Crypto Market Recovers as Bitcoin Stabilises Above $100K, ETFs See Mixed Picture

- Bitcoin has stabilised above US$100k, with most major cryptocurrencies including XRP, Solana and Ethereum recording daily gains exceeding 5%.

- The Fear and Greed Index moved to 27, indicating market caution, and analysts suggest the rally can continue if it remains driven by institutional accumulation rather than retail euphoria.

- Some US spot Bitcoin and Ethereum ETFs have reversed recent outflows, while BlackRock funds continue with large outflows.

The crypto market seems to have turned around for now, with Bitcoin stabilising over US$100k (AU$153.5k). Most major cryptocurrencies are in the green, with XRP, Solana and Ethereum all making gains above 5% on the daily chart. BTC, meanwhile, gained 2.2%, trading at US$103,573 (AU$159,074) at the time of writing.

The Fear and Greed Index has moved to 27 – into Fear – up four points from yesterday’s Extreme Fear.

Analysts at Santiment said the “rally can continue if FOMO stays low, and retail stays on the sidelines,” adding that “markets move in the opposite direction of the crowd’s expectations.”

The idea – at least according to these analysts – is that as long as sentiment remains cautious and the rally is driven by institutional or steady accumulation rather than euphoric retail buying, it’s more likely to be sustainable. Retail enthusiasm arriving too early can, in fact, signal that a correction is near.

Data from Glassnode broadly aligns with that view, though it highlights a market still in delicate balance. “Traders are still hedging, not buying the dip,” the firm noted, adding that the market remains in “a fragile equilibrium, with weak demand, controlled losses, and high caution.”

In their most recent report, they added:

A sustained recovery requires renewed inflows and reclaiming the $112K–$113K region as support.

Glassnode

Glassnode ETF Flows Recover

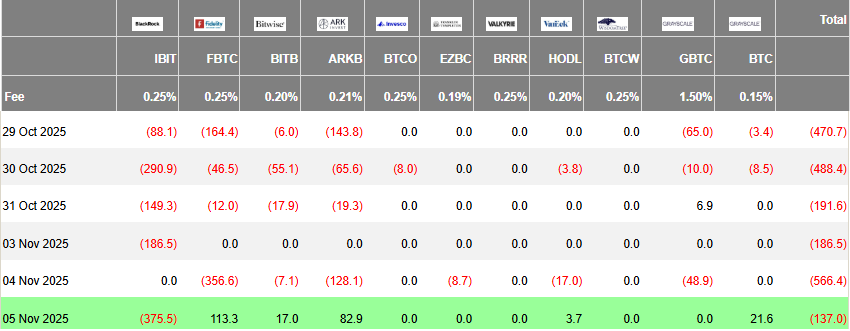

The analysts also noted the recent outflows of US spot exchange-traded funds (ETFs), though the latest data shows some mixed results.

Related: BlackRock Expands Bitcoin Bet with Australia’s First iShares Bitcoin ETF

After five consecutive days of outflows, most US spot Bitcoin ETFs saw a rebound yesterday, posting US$238.5 million (AU$365.9 million) in combined inflows. However, BlackRock’s IBIT recorded a substantial US$375.5 million (AU$576.9 million) outflow, which more than offset those gains – leaving the group with a net loss of about US$137 million (AU$210.4 million) for the day.

On Tuesday, IBIT reported net-zero flows, while most other ETFs lost US$566.4 million (AU$869.2 million).

US spot Ethereum ETFs mirrored Bitcoin’s trend to some extent. Excluding BlackRock’s fund, they recorded US$28.1 million (AU$43.1 million) in net inflows yesterday. Including BlackRock’s US$146.6 million (AU$225.2 million) outflow, the group finished with a combined net outflow of US$118.5 million (AU$182 million).

The much younger Bitwise US spot Solana ETF, BSOL, on the other hand, hasn’t missed a beat. Since inception, it has had a seven-day streak, amassing US$282.9 million (AU$434.2 million).

This comes as XRP is expected to get its own ETF soon.

Related: Bitcoin’s “Silent IPO” Moment: Why Sideways Trading Could Signal Bigger Things Ahead