Crypto Hinting at Rallies Amid Unpredictable Market Conditions, According to Santiment

New data from crypto analytics firm Santiment reveals that digital assets are hinting at rallies despite market conditions being rife with uncertainty.

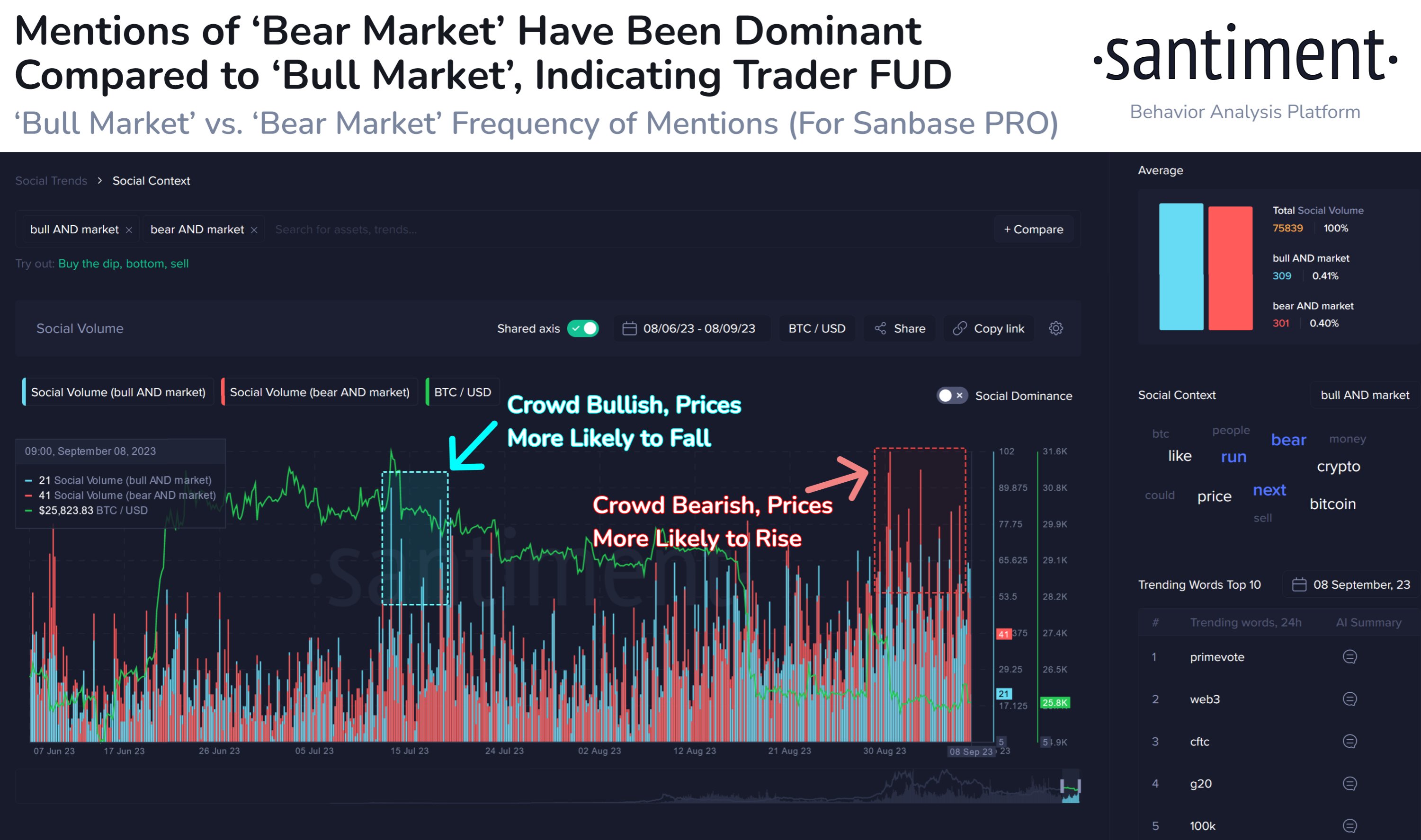

According to Santiment, “bear market” mentions on social media platforms heavily outweigh those of a bull market, causing the spread of fear, uncertainty and doubt (FUD).

However, the market intelligence firm says that periods following increased FUD tend to lead to a bump in prices for crypto assets.

“With crypto markets continuing its unpredictability, we have seen a big uptick in bearish takes by the crowd here in September. Historically, this is a good thing for patient traders. Probability of price bounces rise after FUD becomes the majority.”

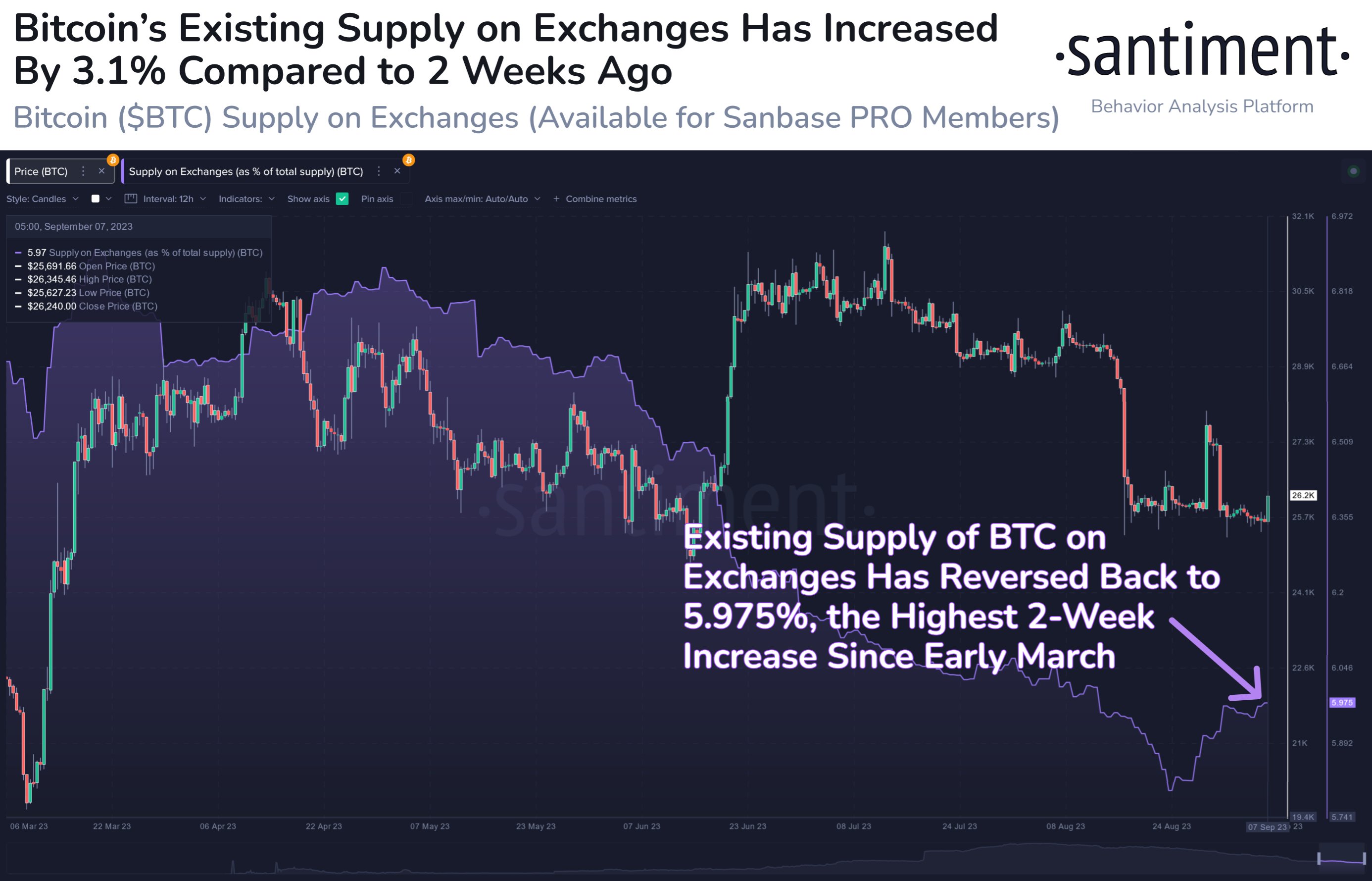

Looking at Bitcoin, Santiment says that traders should keep an eye on BTC‘s supply on exchanges, which has seen a notable uptick in the past weeks.

“Bitcoin has enjoyed a slight 2% price jump, returning back to $26,300 for the first time in a week. Keep an eye on the supply of BTC on exchanges, which has increased by 3.1% in two weeks. Traders appear to be motivated to take small profits.”

Bitcoin is trading for 25,726 at time of writing, a fractional decrease during the last 24 hours.

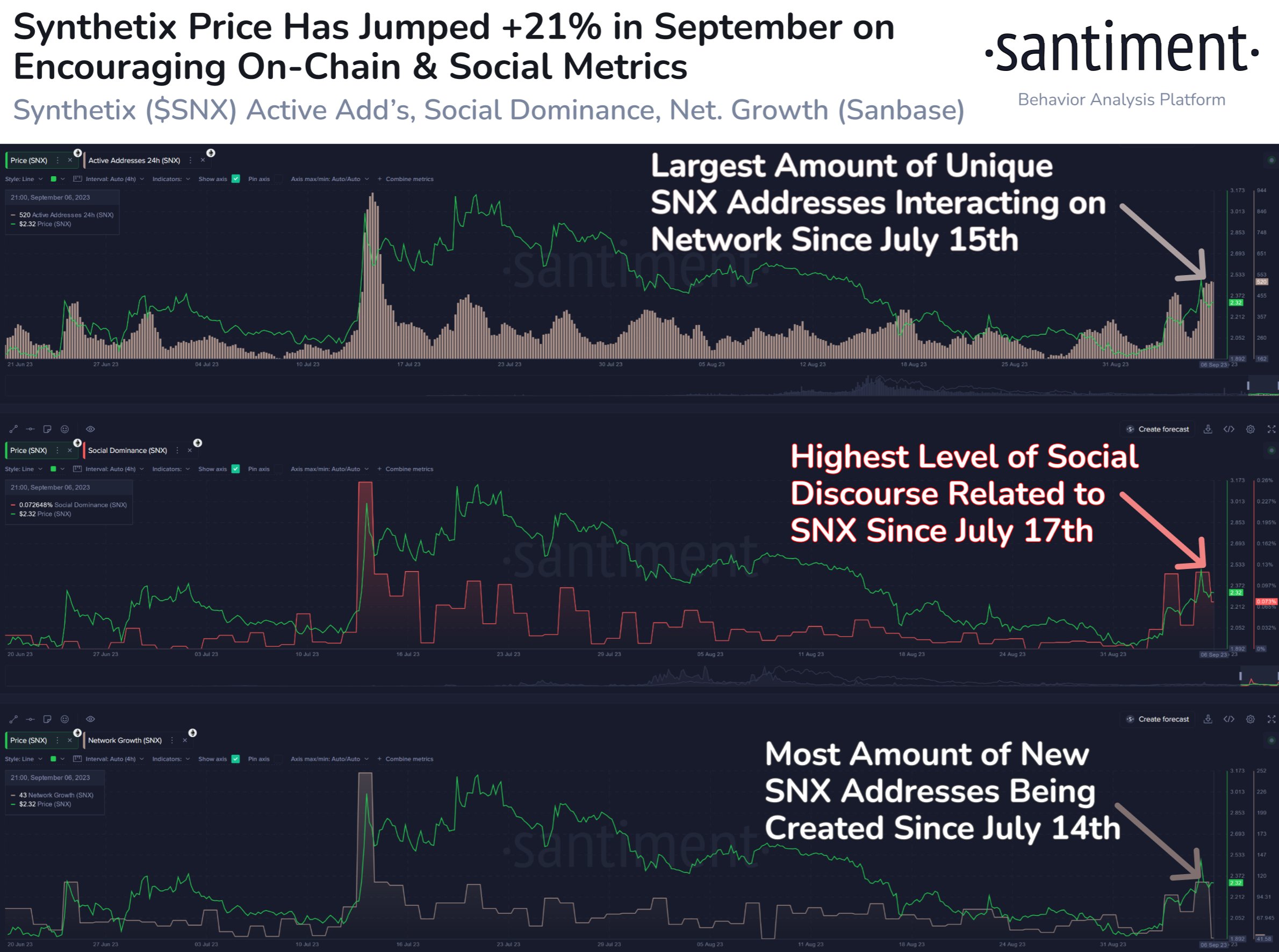

Moving on to Synthetix (SNX), the market intelligence platform says that the synthetic asset issuer has had the highest amount of address interactions, social mentions and new address creations since the middle of July.

“Synthetix is showing an impressive level of on-chain and social activity as it has enjoyed a solid rebound month (+21% in September). Addresses are showing increased engagement, network growth is climbing, and the crowd has notably more eyes on SNX.”

SNX is trading for $2.13 at time of writing, a 1.8% decrease during the last day.

Generated Image: Midjourney