Bitcoin Mining Complexity Hits Record High Despite Price Plunge

Following the BlackRock filing for a Bitcoin spot ETF that helped propel the market at the end of June, Bitcoin reached a YTD high just about $31,800 in mid-July.

The August correction in crypto markets, which reversed the post SEC vs. Ripple court decision rally, can be partly attributed to the broader correction in risk assets such as equities and in particular tech, which in turn appear to have been induced by frothy positioning in tech, higher US real yields and growth concerns about China.

And at the margin, news related to SpaceX liquidating its bitcoin holding in the previous quarter acted as an additional catalyst.

This correction pushed the total crypto market cap back down to around $1 trillion…

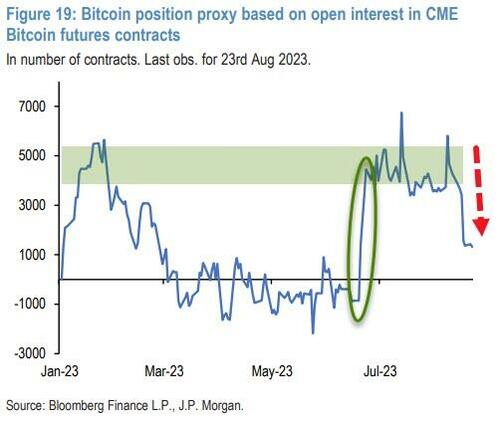

And as JPMorgan’s Nikolaos Panigirtzaoglou notes, these headlines all caught investors with an overhang of long positions (as implied by JPM’s futures position proxy based on CME bitcoin futures)…

These long positions were built on the back of a string of previous positive news such as the district court decision on the SEC vs. Ripple case, the launch of a stablecoin by PayPal, the launch of Coinbase “Base” chain, a wide anticipation that the SEC will approve the recent applications by several asset managers for a spot bitcoin ETF, as well as early positioning by some investors ahead of the bitcoin halving event, tentatively expected to happen in late Apr 2024.

But, as the chart above shows, this unwinding of long positions appears to be at its end phase rather than its beginning.

Additionally, as Michael Saylor noted recently, Bitcoin does not tend to spend too much time below its 200DMA…

Rarely does $BTC trade below its 200 Week Moving Average. pic.twitter.com/f2ItcB8YLb

— Michael Saylor⚡️ (@saylor) August 28, 2023

And so, as a result of this, Panigirtzaoglou sees limited downside for crypto markets over the near term.

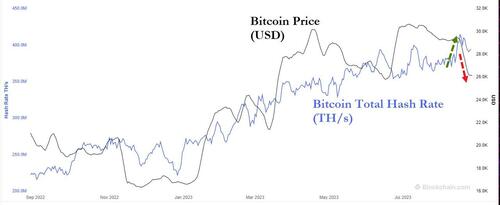

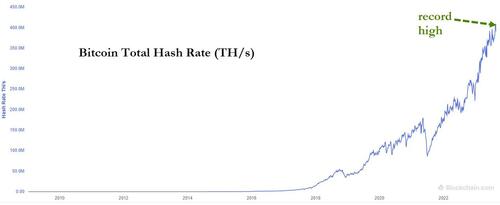

Which perhaps explains why – in the face of this selling pressure – the Bitcoin mining hashrate has only continued to rise recently to a record high, suggesting that the miners may not care too much about the crash.

As Bitcoinist reports, the “mining hashrate” is an indicator that measures the total amount of this computing power that the miners have currently connected to the Bitcoin blockchain.

Generally, the higher the hashrate, the more secure is the network as a 51% hack becomes much harder to perform. This is, of course, given that the hashrate is also sufficiently decentralized.

When the hashrate goes up, it means that miners are finding the BTC blockchain attractive to mine on currently so new validators are joining and/or old ones are expanding.

It would appear that the miners are unfazed by this price plunge, at least for now, even though revenue has plummeted…

As CoinTelegraph reports, market analyst Dylan LeClair commented on the falling revenue and hash rate peak stating that more efficient new rigs will keep being produced, “but it’s almost time for the price to outpace,” meaning that prices need to adjust upwards to keep mining profitable at such high hash rates.

Bitcoin miners have reportedly been relying on funds from stock sales in the second quarter to keep them afloat during the bear market.

🚨🚨Major $BTC miners are in BIG trouble heading to the halving 🧵👇

To avoid selling the ~$900M BTC they’re hoarding, miners relied on debt and diluting shareholders

Now those lifelines are drying up. Soon their only option is dumping into the markethttps://t.co/I27tvV4kxu

— Rho Rider (@RhoRider) August 26, 2023

On Aug. 24, Bloomberg reported that the 12 major publicly traded miners raised about $440 million through stock sales in Q2.

Mark Jeftovic, who runs the Bitcoin Capitalist newsletter, said, “Some mining companies are diluting shareholders at an excessive rate,” adding that “if they are diluting you faster than Bitcoin is going up, then you are going the wrong way on a treadmill.”

Finally, Bloomberg suggests another possible reason for miners scaling up regardless of the current prices is in part due to an upcoming Bitcoin code update called the ‘halving’. The update cuts the Bitcoin rewards to miners in half every four years and maintain the coin’s 21 million supply cap. The next halving is set to take place in 2024. The mining companies have to increase their computing power and stay competitive to fight for even less rewards after the event.

Proof-Of-Work Vs. Proof-Of-Stake: Why Bitcoin Won’t Change

Proof-Of-Work Vs. Proof-Of-Stake: Why Bitcoin Won’t Change