U.S. Senator Cynthia Lummis Believes Bitcoin is a Haven Against Dollar Inflation

In a recent interview on the ABC News program GMA3, Wyoming’s elected Senator Cynthia Lummis alleged that Bitcoin can serve as a good store of value. The former State Treasurer said that she hopes to bring Bitcoin and Cryptocurrency in general to the “national conversation” in the U. S.

“Our own currency inflates. Bitcoin does not. It’s 21 million Bitcoin will be mined, and that’s it. It is a finite supply. So I have confidence that this will be an important player in store of value for a long time to come.”

— Senator Cynthia Lummis

Lummis is the first Senator in the U.S. to currently own Bitcoin. She bought BTC in 2013 thanks to her son in law, Will Cole, Unchained Capital Chief Product Officer.

American and Aussie Politicians Highlighting Crypto

Senator Lummis is not the only politician who recently talked positively about the potentials of Bitcoin and crypto in general. Australian Senator Andrew Bragg spoke about the benefits and potential of blockchain technology during the online panel of the Future Of Financial Services 2020 conference.

The liberal Senator alleged that Australia needs to innovate and look further into blockchain technology to stay relevant in the financial realm. Bragg believes that blockchain can solve several critical regulatory problems in Australia, as well as globally.

“The future is blockchain technology. Instant cross-border transactions powered by blockchain may well be the solution for one-touch government with real-time international transactions.”

— Andrew Bragg

Bragg’s statements came shortly after S. Iswaran, Singapore’s Minister of Communications, urged all countries around the world to use a free flow of data across borders — highlighting the quick expansion and digitization of businesses and economies globally.

“It’s imperative we stay open and connected digitally. We should facilitate the free flow of data so international trade can continue to flourish and our people can remain connected to the global commons.”

— S. Iswaran.

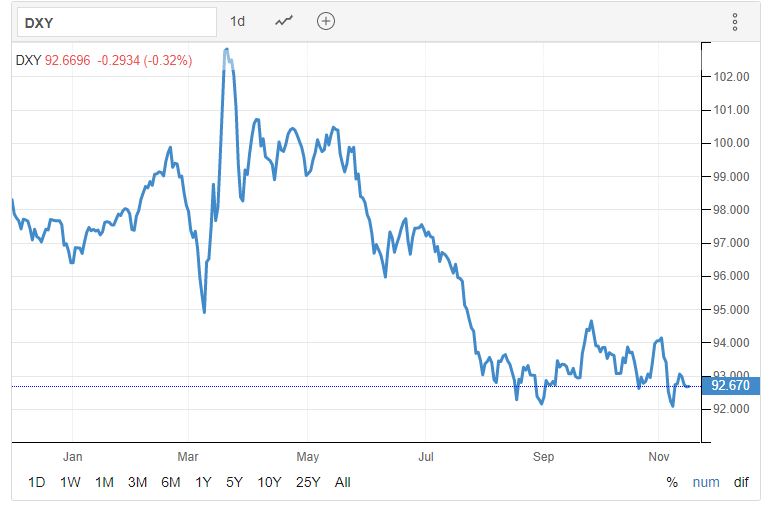

A Weaker Dollar

Economists and investors are agreeing on something: the future of the USD is uncertain. Now that Joe Biden was announced president by the media, fear bases around the tensions between a Republican Senate and a Democrat president. A technical analyst from Token Metrics, Bill Noble, believes that this could especially devalue the dollar — and most investors would look to empty their weakling fiat into crypto.

As more politicians and institutions highlight the potential of digitized economies, traders and investors see Bitcoin and other crypto-assets and their backbone technology — the blockchain, as a haven against a seemingly weaker dollar.