Terra UST Flips Binance USD to Become Third-Largest Stablecoin

Decentralised algorithmic stablecoin TerraUSD (UST) seemingly can’t help but make headlines these days. Most recently, it surpassed Binance USD (BUSD) to become the third-largest stablecoin by market capitalisation (market cap):

UST Making Waves

For the Terra team behind UST, it’s been a busy 2022 thus far, characterised by a string of bullish announcements that have thrust UST into mainstream consciousness.

Its youthful founder recently announced a program to buy US$10 billion in bitcoin to backstop the stablecoin and guard against extreme volatility that could undermine peg parity.

Shortly after, Crypto News Australia reported that its market cap had soared some 700 percent in six months, surpassing Circle’s USD Coin (UDSC) as the fastest-growing stablecoin. In fact, its market cap has grown by 15 percent in the past 30 days alone:

Devil is in the Detail

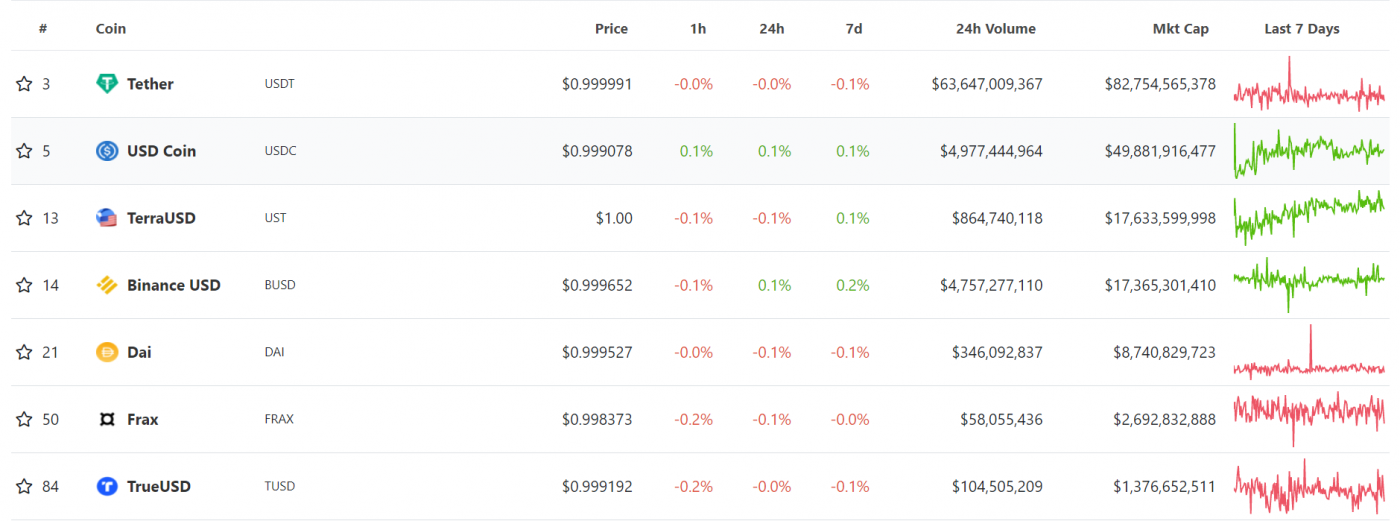

When looking at the market cap for the top US dollar denominated stablecoins, it’s evident that BUSD has been marginally surpassed:

However, eagle-eyed UST fans would be wise to temper their enthusiasm, as 24-hour volume reflected in the chart above demonstrates that BUSD still has almost five times the volume.

Compared to the incumbent, Tether (USDT), UST’s market cap is still five times smaller, not to mention that its volume remains at least 65 times lower.

However, when one looks at UST’s meteoric rise over the past six months (below), it’s self-evident that it is shaping up to become the fastest horse in the stablecoin race.

To be sure, UST isn’t widely embraced by the broader digital asset community. Despite the promise of censorship resistance, most criticism is directed against the stablecoin’s burning mechanism, which is necessary to maintain a 1:1 US dollar peg.

It’s too early in the decentralised stablecoin experiment to speculate how things will play out. For now, the only thing that can be said with confidence is that UST appears to be gaining ground on its rivals.