Yearn Finance Token Soars 50% Amid Aggressive Buyback Program

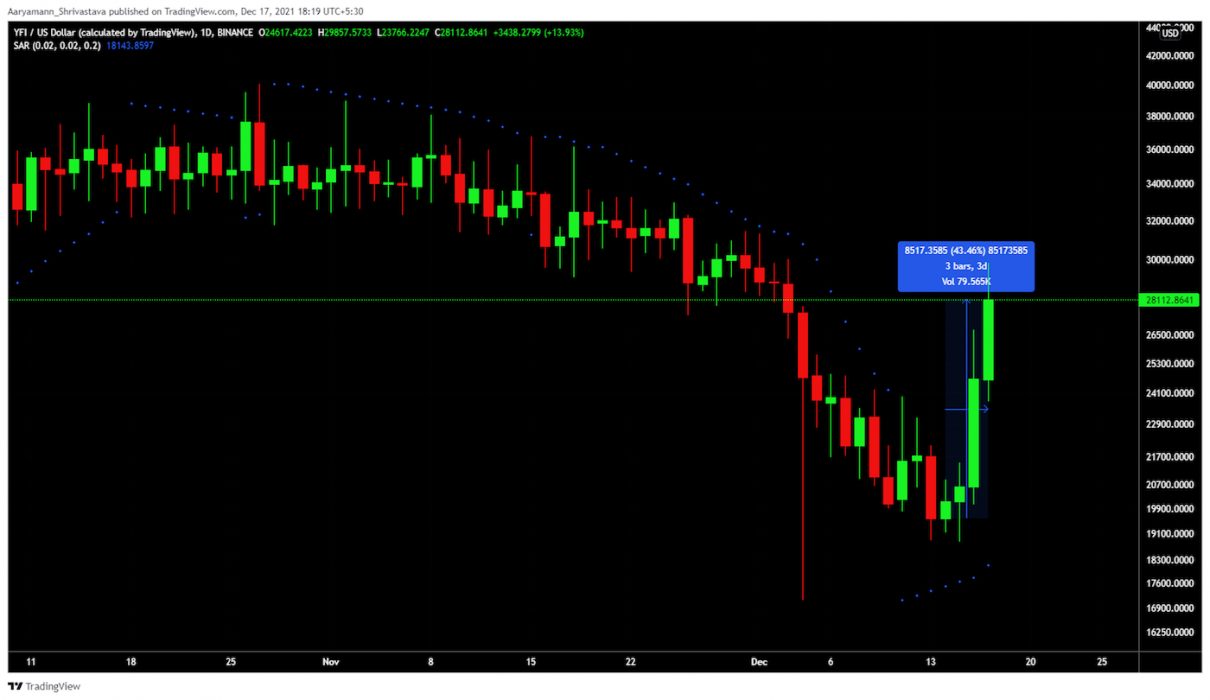

Yearn Finance (YFI) proved to be one of the best performers in the crypto market last week, rallying almost 50 percent to hit a fortnightly high above US$31,700 at the time of writing.

The surge coincided with a revelation by Yearn that it has been buying back its YFI token in bulk since early last month in response to a community vote to improve its tokenomics. The decentralised asset management platform purchased 282.40 YFI at an average price of US$26,651 per token, totalling over US$7.5 million.

Yearn Intends to Buy Back Even More Tokens

Yearn also claims to have more than US$45 million in its Treasury and has recorded “stronger than ever” earnings. As a result, it said it would buy back even more YFI tokens in future.

Yearn reportedly makes about US$100 million per year alone in fees collected from Vaults, its smart savings account service that maximises the value accrual of deposited digital assets. It also has enough liquidity to sustain its token buyback strategy going forward.

YFI Leaves ETH and SOL in the Shade

Right now, Yearn’s primary aim is to recover recent losses and last week’s rally left some of the major altcoins in the shadows. To cite two examples, ETH dropped 3.38 percent with SOL sitting at -1.57 percent in the same period YFI shot up 46 percent.

Back in February this year, Fantom FTM coin pumped more than 73 percent in a single day on the back of its collaboration with Yearn Finance. Perhaps YFI has once again found the magic touch.