Unveiling the Q2 2023 Crypto Industry Report

This ever-changing crypto landscape, where “magical gains” and “wishful thinking” seem to hijack practical consideration, has led to a volatile journey toward mainstream asset adoption. After a slow year in 2022, we are seeing some traction within the crypto landscape, particularly in the past quarter.

As Q1 2023 has been marked by reaching new heights, especially after the 2022 hibernation, it led to a boom that spiked the crypto market. Thus, crafting your investment strategy based on actual events and other influential factors is essential to ensure high gains.

In today’s article, we look at the last quarter’s performance to see where the crypto industry is heading and analyze what could be improved. We’ve included some of the most critical information from CoinGecko’s report so that we can help you further in your trading journey, regardless of your experience.

Top 5 Q2 Crypto Highlights for Your Investment Strategies

1. NFTs Endorsement Plunged by 35%

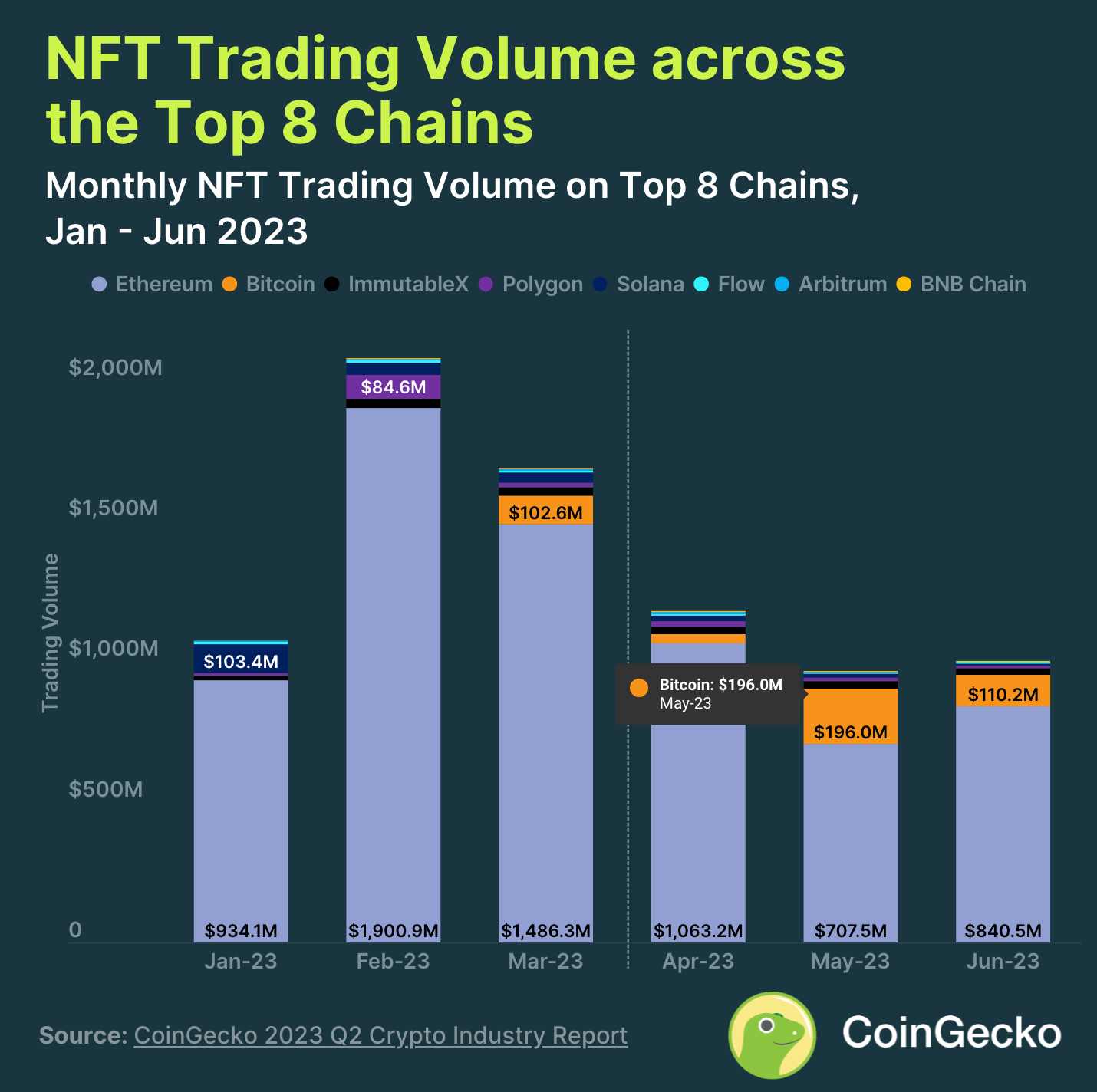

Even though we saw a rise in the popularity of Bitcoin Ordinals, the NFT (Non-Fungible Tokens) trading volume plunged by 35%, hitting a low of $3.15 billion in Q2. As a result, it affected its leading rival, Ethereum, thus making it drop from a considerable 83% to 73.3%.

Despite this, Solana has suffered the most, losing 78.6% in three months, partly due to migrating some of the most appreciated NFT collections, DeGods, and y00ts to Ethereum and Polygon.

2. Bitcoin Ended Q2 with a 6.9% Increase

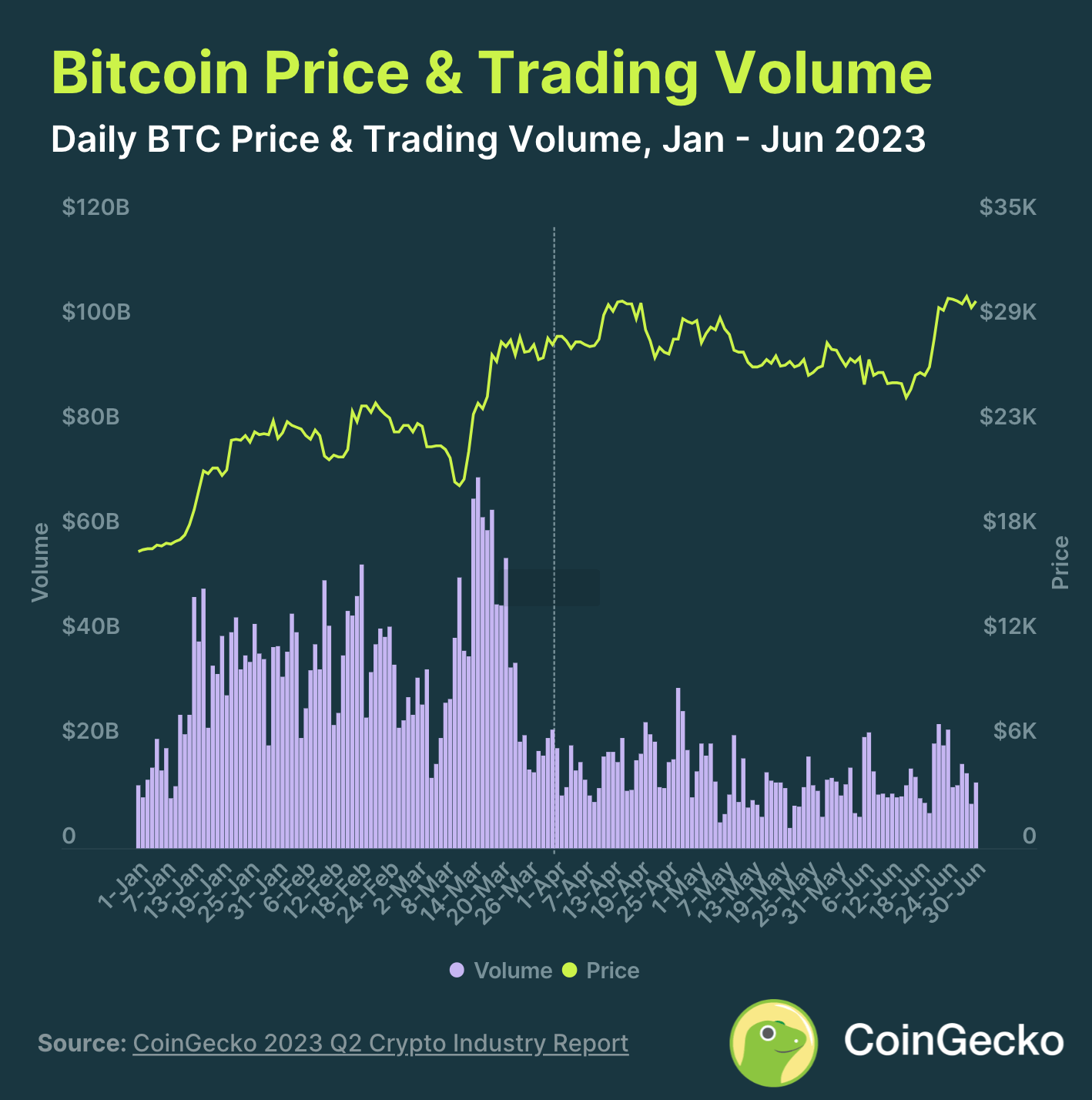

As many investors turn their heads toward the most well-known currency, Bitcoin enjoyed a 6.9% gain in the last quarter. Moreover, it increased its value from $28,517 to $30,481, surpassing the total crypto market cap by 0.14%. A key factor that affected the BTC price was the announcement of BlackRock’s spot Bitcoin ETF, filed on June 15.

Yet, as we all saw a rise in Bitcoin’s price, the average daily trading volume decreased. If Q1 closed at $33.4 billion, in Q2, things did not change for the better, closing the quarter with $13.8 billion.

3. Stablecoins Shrank 3.5%

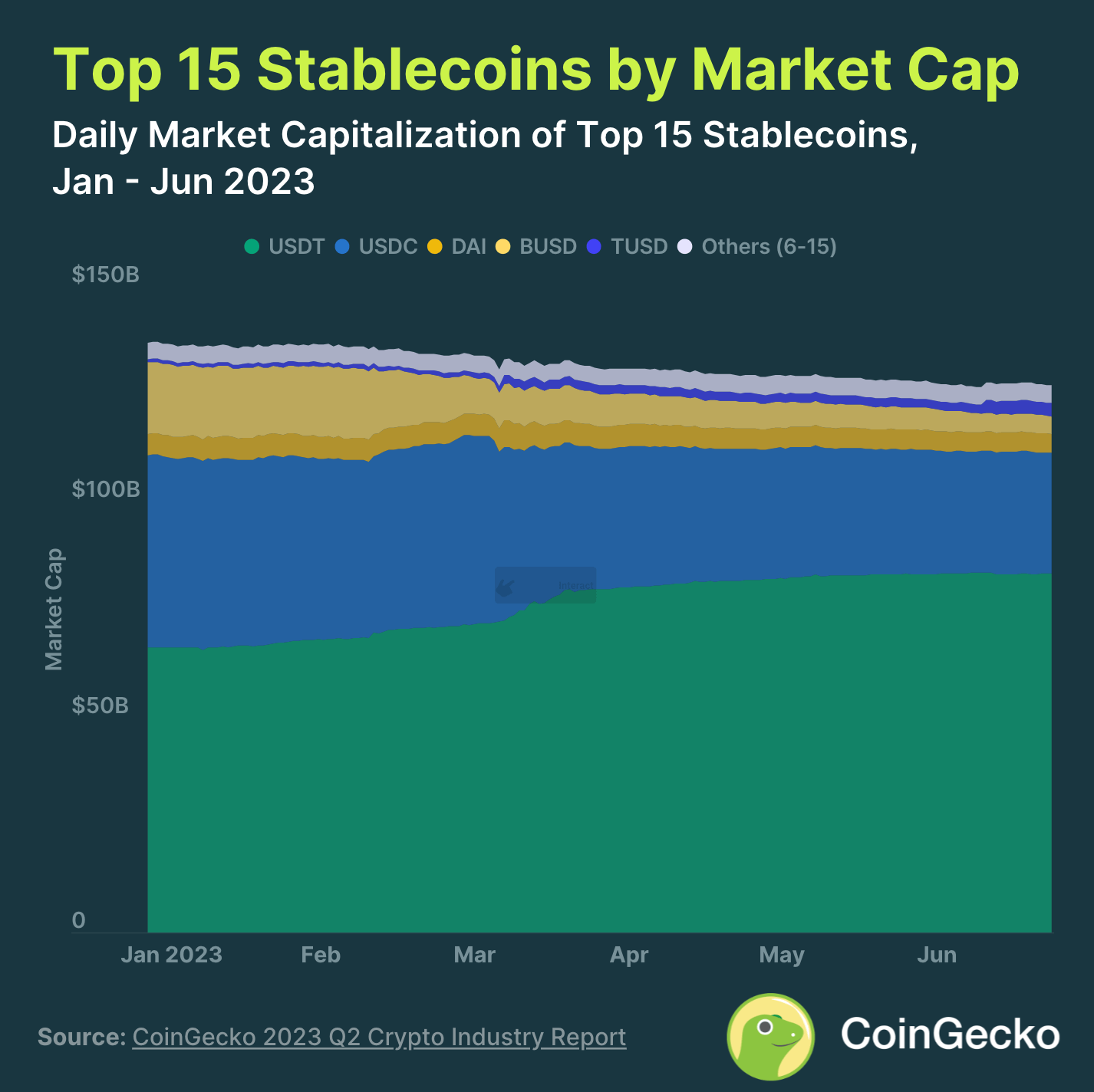

Things changed for the top 15 stablecoins, whereby the total market cap dropped by $4.6 billion between January and June 2023.

The largest gainer for the last quarter is True USD, which added 50% to its market cap. Also, things went well for Tether, which added a considerable 4.4%, meaning + $3.48 billion to its market cap, accounting for 66% market share of the stablecoin market.

On the other side lays USD Coin and Binance USD, which dropped, losing $5.18 billion and $3.43 billion in market cap value.

4. Spot Trading on CEX Lost Ground in Q2 2023

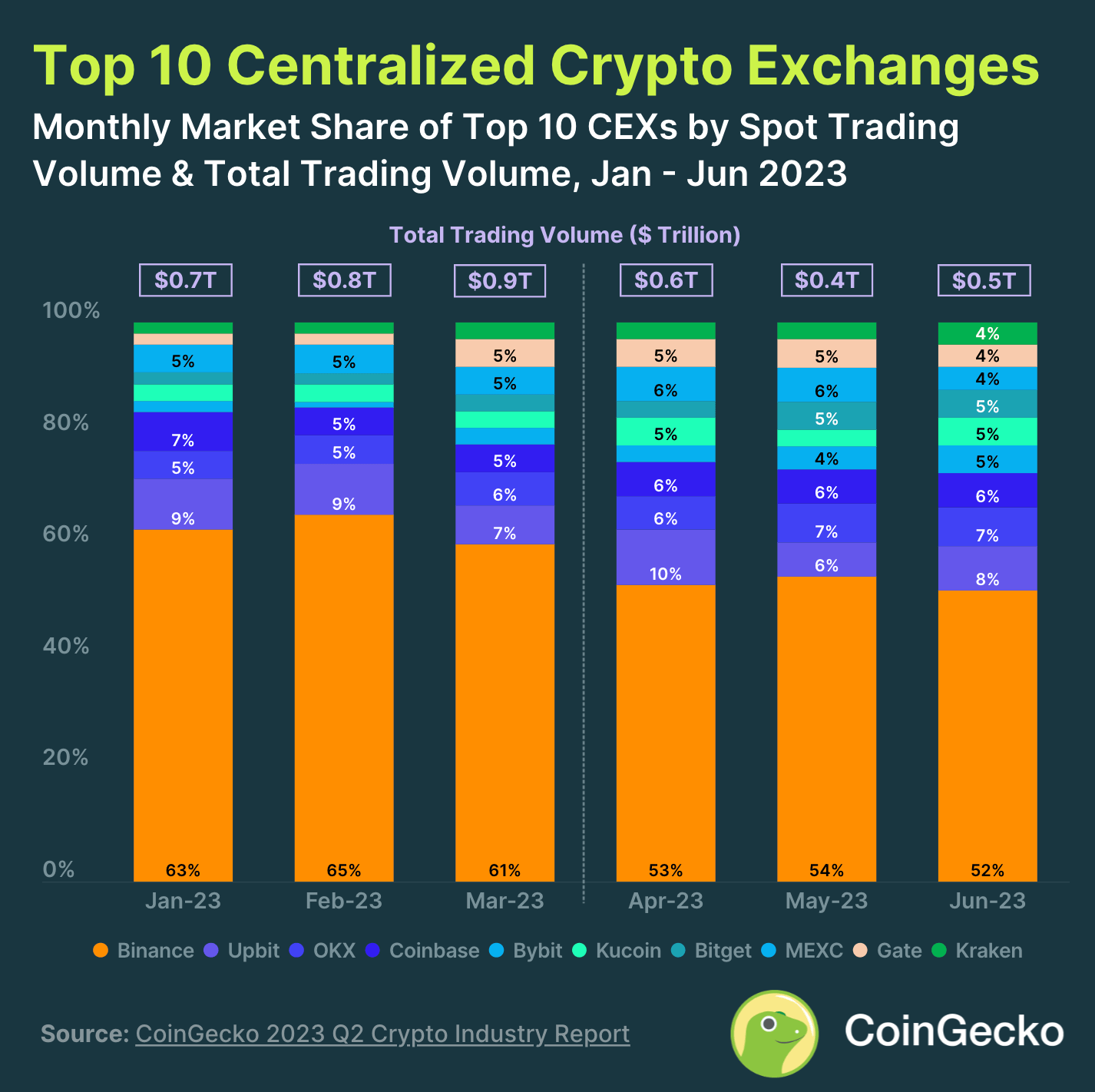

It’s no wonder that the constant regulator’s push has left a mark on the crypto industry, especially on Binance’s spot trading, which slid from 61% in March to 52% in June 2023.

Moreover, we saw a 43.2% decrease across the top 10 CEX from Q1 to Q2 2023. As a result, its value counted at $1.42 trillion. Yet, speaking of the top 10 CEXs, new platforms entered the top, Bybit, and Bitget, making Huobi and Crypto.com lose their spot.

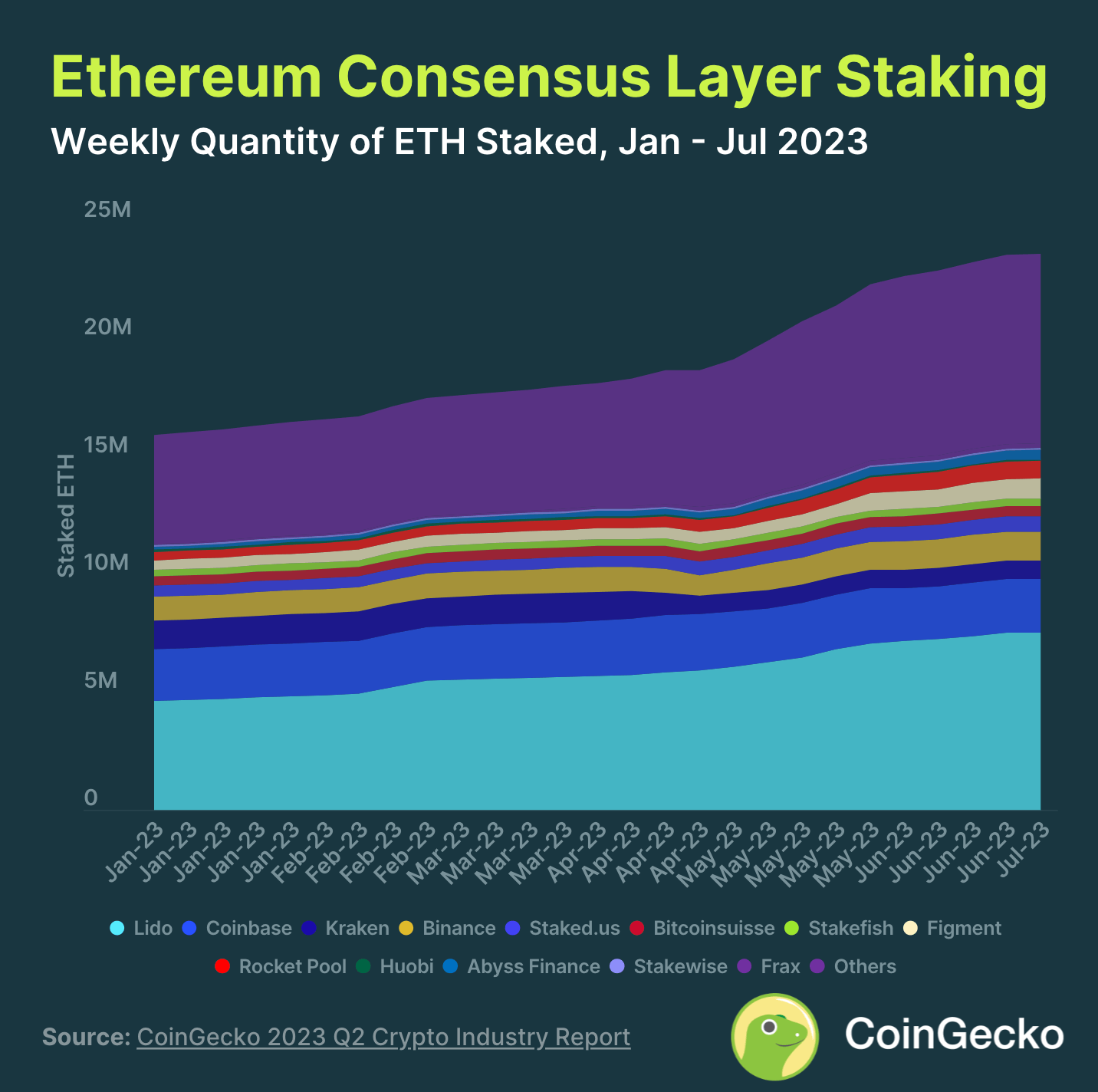

5. Staked ETH Grows in Q2

Ethereum surprised us with a total gain for staking of $5.6 million, reaching $23.6 million, compared to the first quarter of this year, where only 2.2 million ETH were staked.

Yet, the staking market top position has been held by Lido, marking a 31.9% of all staked ETH, and Coinbase’s sunken, ending the Q2 with a 9.6% market share.

Significant Events of Q2 2023

The second quarter of 2023 has been influenced by many events that shook the crypto industry. To paint you a clearer picture, we have:

- The launch of PancackeSwap V3, the change of the Twitter logo with the Doge, Ethereum Shanghai upgrade in April;

- May has brought the launch of Sui on Mainnet, PEPE hit a $ 1 B market cap, Binance’s report for the co-mingled user funds that happened between 2020 and 2021, and Fintoch rug pulled a total of $32 million.

- June survived through Coinbase’s launch of BTC and ETH futures, the breach of security that cost Atomic Wallet $35 M, the SEC lawsuits on Binance and Coinbase, BlackRock’s attempt on spot BTC ETF, and, nonetheless, the ZackXBT lawsuit and the launch of EDX Markets platform.

A critical event in Q2 was the SEC’s lawsuit on Binance and Coinbase, which impacted the many tokens caught in the middle, such as ATOM, BUSD, BNB, COTI, and eight others from Binance’s side. On the other hand, Coinbase has impacted 13 other tokens, like CHZ, NEAR, FLOW, and others.

As you may now wonder why this is relevant, we must remember what a great Spanish philosopher said about history repeating itself if we do not learn from it. Thus, cautiously analyzing the crypto market’s performance must align your yearly and quarter crypto strategy with facts for better gains and more achievable goals.

Q2 2023 Crypto Market at a Glance

Even though the crypto market experienced some volatility in 2023, Q2 ended at $1.2 trillion, with a + $1.7 billion change, which is a +0.14% change compared to last year’s Q2.

Some changes are also influenced by past or current events, like Binance’s zero fee removal in late March in Q1, whereby some of the trading volume declines are due to this, and Ethereum’s Shapella. However, after a quarter-on-quarter analysis, the trading volume decreased by 42.7%, and in Q2 continued to decline gradually.

As a result, the Binance USD kept sliding, reaching a shallow #18 place, followed by TrueUSD and #23 and Internet Computer at #30.

Q2 2023 Crypto Dominance That Will Change Things for the Better

Even though we saw a spike in the meme coin season in May, this has yet to live long enough, and as a result, many investors’ interests returned to the all-time significant currencies.

For example, Bitcoin dominated the market with a 3.2% increase, reaching 47.9%, marking another milestone not achieved since Q2 2021. On the other hand, its rival, Ethereum, slightly increased by only 1% in Q2 this year.

USDT, USDC, XRP, and ADA managed to stay on the ground, holding their market share, but the story isn’t the same for BNB, as it recorded a 1% decline.

Based on this, we can conclude that the lower-cap altcoin has changed its position, thus, making room for the majors like Bitcoin and Ethereum.

Top 5 Crypto’s for Q2 in 2023:

- Bitcoin acquires 47.9% with a 3.2% increase;

- Ethereum is marked by 18.8% with a 1% increase;

- “Others,” as seen in the graphics below, holds 18.6% with a decrease of 18.6%;

- Tether has a 6.7% with a 0.3% increase;

- Binance represents 3.0%, yet, has a 1% decline.

MemeCoin Making the Headlines in Q2 2023

We couldn’t go any further without mentioning May’s return of memecoins, which led to a rise and a new pack of such coins.

The PEPE has captured the attention of many investors and meme enthusiasts, marking a peak return of 1813x, attaining a market cap of $1.8 billion after Binance’s listing announcement. But it didn’t last long, as the price declined after the listing.

The Top 5 MemeCoins as of May 2023

- PEPE;

- AIDOGE;

- LADYS;

- BOB;

- WOJAK;

- BITCOIN;

DeFi Market in Q2 2023

Things have been challenging in the Decentralized Finance sector, showing a considerable decrease in market cap of 5.2%. Even though Ethereum’s upgrade in April positively changed it, DeFi only saw a minor increase of 0.2%.

However, things got a bit better after SEC’s charges in June, which led to a bounce back of 16.4%, but still, it wasn’t enough.

Challenges of the 2023 Crypto Market and How to Overcome Them

The Crypto Regulatory Uncertainty

In the past months, we have witnessed the U.S. Securities and Exchange Commission (SEC) suppression attempts on some cryptocurrency entities, like Binance, Coinbase, and Kraken. Thus, the main concern remains the sale of unregistered securities and non-bitcoin crypto assets, such as XRP.

Ultimately, on July 13, Ripple Labs Inc won the lawsuit, as it was established that it didn’t violate any federal laws by selling its native token, XRP, on public exchanges. As a result, this landmark victory sent XRPs value rocketing.

It is essential to stay informed on future regulatory developments, even in other countries, as you will better understand how they may impact the crypto market.

The Crypto Security Concerns in 2023

The crypto value fluctuation due to security breaches and past hacks could negatively impact cyber-security investors, leading to a shortage in hiring and retaining specialists, increasing scamming, and other cyber-attacks.

Yet, to ensure a great deal of security, please stay updated with the latest trends, use hardware wallets if possible, and enable the Two-Factor Authentication to add an extra layer of protection and prevent any unauthorized access.

The Crypto Education and Adoption for the Years to Come

Despite a growing interest in the crypto landscape, we could say there is still a need for a greater understanding of this ever-changing industry. Thus, increasing financial and crypto education is essential for long-term adoption.

To be a successful trader, investor, and crypto hodler, learning more about blockchain technology, cryptocurrencies, and how they intertwine with other sectors is vital.

You ensure a deep sense of stability and understanding by reading a comprehensive crypto blog, staying informed with the latest events that are changing the norms of this industry, looking for crypto reviews, the best crypto tools, and so on. And as someone once said, knowledge is power, right?

Final Thoughts of This Extensive Q2 Crypto Report

As we already saw, the crypto landscape remains dynamic and volatile, pushing forward mainstream crypto-asset adoption. Despite the many challenges faced in the past years, the cryptocurrency market shows growth potential.

To succeed in the ever-changing crypto landscape, you must stay informed about regulatory developments, focus on security measures, and seek to expand your knowledge through crypto education and research.

* The information in this article and the links provided are for general information purposes only and should not constitute any financial or investment advice. We advise you to do your own research or consult a professional before making financial decisions. Please acknowledge that we are not responsible for any loss caused by any information present on this website.