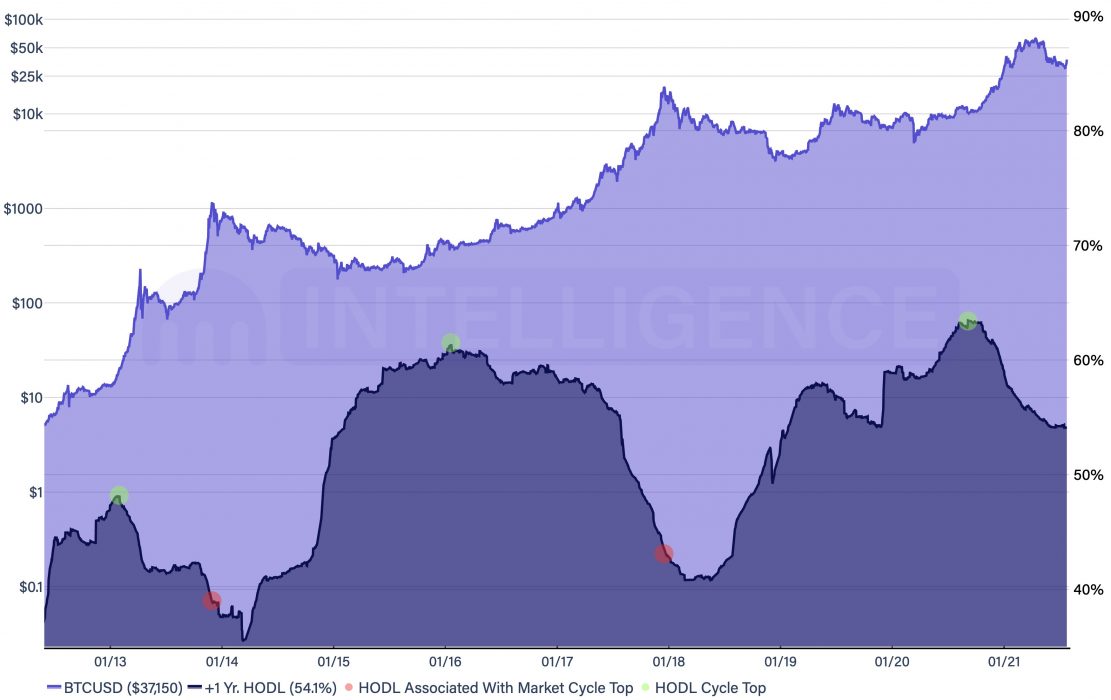

54.1% of Bitcoin in Circulation Has Not Moved in Over a Year

In a year of ups, downs and unprecedented levels of fear, uncertainty and doubt (FUD), more than half of bitcoins in circulation haven’t moved. Bitcoiners have once again proved their conviction in a year full of challenges.

Source: Pete Humiston

What is the Significance?

The fact that more than half of HODLers haven’t shifted their coins in a year offers a few possible interpretations:

- high levels of conviction in the asset (ie diamond hands)

- growing levels of long-term investment, rather than trading of the asset

- belief that a bull market is under way and the top is not yet in

- bitcoins being taken off exchanges and put into cold storage in growing numbers

On-chain analytics and, more specifically, HODL waves highlighted by such data provide useful indications of market trends such as those identified above. Crypto News Australia reported earlier this year on the relationship between HODL waves and bull markets and is certainly worth a read for those keen to learn more.

While Bitcoin sceptics often highlight the asset’s volatility as a weakness, history has shown that those who have the stomach to withstand the ups and downs tend to be rewarded in the long run with exponential returns.

A Year of Challenges

It’s thus far been a bumpy ride for Bitcoin HODLers. After a strong start to 2021, Q2 posted the worst returns in over eight years. Regulatory and environmental concerns have provided the greatest headwinds, in addition to the after-effects of China banning bitcoin mining.

However, following a significant reduction in leveraged shorts and growing accumulation from long-term holders, there are signs that Bitcoin may have turned a corner. In the last week alone, BTC is up 34 percent and at the time of publication was trading at US$40,139.