Australia Targets Crypto ATMs in New Crackdown on Money Laundering and Scams

- Australia’s Home Affairs Minister announced plans to restrict or ban crypto ATMs, labeling them a “high-risk product” tied to money laundering and scams.

- The measure is part of a broader package to expand federal powers, which would grant AUSTRAC’s CEO the authority to prohibit designated high-risk products like crypto ATMs.

- The government is targeting crypto ATMs due to their link to money laundering and untraceability.

Australia’s Home Affairs Minister Tony Burke said Wednesday the government will move to restrict or ban crypto ATMs, labeling them a “high-risk product” tied to money laundering, scams, and child exploitation.

The measure sits inside a broader package expanding federal powers against money laundering, terrorism financing, and related crime risks. For instance, AUSTRAC recently ordered Binance Australia to provide a full external audit after the regulator found deficiencies in its anti-money laundering (AML) and counter-terrorism financing framework.

It also comes at a time when APAC becomes the fastest-growing region in terms of crypto adoption. Notably, older Aussies are the fastest-growing cohort, with investors aged 60+ posting more than 700% in year-on-year surge in first deposits, and a 93% rise in daily trading.

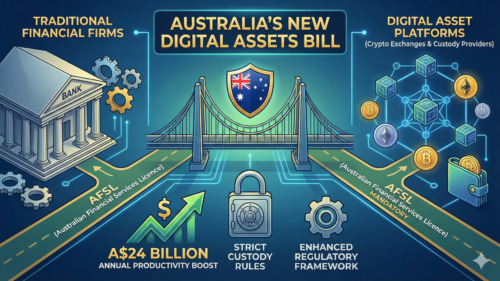

Related: Australia Grants Stablecoin Class Relief to Boost Digital Asset Innovation

AUSTRAC to Target Crypto ATMs Under New Rule

AUSTRAC has linked crypto ATMs to money laundering, scams, fraud, illicit drug activity, and child exploitation, with Burke adding that cash-for-crypto purchases basically block any form of traceability.

Burke intends to introduce the bill to Parliament in the coming months, authorising AUSTRAC’s CEO, Brendan Thomas, the ability to restrict or prohibit designated high-risk products, with crypto ATMs explicitly in scope.

If enacted, AUSTRAC would gain direct levers to curtail or block crypto ATM operations deemed too risky, tightening controls on cash-based crypto conversion points.

Thomas said the risk is becoming “unacceptable” and that the agency will act quickly if Parliament passes the law.

Crypto transactions are becoming integrated into money laundering methodologies and crypto ATMs present even more risks due to the ability to turn cash into digital currency that can be sent instantly and virtually anonymously across the globe. This is a product that is multiplying quickly – six years ago there were 23 machines in operation. Three years ago there were 200.

Brendan Thomas, CEO of AUSTRAC

Brendan Thomas, CEO of AUSTRAC All things considered, the Australian government is tightening oversight of crypto platforms and is currently reviewing a proposal that would fold cryptocurrencies into the country’s existing financial framework.