Regulation is Good for BTC Price Action, Report

Bitcoin-focused financial services firm New York Digital Investment Group (NYDIG) has released a report in which it found that increased regulatory clarity was beneficial to the price and adoption of Bitcoin.

Regulatory Clarity, Helpful or Hurtful?

The report notes that regulatory clarity is often cited as a significant hurdle for institutional adoption, however NYDIG has maintained the opposite view, believing that adoption would grow once investors “know the rules of the road”.

To test its thesis, the company looked at historical events related to digital asset regulation across a number of international jurisdictions. These events encompass matters including tax, accounting, payment, mining, the legal status of exchanges and other service providers, or even the legality of crypto assets themselves.

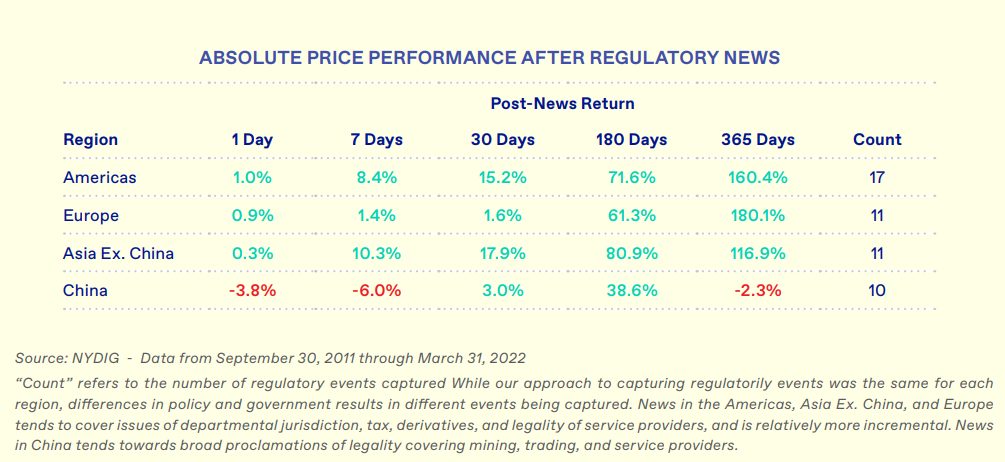

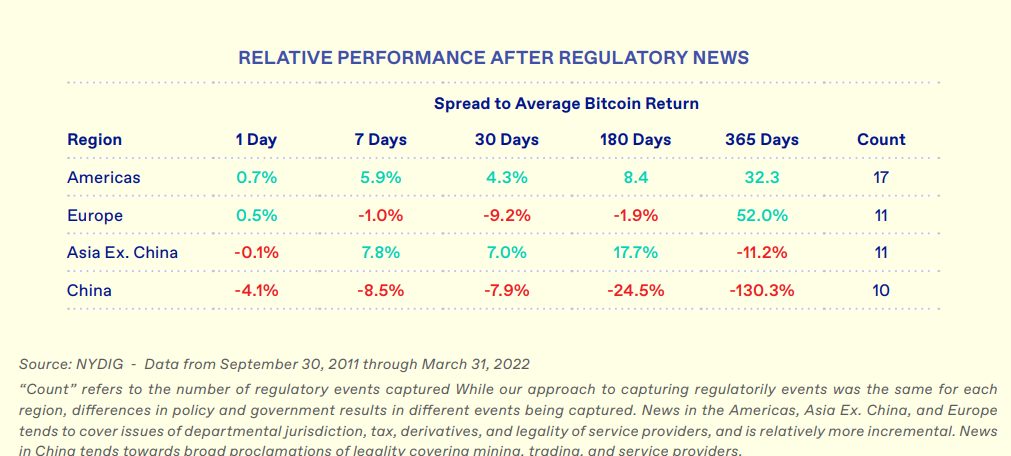

It then tracked the subsequent price returns of bitcoin in the following day, week, month, six months and year, with a focus on the longer-term windows. The returns were then evaluated in both absolute and relative (ie, average) terms.

Investors and Price Welcome Regulatory Clarity (Mostly)

The report noted that, other than China, which has implemented countless bans on mining and digital asset ownership, most other jurisdictions were “supportive but with guardrails”.

Aside from China, where regulations had a deleterious impact on price, across all other jurisdictions the study offered clear evidence that on both an absolute basis and relative basis, increased regulatory clarity was favourable for the price of bitcoin. This was particularly the case across six- and 12-month timeframes.

The implication then is that regulatory clarity, despite its flaws, is appreciated by investors. Noting that retail only accounts for a quarter of volume, it’s little surprise that regulation brings with it positive price action across longer timeframes.

With bitcoin capitulating below its previous cycle’s all-time high, one wonders what the impact will be of the recently released US “crypto bill”, dubbed the Lummis-Gillibrand Responsible Financial Innovation Act, once passed.