Best Crypto Exchanges in Australia in 2026

In summary

In 2025, there are many options for Aussies looking for an easy-to-use, secure and trusted crypto exchange.

Swyftx is our pick for the best crypto exchange in Australia. The platform pairs competitive trading fees with ISO27001 certification and excellent customer support renowned among the crypto community.

Coinspot, Coinjar and Independent Reserve are all great Australian options, while international exchanges like Gate.io and Binance offer low trading fees and a significant list of features.

Best Australian cryptocurrency exchanges

1. Swyftx

About Swyftx

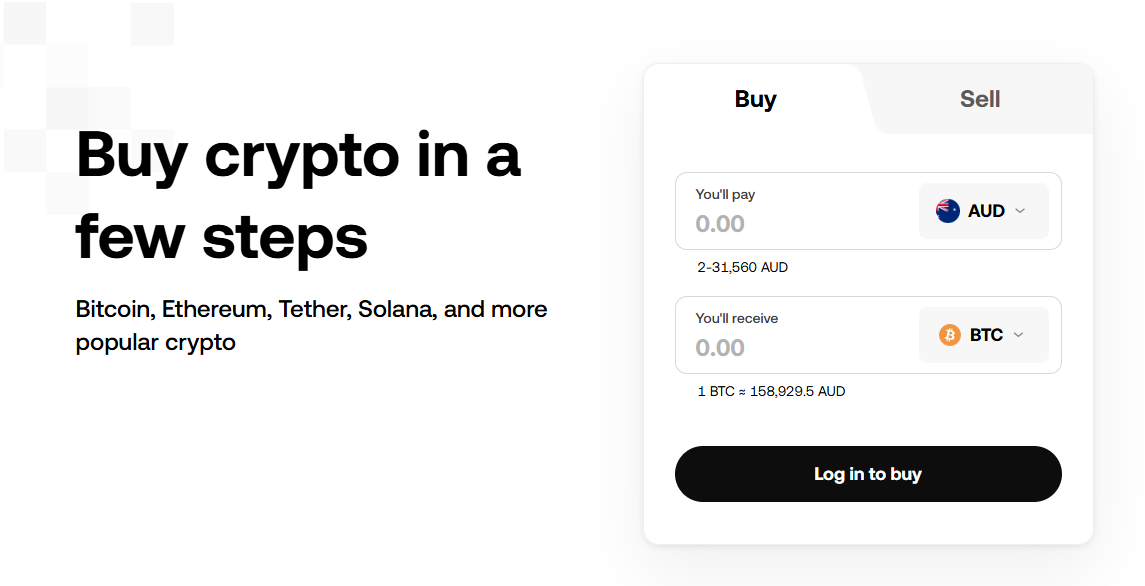

Swyftx is an Australian-based crypto exchange that launched in 2018. Founded by Alex Harper and Angus Goldman, the trading platform has seen massive growth over the last couple of years and has built a 700,000+ strong customer base. It’s considered a beginner-centric exchange due to its easy-to-navigate interface, great learning resources and features like demo mode. However, experienced investors can benefit from its features and competitive fees too.

Pros

- Australian-based

- Strong customer reviews

- Great features for crypto trading

- Easy to use

- Well-optimised and sleek mobile app

- Wide range of supported cryptocurrencies

- Fully functional demo mode

- ISO27001 certified

- Supports SMSF accounts

- Integrated tax reports

- Tiered trade fees for high-volume traders

Cons

- Fees are a bit high for day-traders, compared to international crypto trading platforms (like Binance or Bybit)

- No advanced trading options like derivatives

Exchange details

Trading fees:

0.1-0.6%

Deposit fees:

Bank transfer: Free

PayID: Free

Credit card: 1.99%

Withdrawal fees:

Free

Cryptocurrencies:

440+

Headquarters:

Brisbane, Australia

Fiat currencies:

3

Australian based customer support:

Demo mode:

Full learn platform:

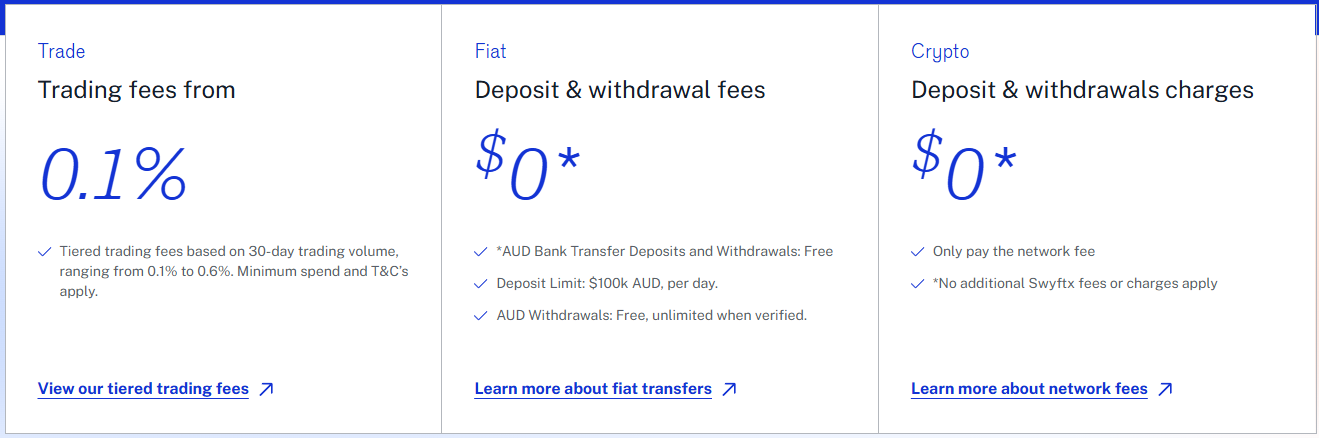

Swyftx offers a base transaction fee of just 0.6%. The exchange has also supports a tiered trading fee, meaning high-volume traders can benefit from fees as low as 0.1%.

Swyftx is also transparent with its spreads, which typically range between 0.2 and 0.8%. Most competitors – especially in the Australian market – do not disclose their spreads, and investors can easily incur fees of over 2% per trade without even knowing it.

Swyftx also offers OTC trading for larger trades.

Swyftx is registered with the Australian regulatory body AUSTRAC. This means they abide by all national financial frameworks, including KYC and AML policies. The company also supports advanced security measures such as 2-Factor Authentification (2FA) and breached password detection.

Swyftx has also achieved ISO27001 certification, the industry-leading standard for information security management.

- AUD deposits and withdrawals. Swyftx supports fast and free AUD deposits and withdrawals using bank transfer, Debit card, Osko or PayID. This makes the platform perfect for Australian residents looking to build a crypto portfolio. Swyftx also supports USD and NZD.

- Low fees. Swyftx charges a flat trading fee of 0.6% on almost all transactions. This is quite competitive for an exchange that offers AUD deposits and withdrawals – several other local platforms charge over 1% per trade. Fees can drop as low as 0.1% per transaction for VIP and high-volume traders.

- Live chat and mobile support. Swyftx employs a local customer service team that can be accessed with an average response time of under 10 minutes (during work hours).

- Recurring buys. Swyftx offers a recurring buy feature, either for a single asset or a basket of different cryptocurrencies. This allows investors to easily employ a dollar-cost averaging strategy.

- ISO27001 Certification. ISO27001 Certification is the industry standard for security among fintech companies. Swyftx is one of few Australian-based exchanges to have secured this certificate.

- Demo mode. Swyftx customers new to trading can use the platform’s crypto demo mode to “try before they buy”. It is an excellent tool for learning about the crypto industry and making practice trades without risking any money.

- Supported assets. The Australian exchange supports 420+ crypto assets, ranging from big guns like BTC and ETH to lesser-known altcoins like PEAQ and HNT. Users can also convert their cryptocurrencies on the platform (e.g., swap BTC for XRP).

- Swyftx Learn. Swyftx is home to one of the most comprehensive educational platforms in Australia, offering a range of courses covering beginner, intermediate and advanced topics. Occasionally, Swyftx will host a Learn and Earn course, allowing eligible customers to earn a small amount of crypto for participating.

Swyftx debuted their latest campaign, titled ‘Where Can Crypto Take You?’, with the featuring in several prominent events such as the 2025 State of Origin.

The platform also introduced CFD leveraged trading (with margin of up to 5x) for eligible wholesale investors.

2. Gate.io

Gate.io is one of the world’s biggest cryptocurrency exchanges, packed to the brim with advanced trading features and earning opportunities. The platform has been operational for over a decade after being founded in China in 2013 and has helped 20M+ people build their digital currency portfolios. As a primarily crypto-to-crypto exchange, Gate.io is renowned among the community for perhaps the largest list of supported altcoins on the market.

Pros

- 3,300+ cryptocurrencies available for trading

- Credit/debit card purchases available through a third-party provider

- Low trading fees

- Earning opportunities such as liquid staking and lending

- Plenty of features for advanced traders including bots and derivatives

Cons

- Limited fiat support – users cannot deposit/withdraw AUD

- The feature-heavy layout may be overwhelming to beginners

- Not registered with AUSTRAC

Trading fees:

0-0.1%

Deposit fees:

Crypto: None

Third-party fiat deposit: Varies between 1-5%

Withdrawal fees:

Varies

Cryptocurrencies:

3300+

Headquarters:

Cayman Islands

Fiat currencies:

15

Demo mode:

Full learn platform:

Important: You cannot deposit AUD into Gate.io. To do this you will need to use an Australian exchange like Swyftx to onboard AUD and then purchase an asset like BTC or USDT to then send to your Gate.io wallet.

Gate.io is one of the crypto industry’s longest-running exchanges, serving millions of customers since its creation over a decade ago. The platform is a popular choice for professional traders due to its low fees and advanced features – Gate.io often sees billions worth of AUD in 24-hour trading volume.

Gate.io is flush with features, including ample earning opportunities, a new project launchpad and even social media elements. Experienced customers can take advantage of a modern trading interface with TradingView integration and order book depth, while beginners will enjoy the “Express Buy” function.

The team has also deepened its focus on the Australian market in recent years, providing Aussie-centric products. That said, it can still be difficult to on/off-ramp AUD from the platform.

A huge appeal of Gate.io is its massive list of cryptocurrencies, with 3,000 and counting currently available for trade. While investors on competing platforms often have to wait months (sometimes years!) for obscure altcoins to be listed, Gate.io customers can often access new tokens before they’ve pumped beyond reach.

- 3,300+ cryptocurrencies. There is perhaps no other centralised crypto exchange that lists as many tokens as Gate.io. For traders who wish to access obscure altcoins, Gate.io is an excellent choice.

- Low fees. Gate.io’s fees cap out at 0.1% for using the advanced trading interface, which is very competitive. Such fees can be reduced to 0% depending on volume and whether you’re a maker/taker.

- Beginner zone. Gate.io offers rewards to first-time users for signing up and learning about the crypto industry, various tokens and how to conduct spot trading.

- Advanced trading. Experienced traders can leverage TradingView integration, bots, copy trading, derivatives and margin up to 10x leverage.

- Earning. Gate.io has a suite of earning products, including liquid staking, lending and liquidity mining.

Gate.io’s fees vary depending on what asset you’re using, your trading volume and more.

Accounts with minimal trading volume and asset value can trade on the spot market for 0.1% per transaction. This fee can fall as low as 0% for high-net-worth individuals on Gate.io.

Deposit fees for all cryptocurrencies are free, while withdrawal fees vary. Withdrawing USDT and ETH incurs a cost of approximately AUD $0.75, while BTC costs around $1.65 per withdrawal.

3. Coinbase

Created by Brian Armstrong in 2012, Coinbase is one of the United States’ oldest and most popular cryptocurrency exchanges. The platform is renowned for its excellent user interface, wide range of useful features and superb security measures. Coinbase also manages one of the industry’s leading smartphone apps, which boasts millions of downloads and lets investors manage their crypto portfolios on the go. Coinbase is registered with AUSTRAC and complies with all relevant financial requirements.

Pros

- Widely trusted and secure exchange

- An excellent learn-to-earn system that lets new investors start building their portfolios for free

- Can connect advanced users with popular decentralised applications

- Supports an NFT marketplace (note that this is a separate platform)

- Clean and simple user interface, perfect for beginners

- Publicly listed company

- Releases well-researched reports on the market

Cons

- Trading fees are ambiguous and can be quite expensive (1%+)

- Minimal advanced trading features – like derivatives – for Australian customers

- Australian investors can’t trade certain assets that are available to US customers

Exchange details

Deposit fees:

PayID: $0

Bank Transfer: $0

Osko: $0

Credit/debit card: 3.99%

Withdrawal fees:

0%

Cryptocurrencies:

200+

Headquarters:

San Francisco

Fiat currencies:

20+

Australian based customer support:

Demo mode:

Full learn platform:

Coinbase supports a range of useful features, including:

- NFTs. Coinbase hosts a detached NFT marketplace for digital collectors or blockchain-based gamers.

- dApps. Coinbase users can find a Web3 tab that helps them navigate the exciting world of decentralised applications.

- Recurring buys. Investors on Coinbase can place a recurring order to employ a dollar-cost averaging strategy.

- UX. Coinbase is renowned among the community for its streamlined user interface, perfect for beginners.

- Security measures. Coinbase has been operating for over a decade and has not faced any significant security or privacy breaches. 2FA is required for all exchange accounts, and customer funds are backed up 1:1 by Coinbase reserves.

- Learn to earn. Coinbase’s Learn hub is engaging and insightful, allowing new investors to learn about the industry while making a few dollars on the side.

Coinbase was involved in a lengthy legal battle with the SEC which has stretched several years. The company secured several important rulings throughout 2024, benefitting not just Coinbase but the industry as a whole. Following Donald Trump’s election in 2024, the SEC’s ‘regulation by enforcement’ stance pivoted into a more pro-crypto framework. As part of this, the US regulator dropped their case against Coinbase.

Additionally, Coinbase was selected by 8 of 9 ETH ETF issuers (i.e. BlackRock, Fidelity etc.) as a trusted partner and custodian through it’s newly launched Coinbase Prime institutional focused platform.

Coinbase also continued development of the popular ETH L2 solution, Base, which has attracted significant attention since its launch in 2023.

4. OKX Australia

OKX is an advanced cryptocurrency exchange with modern trading features perfect for investors on the cutting edge. The platform was founded in 2017 by Star Xu in China, but relocated amid the nation’s crackdown on crypto-related products. OKX is often used to trade derivatives, but also has an in-depth spot market for less experienced crypto traders. Users can choose from hundreds of trading pairs, including all major tokens like BTC, ETH, USDT, etc. OKX Australia is registered with AUSTRAC, entering the nation in 2024.

Pros

- Supports trading over 300 cryptocurrencies

- Excellent trading fees with a maximum of 0.5% per transaction (and less for high-volume users)

- A swathe of trading features perfect for advanced investors

- Clean user interface

- Supports buying crypto directly with a credit card

- Highly-rated smartphone app available on iOS and Android

Cons

- Most trading features are intended for experienced users

- Limited AUD trading pairs

Exchange details

Trading fees:

-0.01 - 0.5%

Deposit fees:

Bank transfer: Free

Credit/debit card: 3.5-5%

Withdrawal fees:

Bank transfer: Free

Crypto: Varies

Cryptocurrencies:

350+

Headquarters:

San Jose, California for the Americas

Dubai for the Middle East

Fiat currencies:

30+

Australian based customer support:

Demo mode:

Full learn platform:

OKX came onto the scene in the late 2010s as OKEx, before officially rebranding to the simpler OKX. This change in style reflects the cryptocurrency exchange’s modus operandi – provide a sleek, clean and modern trading experience. At its heart, OKX is for the more experienced crypto traders, offering impressive features, including bots, copy trading and derivatives trading.

Over the past few years, OKX has rebranded its Aussie arm to OKX Australia, with a keen eye to capturing the Oceanic market.

Regular Aussie users will incur a base trading fee of 0.7% for buys, sells and swaps. However, the exchange offers a tiered fee structure, with high-volume, VIP customers able to trade with fees as low as 0-0.11%.

Crypto novices can find a home at OKX, too. Buying Bitcoin or 20+ other major tokens through the platform’s Express buy mode is incredibly easy and convenient. Investors can attach their credit/debit card, or fund their account with a bank deposit, and instantly add new coins to their portfolio.

OKX has moved its way into the Australian market, making it much easier for Aussies to buy prominent digital currencies with AUD.

- Industry-leading fees. A maximum fee of 0.5% is incurred when trading on the spot market, which is solid relative to most other Australian crypto exchanges.

- Trading bots. Experienced users can set up algorithms to execute trades on their behalf and automate their investment strategy. This can be as simple as setting up a recurring order, or implementing an arbitrage plan.

- Derivatives and margin trading. These advanced trading tools are a great way for experienced investors to make the most of the crypto market. Be warned though, novices should stay well away from trading with leverage. This product is only available to certain wholesale Australian investors.

- DeFi. Users can navigate the Web3 world via OKX’s wallet, as well as manage their NFT portfolio.

- OKB Chain. The team at OKX has developed its own blockchain – OKB Chain. This scaling solution for Ethereum allows users to navigate EVM dApps with lower fees and congestion.

- Mobile app. OKX’s smartphone app has received plaudits from the community, boasting a 4.5-star rating on both the Apple and Google Play stores.

OKX Australia added several new features in 2025, including:

- Trading bots that include customisable stop-loss and real-time monitoring

- USDG holders automatically receive yield on their holdings, with no lock-ups or staking required

- Introduction of an SMSF platform

- On-Chain Earning protocol

- Buy digital assets with card, Google and Apple Pay

5. Crypto.com

Crypto.com emerged in 2016 as a Hong Kong-based exchange founded by Bobby Bao, Gary Or, Kris Marszalek and Rafael Melo. After a few formative months, the platform became one of the industry’s most popular trading hubs for new and experienced crypto users. Much of its newfound status came from an intensive and targeted advertising campaign, including partnerships with Matt Damon, the Australian Football League, and purchasing naming rights to Los Angeles’ top sporting stadium.

Pros

- Crypto.com’s desktop exchange has low fees and high liquidity, making it a cost-effective choice

- Fast and free deposit options for AUD

- A $750m+ insurance policy in case of hack or liquidation

- A huge list of rewards for holding and staking the platform’s native token, CRO

- In-built NFT marketplace on mobile app

Cons

- Crypto.com’s mobile app and desktop exchange offer two different services which may confuse some

- Crypto.com mobile transactions are noted for high spreads

- High minimum withdrawals ($100 AUD)

- Crypto.com was hacked in 2022

Trading fees:

0-0.075%

Deposit fees:

Bank transfer: Free

Osko: Free

PayID: Free

Credit/debit card (instant purchase): 3.5%

Apple/Google Pay: 2.99%

Withdrawal fees:

None (can vary)

Cryptocurrencies:

350+

Headquarters:

Singapore

Fiat currencies:

30+

Australian based customer support:

Demo mode:

Full learn platform:

Crypto.com is a unique exchange, as it comes with two distinct platforms. The first is the smartphone application, intended for beginners to start building their crypto portfolios. The application offers several basic services, including the ability to instantly buy/sell crypto with a card, earn passive, on-chain income on certain assets, and receive rewards for holding CRO.

The desktop exchange comes with greater flexibility and is intended for more advanced investors. It’s worth noting the Crypto.com exchange is available on both desktop and mobile, whereas the app is exclusive to smartphone devices.

Australians can also benefit from the Crypto.com card, which allows them to spend their crypto holdings at EFTPOS machines as though it were fiat currency (like AUD). The card also comes with cashback and subscription promotions, which varies from month to month.

-

- Separate exchange and app. Crypto.com’s mobile app is more of a beginner-friendly introduction to cryptocurrency, whereas the desktop exchange is more like your average trading platform such as OKX or Binance.

-

- NFT marketplace. Mobile and desktop users can access the Crypto.com NFT marketplace with ETH holdings.

-

- Zero-fee swaps. The Crypto.com app allows customers to swap between cryptocurrencies with no fees attached. Note that conversions will likely make up for the lack of a fee with a high spread, so compare buy/sell rates if possible.

-

- Integrated on-chain staking. Crypto.com users can stake their tokens on-chain by connecting to the Web3 world. Unfortunately, Australians cannot access the in-app earn system anymore.

-

- Excellent rewards system. Crypto.com offers its users a slate of rewards for locking up CRO tokens or using their Visa card. This includes free Spotify/Netflix subscriptions, cashback and free ATM withdrawals.

6. Binance

Binance launched in 2017 and has quickly catapulted to prominence and now sits as the world’s most popular cryptocurrency platform. Binance regularly leads the industry in terms of trading volume and liquidity. The exchange is renowned for its list of altcoins, features, and international presence. Recently, Binance was debanked by its Australian banking partner, meaning they can no longer accept AUD deposits.

Pros

- One of the leading exchanges with possibly the most advanced features in the crypto exchange market

- Low trading fees for market orders (0.1%)

- NFT marketplace for buying, selling and minting digital assets

- Ranked #1 globally for liquidity, trading volume and average customer visits

Cons

- User interface is a little cluttered and can take some getting used to

- The huge range of features and altcoins, while beneficial for experienced crypto traders, can be confronting for crypto newcomers

- The leading exchange has run into regulatory issues with various nations (the U.S., the UK and China)

- Live chat support can leave a lot to be desired

- No longer accepts AUD deposits

Exchange details

Trading fees:

0.1%

Deposit fees:

Cannot deposit AUD

P2P bank deposit: Free

Withdrawal fees:

Cannot withdraw AUD

P2P bank deposit: Free

Cryptocurrencies:

500+

Headquarters:

Caymen Islands

Fiat currencies:

10+

Australian based customer support:

Demo mode:

Full learn platform:

Binance isn’t the oldest exchange in the crypto scene after being founded in 2017 by Changpeng Zhao (CZ). But what the exchange lacks in duration, it makes up for in popularity. Binance is by far the world’s highest-volume cryptocurrency exchange, frequently beating out all competitors in terms of 24-hour trading volume.

The website is renowned for its massive list of features – Binance is more of a decentralised ecosystem than a simple trading platform. Users can trade hundreds of crypto assets, support up-and-coming blockchain projects or mint their own NFTs. Binance’s low fees, industry-leading range of features and immense global liquidity make it a great choice for crypto investors of all skill levels.

Unfortunately, the Binance platform’s efficacy for Australians was harmed significantly in June 2023, when the business stopped supporting AUD deposits and withdrawals. Alongside this development, Binance ceased all trading pairs that used AUD. Major banking institutions such as Westpac had “barred clients from trading on Binance”. At the same time, payment providers PayID also ceased support for transferring AUD to Binance. Earn is similarly no longer available to Australians.

Binance is searching for new suppliers to bridge the gap between Australian customers and the popular trading platform. Until then, access for AUD users will be limited. Australian traders can still benefit from using Binance, however, they now must deposit cryptocurrency, utilise P2P trading or use the rather expensive bank/credit card “instant buy” feature.

Binance is regarded as the industry’s most feature-laden exchange. And for the most part, the platform lives up to this reputation.

-

- Beginner and advanced trading options. Beginners can use Binance’s Instant Buy feature, while more experienced traders can take advantage of the platform’s spot trading and derivatives markets.

-

- Binance Launchpad. Binance’s Launchpad is perhaps the most prestigious among the community, having incubated several prominent projects like Axie Infinity and Polygon. This lets investors get in early on opportunities they might otherwise miss.

-

- Decentralized wallet. Binance offers a custodial wallet to security-conscious investors who want complete control over their assets.

-

- NFT marketplace. A sprawling NFT marketplace built on BNB allows investors to mint their own digital collectibles.

-

- Binance Learn. Binance Learn is an excellent resource for newcomers learning some of the more difficult blockchain-related concepts.

7. CoinSpot

CoinSpot is Australia’s biggest exchange with over 2.5 million users nationwide. Founded in 2013, CoinSpot is also one of Australia’s oldest and most established exchanges. Similar to Swyftx, the platform takes a beginner-friendly approach with its sleek interface and simple navigation.

Pros

- User-friendly interface

- Lists 400+ cryptocurrencies for trading

- Features an NFT market

- Strong, local customer support

- Low fees on market trades (0.1%)

Cons

- High fees for instant buy and sell orders

- No demo mode

- High spreads

- Lack of learning resources

Exchange details

Trading fees:

1% for instant buy and sell orders

Deposit fees:

Bank transfer, PayID: None

PayPal: 0.5%

Cash: 2.5%

Card: 1.88%

Withdrawal fees:

$0 on AUD withdrawals

2% on PayPal withdrawals

Cryptocurrencies:

460+

Headquarters:

Melbourne, Australia

Fiat currencies:

1

Demo mode:

Full learn platform:

CoinSpot was one of the first cryptocurrency exchanges on the Australian scene. The platform was founded in 2013, and in a decade of operation has built a reputation as a trustworthy and feature-rich exchange. The smooth user interface and easy-to-use buy/sell mechanism make CoinSpot a beginner-targeted exchange, although there’s plenty for intermediate crypto investors too.

The CoinSpot developers have steadily added new features to the site, including an NFT marketplace and crypto bundles. As an Australian-based exchange with an eye to simplicity, CoinSpot is an excellent choice for crypto newcomers looking to build the foundations of a portfolio.

Coinspot charges relatively high “instant buy” fees (1%) and spreads reportedly range between 1-4%.

However, spot market fees are a very competitive 0.1%, while bank transfer deposits/withdrawals made in AUD are free.

- NFT Marketplace. CoinSpot is one of the only Australian-based exchanges to offer an NFT marketplace. Customers can browse hundreds of popular digital collectibles, including blue-chip investments like Bored Ape Yacht Club (BAYC).

- 500+ cryptocurrencies. CoinSpot offers a wide range of digital currencies.

- OTC orders. High-net-worth individuals can order large sums of cryptocurrency through CoinSpot’s over-the-counter hub. This lets investors “perform high-volume transactions” without worrying about liquidity and high spreads.

- ISO 27001 certificate. CoinSpot is among the few Australian exchanges to hold ISO 27001 certification. This achievement means the platform is up to the modern standard for information security.

- Bundles. CoinSpot offers crypto bundles that act a bit like ETFs or index funds. Essentially, users can choose a “themed bundle” that buys a weighted amount of several tokens. For example, a Metaverse bundle comes with AXS, MANA, SAND and more.

8. CoinJar

2% Instant Buy (via card)

0.1% exchange orders

CoinJar is Australia’s longest-running crypto exchange, with the platform bursting onto the scene over a decade ago in 2013. The team has helped over 600,000 Australians begin building their crypto portfolios with all the basics – Bitcoin, Ethereum and Litecoin. The platform is AUSTRAC registered and adheres to all regulatory requirements. In its years operating in Australia, CoinJar has built a reputation as a trustworthy and secure exchange perfect for beginners and intermediate investors.

Pros

- Offers a debit card that allows Australians to pay with crypto at participating merchants

- The CoinJar Exchange fees are quite low

- 90%+ of customer assets held in cold storage

- Long history and reputation of security and trustworthiness

- Advanced traders can use multiple fiat currencies (AUD, USD, EUR and GBP)

Cons

- Relatively small list of tradeable cryptocurrencies

- Light on features

- Spot trading fees (1%) are a little high

- Customer service can be a little slow

Exchange details

Trading fees:

1% instant spot orders

2% Instant Buy (via card)

0.1% exchange orders

Deposit fees:

PayID: Free

Bank transfer: Free

SEPA deposit: Free

Withdrawal fees:

Free

Cryptocurrencies:

60+

Headquarters:

Melbourne

Fiat currencies:

4

Australian based customer support:

Demo mode:

Full learn platform:

CoinJar offers a smaller list of crypto assets than most modern-day competitors, but this is not necessarily a bad thing. It is a simple, beginner-friendly platform that doesn’t tend to bother with lower-cap altcoins. Customers can choose from the basic CoinJar platform (perfect for getting started) or the dedicated CoinJar exchange (excellent for intermediate traders).

The main CoinJar platform can get a little pricey – with spot trading fees a flat 1% – but is still a convenient option for a no-frills trading experience. The CoinJar exchange has an appealing fee structure, with costs as low as 0.02% per trade.

CoinJar prides itself on being a streamlined, easily accessible crypto exchange. This means it has done away with many features seen in modern trading platforms. With that said, there is still plenty for investors of all skill levels:

-

- Mobile app. CoinJar has a popular smartphone application available for both iOS and Android devices. It’s worth noting that the Google Play reviews for the app are quite poor, whereas it has been well-received on Apple phones.

-

- CoinJar Card. CoinJar is one of the only Australian-based exchanges to offer a crypto-based debit card. Customers that want to spend their crypto like cash need to look no further.

-

- Cold wallet storage. Approximately 90% of all customers’ assets are stored in cold, hardware wallets.

-

- Crypto bundles. Investors can choose from ten crypto bundles to quickly and easily diversify their portfolios.

9. Independent Reserve

Independent Reserve is a long-standing exchange that has cemented itself in the Australian crypto industry. The company was founded in 2013 by Adam Tepper and Adrian Przelozny as part of the first-wave of Australian crypto platforms. The exchange only supports a handful of digital currencies, but balances this with strong customer support and advanced trading options.

Pros

- Insurance fund in case of hack or lost customer funds

- Good fee structure for high-volume traders

- Integration with PayPal

- Unlimited daily deposit limit

- ISO 27001 certification

- Support for SMSF accounts

Cons

- Base trading fee is a little high for an intermediate/advanced exchange

- Supports much fewer digital currencies than competitors

- Fees for AUD deposits under $100

Trading fees:

0.02-0.5%

Deposit fees:

Bank transfer: Free for deposits of $100+

$0.99 charge for deposits under $100

Debit and credit cards: 1%

PayPal: 1%

Withdrawal fees:

Bank transfer: Free

PayID/Osko/Instant withdrawal: $1.50

Cryptocurrencies:

30

Headquarters:

Sydney

Fiat currencies:

4

Australian based customer support:

Demo mode:

Full learn platform:

Independent Reserve is a clean, modern crypto trading platform ideal for higher-net-worth or institutional investors. The platform caters heavily to those who trade professionally or frequently. For example, the base trading fee (0.5%) can be reduced to 0.02% for accounts that trade more than $200 million AUD monthly.

The lack of cryptocurrencies available may be off-putting to more speculative investors, but Independent Reserve targets customers who only want to trade a select few digital assets anyway (or already use an alternative altcoin platform). Advanced traders will also enjoy the multitude of deposit options, leveraged trading (up to 2x) and Independent Reserve’s integration with the KPMG tax estimator.

The Independent Reserve platform offers a modern, cutting-edge trading interface without the clutter found when using some competitors. There’s admittedly less on Independent Reserve for the casual investor. Still, businesses, institutions and high-net-worth individuals should enjoy the advantages offered by the long-running Australian exchange.

- HNWI and business solutions. Independent Reserve fosters high-volume traders and will go out of their way to accommodate large transactions.

- Margin trading. Independent Reserve is one of the only Australian-based platforms that support leveraged trading. Investors can trade with margins of up to 2x.

- Tax estimator. Tax time can become less stressful with Independent Reserve thanks to the exchange’s in-built KPMG tax tool.

- AUSTRAC registered. Independent Reserve is registered with AUSTRAC and abides by all relevant regulations.

- Smartphone app. Independent Reserve customers can trade on the go with their well-designed mobile application.

- PayPal and card deposits. Independent Reserve supports cheap PayPal and credit/debit card deposits, one of the only platforms in Australia to do so.

How do I open an exchange account?

Opening a crypto exchange account for the first time can be a little intimidating. However, most modern platforms have straightforward sign-up processes that takes less than ten minutes to complete. The most difficult element of registering on a crypto trading platform is verifying the new account, which usually requires government-issued identification like a passport or driver’s license.

To assist newcomers, here is a step-by-step guide to opening an exchange account using Swyftx as an example:

1. Navigate to the exchange’s website

First, head to the exchange homepage being used. Most landing sites will make it extremely easy to begin the registration process – select “Sign up”, “Create an Account” or any other prompt given by the platform. On Swyftx, we can click “Signup” or “Start Trading”.

2. Create an account

Next, we must enter relevant details to create a crypto exchange account. This typically includes email, country of residence, full name and a mobile number. Fill in the form accurately and move on to the next step. Ensure you have access to the quoted mobile and email address, as most platforms require these contact methods to be verified.

Verify the mobile number and email address entered using a unique six-digit code.

Finally, create a secure password to keep the account safe. Some platforms (such as Swyftx) will require passwords to contain unique characters like numbers, capital letters and so on.

Select “Create” and that’s it – the account is ready to rock and roll.

3. Complete identity verification

Although we now have an account that can browse our exchange of choice, we must still pass KYC protocols before depositing AUD and trading. Most platforms will automatically prompt new users to complete verification. If not, the process can be started via “Account Settings” or a similar tab.

To get started, new accounts need a form of government-issued identification. They may also need to take a selfie or sometimes even record a short video. Completing this process via a smartphone is much easier than a desktop browser. Follow the on-screen instructions and submit all required images and videos.

Most exchanges automatically verify new users, so the account should be ready to trade within five minutes if everything checks out. In some circumstances, the new account must undergo manual verification. This can take 24-72 hours, so some patience is required.

Either way, users can deposit AUD and begin trading their favourite cryptocurrencies once the account is fully verified.

How to choose the best crypto exchange?

Perhaps the hardest part of starting the crypto investment journey is choosing a trading platform that suits your needs. While the platforms noted on this list are all excellent options, what might work for one investor might be a poor choice for another. That’s why several factors are worth considering before choosing the best crypto exchange for you.

Australians should always consider using an Australian-based exchange – at least while starting out. There are many advantages to using a local exchange. For starters, they must abide by Australian financial regulations. Australian businesses also offer more relevant (and often free!) deposit options (PayID/Osko, for example), operate in the same timezone and tend to have locally-based customer support.

On the other hand, more experienced traders may want to actually consider an exchange outside of Australia. This is because the nation is a relatively small market, and higher net-worth orders may suffer from poor liquidity and high spreads. Additionally, overseas platforms typically have better support for derivatives and margin trading.

That said, several major Australian exchanges lean on international liquidity to help settle trades.

A crypto exchange’s reputation is extremely important. A good resource to use is Trustpilot or Productreview, where independent customers give a rating out of five to various businesses and their associated customer support. New investors should also look at the customer service options available. Exchanges that offer 24/7 support, live chat or a mobile hotline are often preferable to those lacking these options.

These reviews give insight into the most trusted crypto exchanges in Australia.

Hacks and exchange attacks are slowly becoming less of a common occurrence for the crypto industry, but they are still a real threat. Australian exchanges are often innately more secure than international exchanges due to their lower turnover – making them less of a target. Other security metrics to consider include:

- 2FA. This is a non-negotiable. Investors should avoid exchanges that do not offer this function.

- Cold storage of customer assets

- An insurance fund in case of hack or privacy breach

- ISO27001 Certification

Beginner investors likely only need a few cryptocurrencies to start building their portfolios. Nearly every major exchange supports a wide enough range to get their customers started. However, experienced traders interested in more obscure altcoins should always double-check each platform’s listed coins. For example, it wouldn’t make much sense for an investor who wants to purchase SUI to sign up for an exchange that doesn’t offer it.

Platforms that do not accept AUD can pose a major inconvenience to investors – especially newcomers to the crypto scene. These exchanges should be avoided by those who want to take a backseat on their investment voyage.

Additionally, certain platforms may offer unique and appealing payment options. An exchange that allows investors to buy crypto with debit/credit card, PayPal or cash could be an advantage over a competitor that only supports bank transfers.

Fees are rightfully one of an investor’s biggest considerations before selecting a crypto exchange. For some traders, a fee difference of just 0.1% can be the difference between turning a profit and making a loss. While most platforms are fairly transparent with their trading fees, investors should always investigate spreads – the difference between an asset’s buy and sell price. These “hidden fees” can easily make a seemingly cost-effective exchange rather expensive. Deposit and withdrawal fees are always worth investigating, too.

Decentralised finance regulation still sits in a grey area, but Australia is joining the trend of updating their financial frameworks to incoroprate digital assets. With Aussie crypto exchanges now requiring an Australian Financial Services Licence (AFSL), there are important and strict government protocols for trading platforms to follow. Most of these rules act in the consumer’s best interest, so it’s a good idea for beginners to stick to exchanges registered with their local financial authority. For Australian operating platforms, this is AUSTRAC.

Frequently Asked Questions

There are several high-quality exchanges in Australia for crypto enthusiasts to choose from. The “best exchange” will be one that suits each investor’s personal financial goals. Swyftx, Independent Reserve, OKX Australia, CoinSpot and CoinJar are all solid options.

Very few Australian exchanges have encountered major issues with liquidity or security. However, very few have only a select few have ISO27001 Certification, the industry standard for information security – including Swyftx, CoinSpot and Independent Reserve.

Swyftx has the highest Trustpilot score of Australian exchanges, with an excellent rating of 4.7/5. Other high-scoring local trading platforms include CoinSpot (4.4), CoinJar (4.1) and Coinstash (4.5).

International heavy-hitters Gate.io & Binance have some of the lowest fees on the market. High-volume traders can see fees as low as 0.075%. For Australian exchanges, Swyftx reportedly has the lowest spreads, while Independent Reserve and Coinjar offer the lowest fees for institutional investors.

Performing due diligence on an exchange and the development team behind the company is a great way to ensure the exchange is trustworthy. However, the only way to truly avoid counterparty risk is to eliminate it altogether. Long-term investors should consider moving at least some of their crypto assets off an exchange and into a non-custodial wallet.