TradeRoom: Our Weekly Crypto Trades Analysis – Dec 13, 2021

Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

Well, compared to last week it’s been a pretty non-eventful seven days, which makes it very difficult for those traders/investors who cannot control their psychology and remain patient. In our TradeRoom we’ve seen some successful short trades over the past week or so and haven’t started entering into longs just yet.

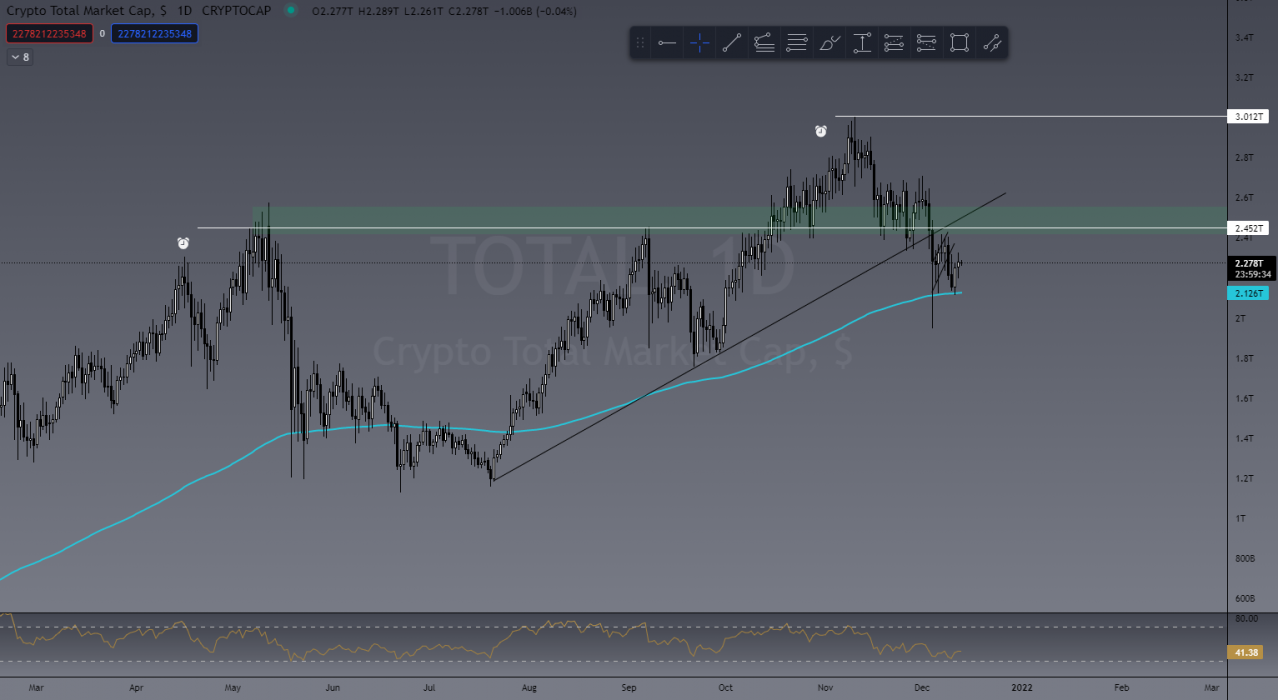

Do I think the market is about to go up? Well, maybe for a short while, as a bit of a trap. The TOTAL chart is still showing lower highs (LH) and lower lows (LL) and until that market structure changes, nothing else changes. We’re still below resistance and a daily uptrend. A positive to note is the bounce off the 200EMA, but I won’t put a lot of weight behind that at this stage.

BTC needs a change in market structure as well before I scale into long trades. At this stage, the daily has closed below the 200EMA and major resistance. We could see a slight push up before a continuation down to test that weekly uptrend (white line) again. BTC needed a healthy retracement, so while we trade up and down in the futures market I’m still holding spot positions strong. I see no real reason to start panic selling.

If this market structure changes then we blast off, however a weekly close below US$40,000 would be very bearish. It’s important to have a trade plan in place for both scenarios.

I’m thinking another stop on US$43,000 could be good.

Last Week’s Performance

As I mentioned above, we’ve seen some good short trades coming out of the TradeRoom this last week. Below are some examples of those trades:

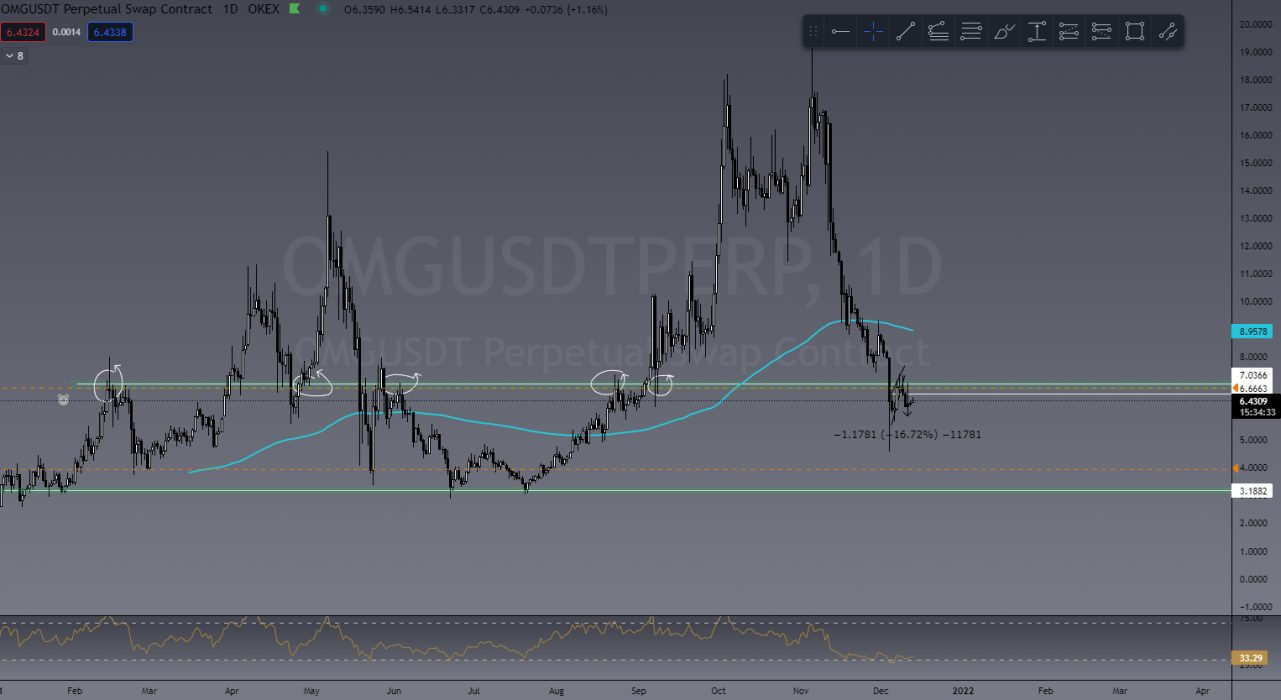

OMG/USDT

A cheeky little 160% trade so far on OMG – this one was talked about in one of our LIVE market scans that we hold twice a week via Zoom. If we do see BTC take another downside turn, ALTS will almost certainly follow and this OMG short trade showed a lot of potential.

LRC/USDT

In the past two weeks, LTC has been great for short selling. I’ve had three separate entries into this short on 10x leverage producing 220%, 400% and 160% trades. Currently still an active trade, until we get that change in BTC market structure mentioned above.

This Week’s Trades

BTC/USD

I’ll be keeping my current short in BTC open for now as I think we could see that weekly trend retested before the moon launch. Something like the below to play out would be nice for this short trade. This would see an almost 20% drop in price action and test key support.

ETH/USDT

Like BTC, ETH is still in a LH/LL market structure and it would be good to see another test of the US$3,500 area. I’m still in an active short trade on ETH also, and will let this ride unless that structure changes.

I should note that these short trading positions are temporary for now. I still see a huge bullish push coming for BTC and I’m simply taking short to mid-term opportunities in trading while I can.

IMPORTANT NOTES ON SHORTING:

These trades taken this week have been short trades using leverage. The reason for this is simply because the market has been trending DOWN and this is how we profit from a bearish market. This cannot be done in a SPOT trading market, where your only option would be to sell and wait for a new buy level.

Shorting a market should only be done by experienced traders and should NOT be taken by beginners. While the profits I’ve mentioned above seem very attractive, it takes time to learn and practise this craft before being profitable.

This is also considered “counter trend trading”, and again should only be performed by experienced traders!

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new, volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!