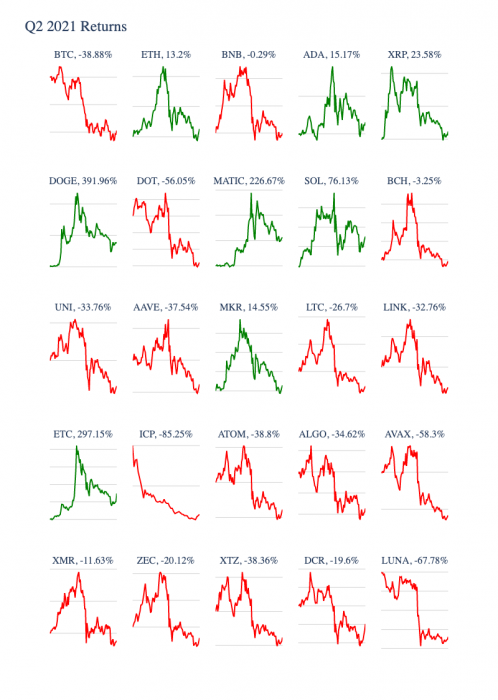

Q2 2021 Crypto Returns Analysis: BTC -38%, ETH +13%, DOGE +391%

The cryptocurrency market took a big hit in the second quarter of the year, to the extent that almost US$1 trillion was wiped off the entire crypto market capitalisation from the all-time high (ATH) in May.

In Q2 2021, Bitcoin (BTC) registered its worst quarterly performance for the past three years. However, Dogecoin (DOGE), Ether (ETH), and a few other major altcoins made positive returns within the same period.

BTC Returned -38%, Worst Record Since 2018

Bitcoin had been in an uptrend during the first three months of this year. However, it began tumbling in value shortly after reaching an all-time high of over US$63,000 on April 14. Based on data from Coin Metrics, BTC closed Q2 with a negative return of -38 percent.

Besides the bear market, some developments may have contributed to the significant drop in BTC. These include Tesla’s suspension of Bitcoin payments and the recent crackdown on Bitcoin mining in China.

Dogecoin Led Q2 With +391% Return

Despite the fact that the largest crypto tanked heavily in Q2, a few major altcoins came out with positive returns, including Ethereum (ETH).

At today’s price of US$2,000, ETH has lost about 54 percent value from its ATH of US$4,362 on May 12. However, it still pulled through the second quarter with about 13 percent gain.

It’s worth noting that the meme cryptocurrency Dogecoin (DOGE) was the best-performing major crypto in Q2, based on the data from Coin Metrics. Dogecoin posted a return of 391 percent in Q2, although it has lost over 70 percent of its value from the ATH.

Ethereum Classic (ETC) and MATIC follow on the list with about 297 and 226 percent gains, respectively.