US Amendment Has Far-Reaching Implications for the Crypto Industry

A hotly debated US$1 trillion infrastructure bill has been passed by the Senate, which may have some problematic repercussions for the American and wider crypto community.

Cryptocurrency took centre-stage in US Congress on August 10 when the massive infrastructure bill was discussed. One section of the bill aims to generate tax revenue and customer information from cryptocurrency brokers, which in its current definition looks at taxing everyone who plays a part in a crypto transaction.

Advocates for the crypto industry pushed back on the provision, leading to lawmakers introducing amendments in an attempt to modify the language. Republican Senators Pat Toomey and colleagues proposed explicitly defining which types of entities are brokers, while a competing amendment introduced by Senators Rob Portman (Republican) and Democrats Mark Warner and Kyrsten Sinema proposed a more narrow modification that only exempted Proof-of-Work (PoW) miners.

A Problematic Definition

The bill drew controversy due to its plan to collect US$28 billion in tax revenue from the crypto sector. One of the main problems crypto advocates have with the bill is its definition of “broker”, currently defined as anyone who facilitates a transaction.

According to legal experts, this term may be broadened to encompass PoW miners, Proof-of-Stake (PoS) validators, and even protocol creators, affecting nearly everyone in the crypto ecosystem.

Additionally, brokers will be required to go through Know Your Customer (KYC) processes and follow rigorous tax reporting standards under the new laws.

The overly broad definition will hurt blockchain innovation, may possibly cost jobs, and most importantly will endanger the privacy of many American users. Senators have been urged to take a step back and implement incremental regulations, as many of them don’t yet understand what they are trying to regulate.

Banks Don’t Like Crypto

In a failed last effort to get the amendment passed, Republican Senator Richard Shelby objected to the provision after his effort to add a military funding amendment was blocked by Democrat Senator Bernie Sanders. The vote fell short by one.

Following the rejection of the amendment, Charles Hoskinson, founder of Cardano (ADA), stated that “it was a really tense moment, listening to senators speaking [about] how badly this bill can damage the crypto industry. I have no intention of living in a dying empire.”

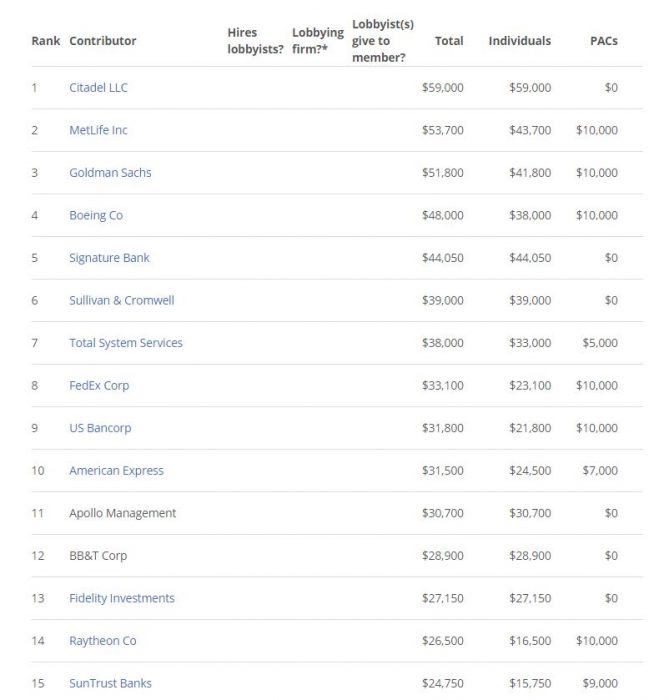

Senator Shelby also has connections to banks in the US, with Citadel and others showing up as some of the biggest donors to his previous campaigns.

The infrastructure bill represents the first time that crypto has entered the highest echelons of political discourse in the US. Instead of pushing quiet legislation through, this crypto provision gave the industry an unprecedented platform and relevance in the eyes of lawmakers.

The bill now moves to the House for further deliberation, though it is unclear how much room there will be for modifications once it gets there.

The Potential Impact on Australia

Landmark regulatory standards and legislation are very important in the expanding crypto industry. New legislation created by frontrunner countries has the potential to set a precedent that could be followed by other countries also developing their own legislation.

The passing of this bill has various knock-on effects, not only in the legislative environment but for new crypto start-ups and innovators in the US, stifling growth of one of the sector’s major players. If the industry takes a hit like this, it could spell danger for ongoing innovation in the crypto space.

The decision may also hurt the market value of some projects based in the US, in turn having an effect on overseas investors.