How to Buy Crypto in Australia

In short

There are several ways to buy crypto in Australia, with the most common one being buying through an exchange. Simple choose a reputable exchange like Swyftx and follow these simple steps:

- Create an account

- Verify your email address, phone number and ID

- Deposit funds from your bank account to your exchange using your preferred payment method

- Choose the crypto you want to purchase

- Confirm your order and buy crypto

The first step: Choosing an exchange

The first step along any journey can often be the hardest – and venturing into the crypto world is no exception. Choosing an exchange is a vital part of the crypto-buying process, but the wide range of options available can quickly overwhelm newcomers. That’s why it’s so important for investors to research reputable Bitcoin exchanges – only they can determine which platform is best suited to their personal financial goals.

Factors to consider when choosing a crypto trading platform

Australians wanting to keep things simple when buying their first cryptocurrency should stick to a local digital currency exchange. Such platforms fall under the thumb of the Australian Government and must abide by stringent financial regulations to operate locally. Additionally, Aussie exchanges usually accept AUD payment methods, are less of a target for hackers, and often boast an Australian customer support team.

Other factors worth considering include:

- Fees (transaction, spreads, deposit and withdrawal)

- Supported cryptocurrencies (Does the exchange sell the cryptocurrency I want?)

- Customer service (Do they have live chat? What are their business hours?)

- Security (Do they have an insurance fund? Has customer information been compromised? Do they have ISO27001 certification?)

- Payment methods (Does the platform support fast and free bank transfers? What about debit/credit cards or PayPal?)

We have compared the best crypto exchanges in Australia for more information.

How to buy crypto in Australia

Once you’ve decided on a trustworthy and secure cryptocurrency exchange, it’s time to begin buying Bitcoin or another crypto. We will use Swyftx as our platform of choice for this demonstration, but there are several other fantastic exchanges that also work.

You can view our in-depth review of Swyftx for more details.

1. Create an account

Creating an account on most modern crypto exchanges is usually straightforward. Head to the website’s home page and select “Sign Up”, “Start Trading” or a similar call-to-action.

New users will be presented with a standard application form that requests basic personal information, including mobile number, date of birth, email address and nationality. Ensure you can access a smartphone and email address to move forward as quickly as possible.

Verify the email and mobile number through a six-digit code sent to each address and move onto the final part of this step – deciding on a password. Make sure to use a unique passcode with special characters, capitals and numbers.

2. Verify account

Now that our Swyftx (or other exchange) account is ready to rock and roll, it’s time to deposit funds. Due to the Australian Government’s Know Your Customer (KYC) requirements, users must verify their identity before depositing AUD. New users can begin this process by selecting “Verification” from the settings dashboard.

It’s a good idea to have government-issued documentation such as a driver’s license or passport on hand to speed up this process. New accounts must provide images of these documents to the exchange before depositing AUD (or another fiat currency).

All up, the verification process should only take five to ten minutes. However, sometimes the exchange (or verification party) may be required to manually review your documentation, which can take up to 24 hours.

3. Deposit funds

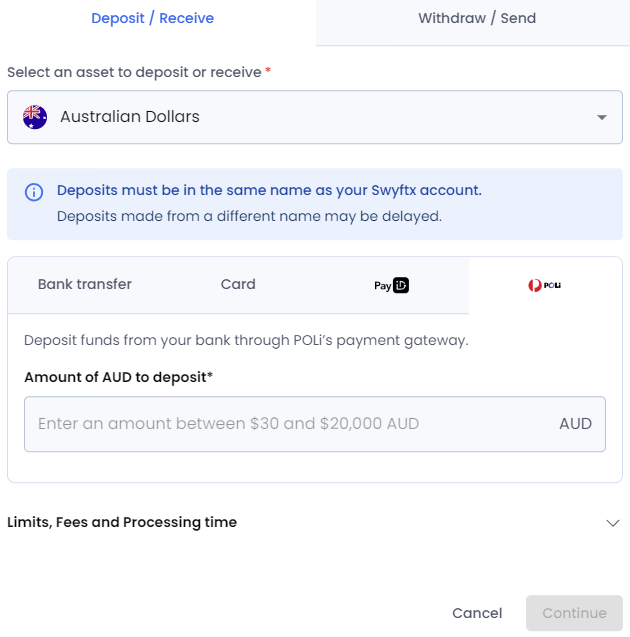

Once our new account is verified, we’re ready to deposit AUD. Most Australian crypto exchanges like Swyftx support several fast and free payment methods, giving new users plenty of flexibility for funding their accounts.

Click “Deposit” from anywhere on the platform and select the asset being deposited – for most, this will be Australian Dollars (AUD).

Choose a payment method – Swyftx offers PayID, Debit/credit card or bank transfer – and input the amount of cash to be transferred. Confirm that the transaction and the exchange account should be funded within 48 hours (depending on the deposit method used).

4. Pick your chosen cryptocurrency

Possibly the most important decision any investor must make is what to actually invest in. New users should reflect on the many factors that can influence the long-term viability of each potential investment (i.e., project developers, historic performance, real-world functionality). Generally, it is recommended that beginners start off with safer options like Bitcoin (BTC) and Ethereum (ETH) before branching out into more speculative projects.

Navigate to the exchange’s trading hub to bring up a list of supported cryptocurrencies. Finding the coin you want to buy is easy – you can either scroll through the list or simply search for the asset’s name.

5. Confirm your order and buy crypto

Now that we’ve chosen and located the crypto we wish to buy, it’s time to complete the transaction. Select “Buy” to bring up the trading interface. Here, we can decide how much cryptocurrency we wish to buy.

Once everything looks good, simply review and confirm the transaction. That’s it! The newly purchased cryptocurrency should hit your exchange account within a few minutes.

Other ways to buy crypto

Owning crypto coins directly is just one of many ways for investors to expose themselves to the blockchain market.

While this provides direct exposure to the peaks and troughs of the digital asset market, this volatility can be a little uncomfortable for new investors.

Another advantage of crypto alternatives is that you don’t need to figure out a storage solution. Working with a digital wallet isn’t too complex, but learning to manage Bitcoin by yourself can be a bit of a barrier for some.

Invest through spot crypto ETFs

By far the most popular way to gain exposure to the crypto market without holding BTC and co is via spot ETFs. Exchange-traded funds comprising Bitcoin were approved in 2024 by the Securities and Exchange Commission, giving birth to a billion-dollar industry.

Within months, institutional giants like BlackRock had raked in billions of dollars from investors wanting access to BTC, but without the responsibility of managing its custody. Spot ETFs helped a wave of new parties enter the crypto scene, allowing them to add digital assets to their portfolio through traditional stock exchanges.

The popularity of the spot Bitcoin ETFs led to the eventual approval of spot Ethereum funds, and several others are set for release in 2025. On top of this, institutions are strongly considering releasing ‘basket’ ETFs that give investors exposure to more than just one crypto simultaneously — providing a market index like Nasdaq or the S&P.

Invest in companies connected to crypto

A few companies operating in the crypto space offer shares on public stock markets. Perhaps the most prominent example is Coinbase, one of the world’s largest digital currency exchanges. The US-based company went public in 2021 and was the first-ever exchange start-up to sell shares on the stock market. The company’s stock, COIN, copped a beating in the first few years since its IPO.

It has since recovered to a market cap of more than US $50b and became the first crypto-centric business to enter the S&P 500 index, a curated list of the United State’s top 500 public companies.

Another option is to stick to crypto-connected businesses that aren’t exclusively associated with the blockchain industry. A great example is MicroStrategy Inc., a multi-national analytics company that has by far the biggest corporate holdings of Bitcoin.

As of 2025, MSTR holds nearly 600,000 BTC, valuing its portfolio at over $500 billion USD.

Therefore, investing in the stock (Ticker: MSTR) provides exposure to their massive BTC holdings and other unrelated business operations. In fact, MicroStrategy’s BTC ownership is so immense that the company’s stock is now very highly correlated with the digital asset — even outperforming the price of Bitcoin over the same timeframe.

Other crypto-connected companies that offer public stocks include:

- PayPal Holdings (PYPL)

- Block, Inc. (SQ)

- Tesla (TSLA)

- CME Group (CME)

- Hive Digital Technologies (HIVE)

Interested investors can buy these stocks via their preferred international stockbroker.

Invest through corporate crypto ETFs

Rather than purchasing the stock of a single company connected to the crypto industry, investors should also consider exchange-traded funds (ETFs). These are baskets of assets (rather than just one) that usually track the price of an underlying index, commodity or security.

Australian investors aren’t spoiled for choice when it comes to crypto ETFs. The only option on the ASX comes from wealth manager BetaShares, who released the Crypto Innovators ETF (ASX : CRYP) in 2021. This fund doesn’t track the price of a specific crypto asset. Rather, it provides exposure to several blockchain-related companies (such as Coinbase and MicroStrategy).

Invest in Bitcoin mining companies

Bitcoin mining involves specialised computers verifying transactions on the Bitcoin network, with miners receiving new Bitcoins as a reward.

While mining Bitcoin in Australia as an individual is a difficult and mostly inefficient method of earning cryptocurrency, investors can instead purchase stocks of public companies with dedicated mining warehouses.

There are not many options to buy publicly-traded Bitcoin miners on the ASX. The Australian Crypto Innovators ETF mentioned above is the best bet, however, this is a basket and includes companies that perform crypto-related activities beyond mining. Luckily, international stockbrokers (particularly NASDAQ) list several public mining companies. Examples include:

- BitFarms

- Stronghold Digital Mining

- Cipher Mining

- Hut 8 Mining Corp.

Why do people buy crypto?

Profit from price speculation

Let’s be honest. Most people buy Bitcoin and other cryptocurrencies because they want to spin a profit.

Since its inception in 2009, Bitcoin’s price has increased by a ridiculous 4 million percent. And while historical performance isn’t a guarantee of future price movements, new investors are banking on the continuation of these crazy returns.

Many other cryptocurrencies have excellent use cases in theory but still need to achieve widespread adoption. So, crypto investors often speculate that the potentially groundbreaking technology of certain blockchain projects will break into the mainstream in the coming years. Such an event would likely result in significant price gains.

Related: How to buy and sell Bitcoin in Australia

Inflation hedge

Inflation is the reality of any government-printed fiat currency. Generally, central banks target an inflation rate of 2-3% per year. This means that every AUD loses 3% of its spending power yearly – typically via products like energy, groceries or fuel becoming more expensive.

In the early 2020s, governments worldwide implemented record-low interest rates to help combat the difficulties of the Covid-19 pandemic. While this helped jolt the economy in the short term, it caused inflation to run rampant and fiat currencies like the AUD to become debased.

Holding cash is an investment position like any other. So, when inflation is sky-high, an AUD bank account could lose 6-8% annually. This is why Bitcoin and other deflationary cryptocurrencies are often used to hedge against inflation. BTC has a limited supply of 21 million, as opposed to AUD, an inflationary currency with no maximum supply. As more and more BTC is mined, it stands to reason upward pressure on the coin’s price will follow (this assumes demand remains the same, which is impossible to predict).

Investigate and try out new technology

Cryptocurrency is so much more than coins that people invest in. It’s a trillion-dollar sector loaded with thousands of ambitious projects. Blockchain technology has the potential to revolutionise modern databases. It can shake up the supply chain, pressure banks to reduce their monopolies and democratise governance among big and small businesses. A lot is happening in the crypto world – and many people buy tokens just to get a taste.

NFT-based gaming is a perfect example – the top games can see unique active wallets (UAW) of over 100,000. These burgeoning communities are often built around an in-game economy, for instance, AXS, the token used in the Pokemon-esque release Axie Infinity. Others may buy SAND tokens to pay for unique metaverse experiences via The Sandbox gaming platform.

The blockchain and crypto space is constantly evolving, with new sectors popping up constantly. For instance, a hot topic right now is the tokenisation of real world assets (RWA). CEO of BlackRock Larry Fink has stated that he sees this a huge use case of crypto and one that will still large adoption in years to come. His team took a step into the industry with the release of BUIDL, which provided on-chain access to Treasury Bills.

Earn passive income

Cryptocurrency – specifically decentralised finance – roared into the public’s eye in 2021 as inflation started taking hold of the global economy. Banks were slow to adjust their interest rates, leading investors to consider alternatives to protect their wealth. One potential alternative was DeFi, as it provided multiple ways to earn passive income on top of superior rates to your average high-interest savings account.

The easiest way for investors to accrue passive income is through a basic lending protocol. These are available on major centralized exchanges and often provide annual yields of 4-10% – making it a fast and easy earning method. A common strategy is to convert fiat currency like AUD into a stablecoin. Therefore, the investor’s portfolio isn’t subject to the crypto market’s wild swings while benefiting from its better yields.

More advanced users can dive into the breadth of earning options available in the DeFi ecosystem. Staking on-chain has two advantages – contributing to a blockchain’s safety while generating cash on the side. Some investors even try their luck with yield farming. This complex earning mechanism takes advantage of short-term liquidity pool imbalances. Either way, none of these unique and productive income-generation techniques are accessible without first buying cryptocurrency.

Frequently asked questions

Yes, but only a handful of exchanges in Australia offer support for PayPal as a payment method. Australian residents can not yet buy, sell, or hold major cryptocurrencies with their PayPal accounts, unlike those from the UK and the US. It is likely that PayPal will introduce crypto integration for Australian customers in the coming years.

Beginner investors in Australia should stick to local, trusted exchanges with low trading fees. Local exchanges tend to have better customer support and must abide by all regulations handed down by the Australian government. For example, Swyftx is an Australian-based, cost-effective trading platform that is well-respected among the crypto community. Once you have bought Bitcoin, it’s important to consider storage options and security methods.

Yes, being able to purchase Bitcoin and other cryptos with credit card is becoming more and more common among centralised exchanges. Several major trading platforms in Australia support buying crypto with a credit or debit card, such as Swyftx and Coinspot. It’s worth noting that buying digital assets with a credit card can be quite expensive, with fees of 2.5%+.

Buying from Australian-based exchanges with a reputation for excellent customer service and security is the safest way to build a crypto portfolio. Keep an eye out for platforms with ISO27001 certification, such as Swyftx, Coinspot and Independent Reserve.

Yes, buying, selling and trading crypto is legal in Australia. Although cryptocurrency is not accepted as legal tender, some merchants do accept payments in specific digital currencies like BTC or ETH.