Tron DeFi Soars to $6 Billion Amid Release of New Stablecoin

Tron has become DeFi’s third-largest blockchain, with the launch of its new Terra-like algorithmic stablecoin promising yearly returns of more than 20 percent.

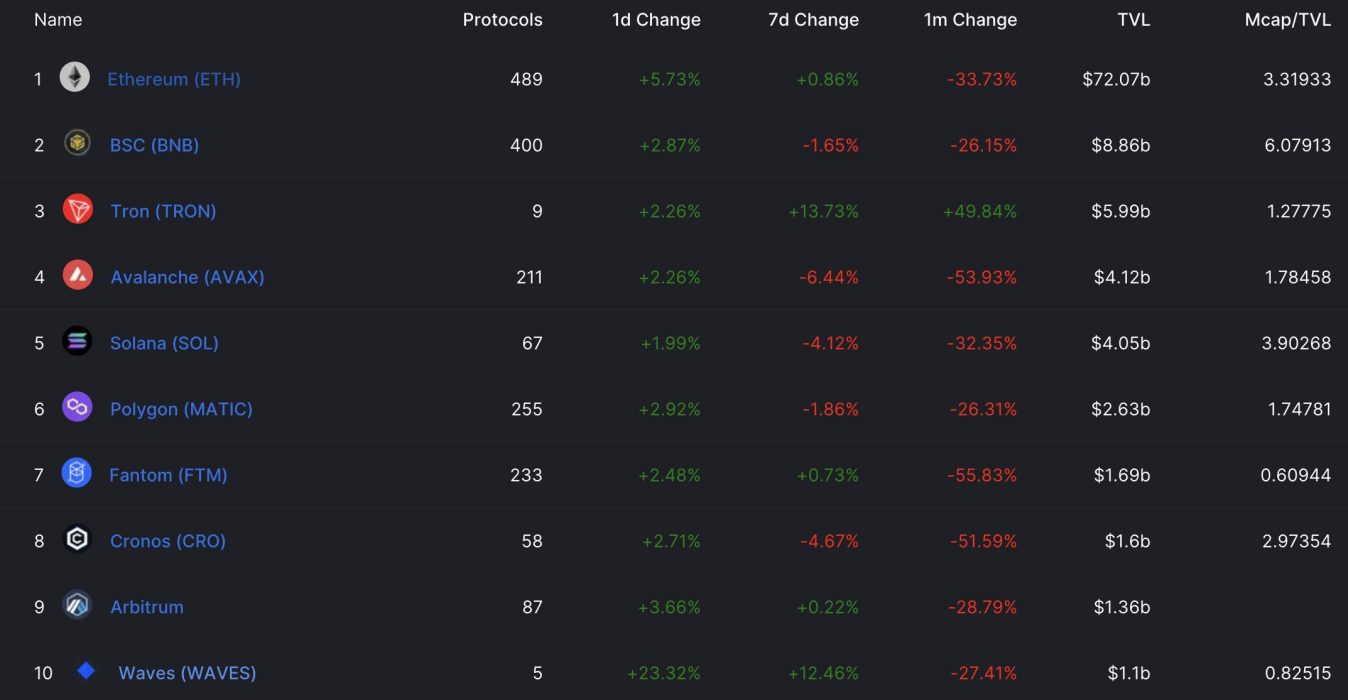

In terms of total value locked (TVL), Tron now trails only Ethereum and BNB Chain. The surge in TVL can be attributed to its algorithmic stablecoin USDD, which has grown to US$545 million on the promise of 30 percent “risk-free” yields.

Tron’s USDD follows a similar stabilisation method to Terra’s UST stablecoin, which suffered a US$40 billion loss last month. According to data from DeFi Llama, Tron’s DeFi ecosystem has grown by almost 44 percent over the past 30 days, from US$4 billion to US$5.99 billion at the time of writing. BNB Chain and industry leader Ethereum are at US$10.8 billion and US$93 billion, respectively.

What is Driving Tron’s Growth?

The growth observed on the Tron network is primarily driven by the double-digit returns promised by USDD – very similar to what Terra’s UST offered. USDD is not backed by anything, but governing the stablecoin’s dollar peg is an arbitrage trade between USDD and TRX, Tron’s native token.

Investors can always swap 1 USDD for US$1 worth of TRX, and if the price of USDD falls below the dollar peg, they can buy the discounted USDD and swap it for TRX, thus pocketing the difference by selling TRX on the open market.