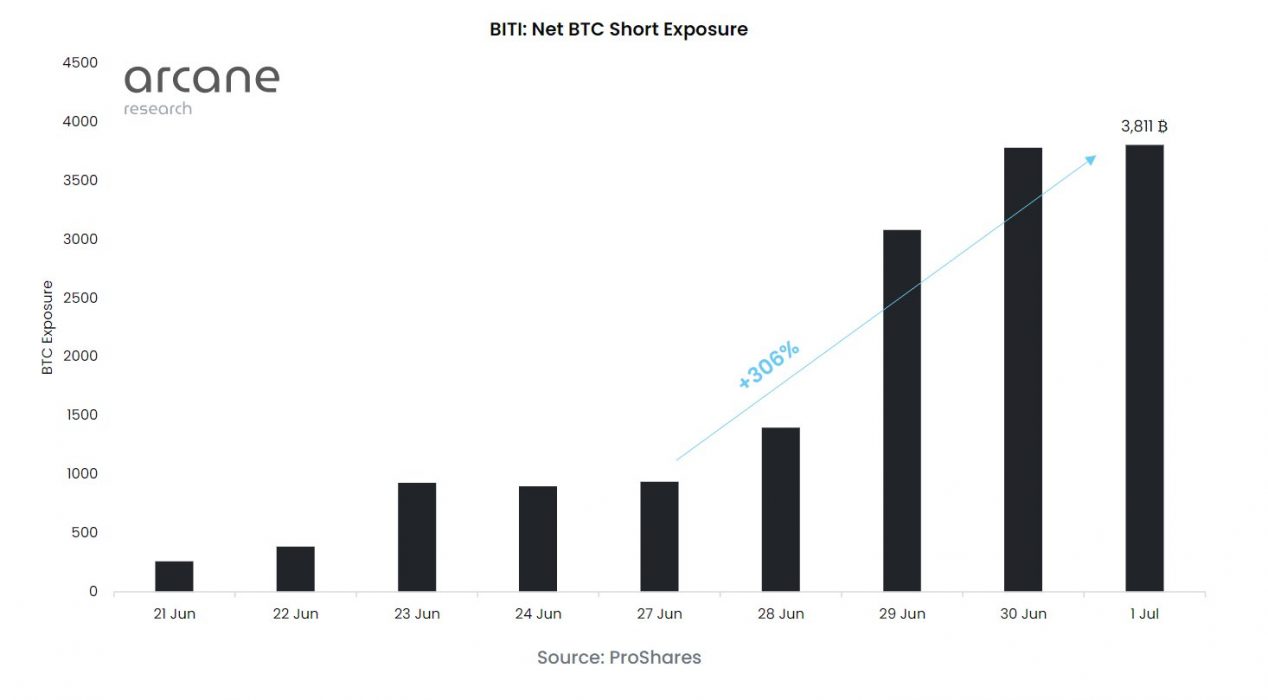

World’s First Short BTC ETF Sees Interest Explode 300% in Days

Following its hotly anticipated launch two weeks ago, the Proshares Short Bitcoin exchange-traded fund (BITI) initially got off to a rather lacklustre start. However, according to Arcane Research, interest of late has soared by over 300 percent:

Betting on More Downside?

As bitcoin managed to claw its way above US$20,000 amid ongoing fears of a recession, investors appeared to take a particular liking to BITI, resulting in some US$51 million worth of inflows over the past week.

Speaking to CoinDesk, Pawel Cichowski, the head of dealing at crypto exchange XBO, suggested that market consensus appeared to favour more pain on the horizon:

People who are involved in the market think that the bottom is still to come, so if they can’t make money on the rise, they want to make money on the fall by shorting Bitcoin.

Pawel Cichowski, head of dealing, XBOAdvertisement

Cichowski added that “with signs of a global recession coming up and the bond yield curve inverting, nobody knows for sure where the price of bitcoin will go next. However, based on ProShares statistics, people are preferring to expect the worst”.

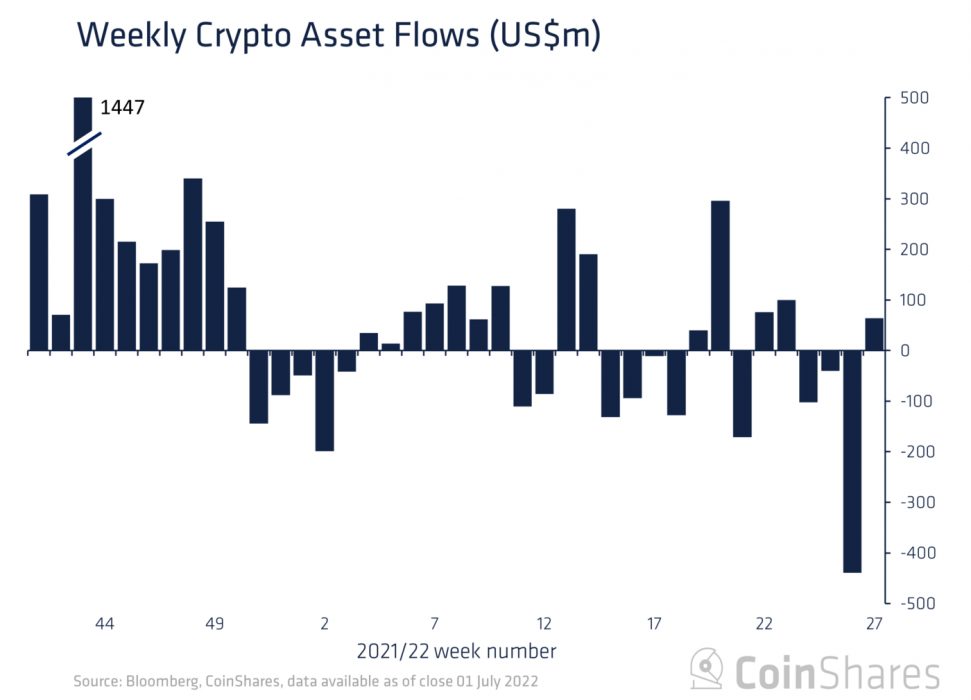

Inflows Back into Crypto Mask the Reality

In its latest report, CoinShares reveals that despite a lack of good news, investment flows are returning to crypto products:

Analysts were however quick to note that despite seeing inflows of US$64 million over the past week, the “headline figures obscure the fact that a significant majority were into short-bitcoin investment products (US$51 million)”.

Addressing the issue of whether increased inflows into BITI offered evidence of renewed negative sentiment, CoinShares argued that it was possibly instead due to “first-time accessibility”, reflected by some US$20 million inflows into bitcoin long products from Canada and Europe (Germany in particular).

Whatever the reality, the figures in question remain a long way off recent record weekly outflows of US$423 million, witnessed shortly after news broke that Celsius was in trouble and the contagion that followed.

As bitcoin continues to trade in the US$17,500 to US$20,000 band, it remains unclear whether the bottom is in. Of course, for those with conviction dollar-cost-averaging over the long term, it’s perfectly irrelevant: