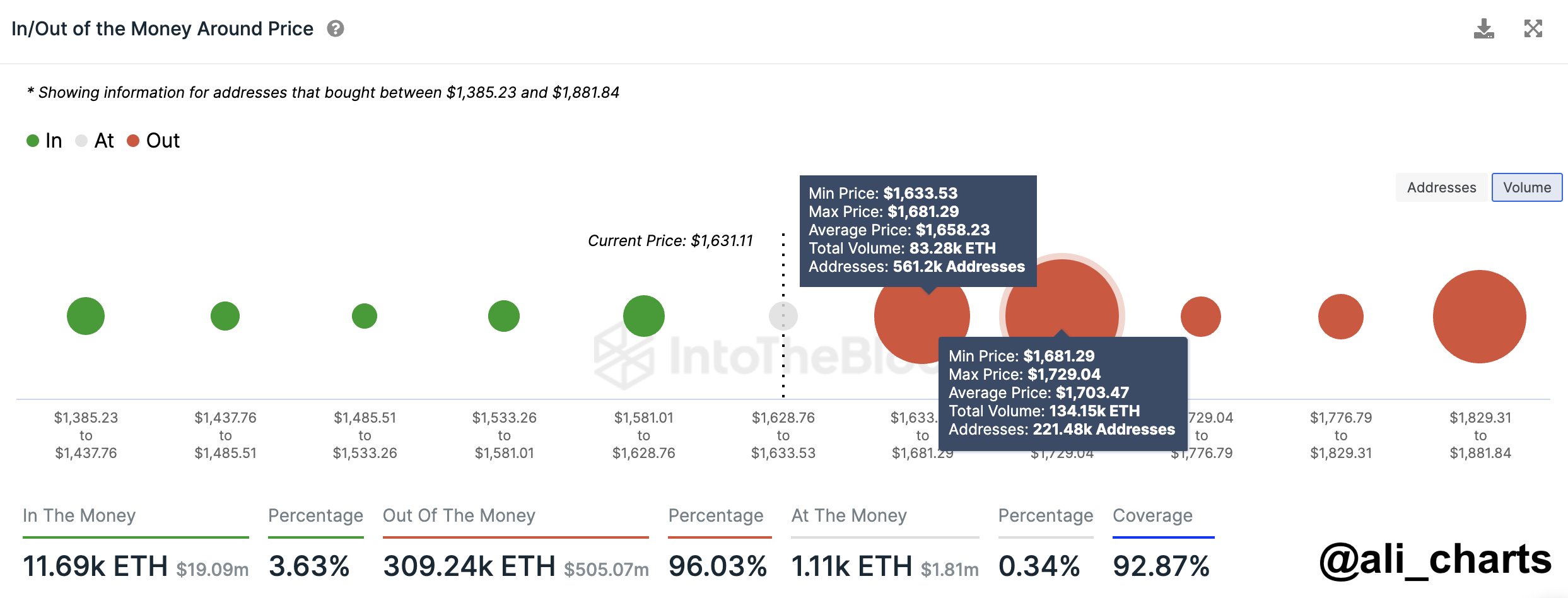

However, the same analyst has pointed out that Ethereum’s current price is risky, as not many investors have their cost basis at this level.

The above data shows the number of investors that bought in each Ethereum price range. From it, it’s apparent that the current level is relatively thin on holders, and the ranges below don’t host the cost basis of that many holders.

The most dense groups are situated in the price ranges just above the current one, meaning that at the current prices, all those investors would be sitting at losses on average.

Related Reading: Shiba Inu’s Large Holders Accumulated $100M During Past Week: Data

Generally, zones with a high concentration of cost bases support the price, but no such zone exists in the lower ranges. Ali notes that this could lead to a correction towards the $1,200 level, the next level, with some support.

Buying from the whales at the current prices is naturally a step in the right direction for the asset, but it will still need to recover a bit to the more dense cost basis zones if a solid rebound has to build up.

ETH Price

At the time of writing, Ethereum is trading at around $1,600, down 5% in the last week.