TradeRoom: Our Weekly Crypto Trades Analysis – Jan 10, 2022

Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

Welcome to my first analysis of 2022! I hope all of you had a wonderful break over the holiday period and have been keeping safe!

Bitcoin has seen some nice bearish price action over the holidays, which wasn’t overly unexpected. Coming into Christmas, the warning was basically to expect volatility as when the market loses liquidity it becomes easier for big swings to occur.

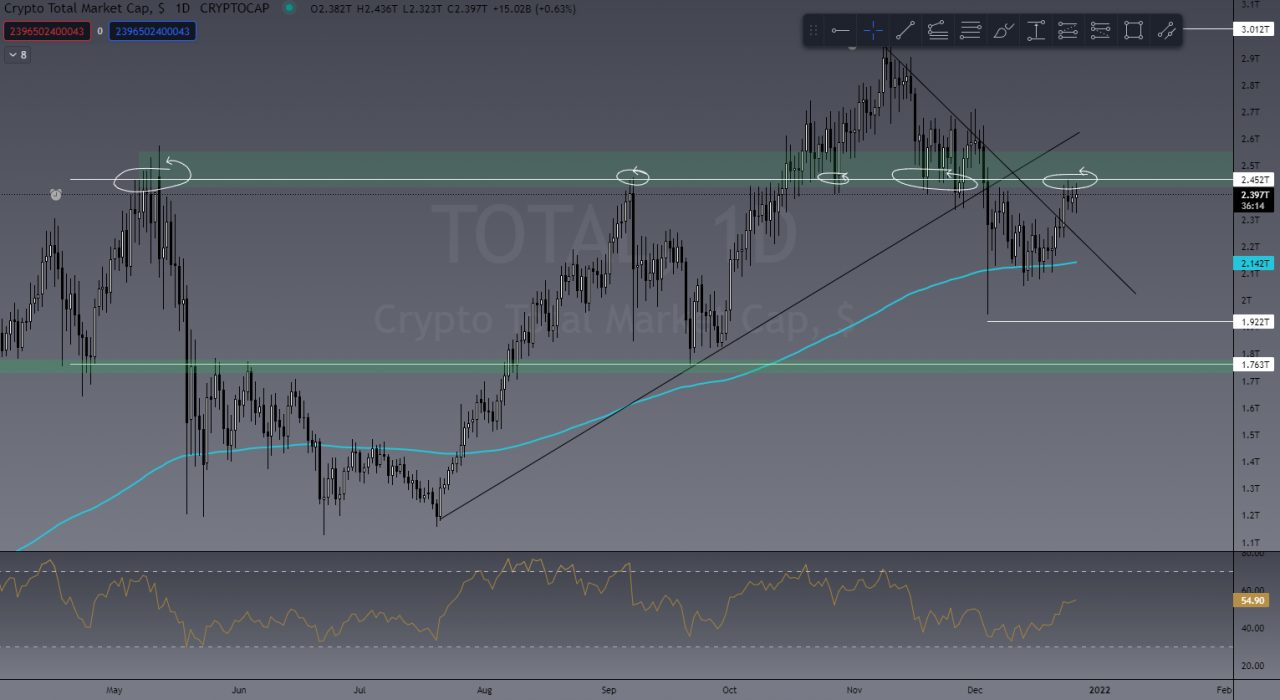

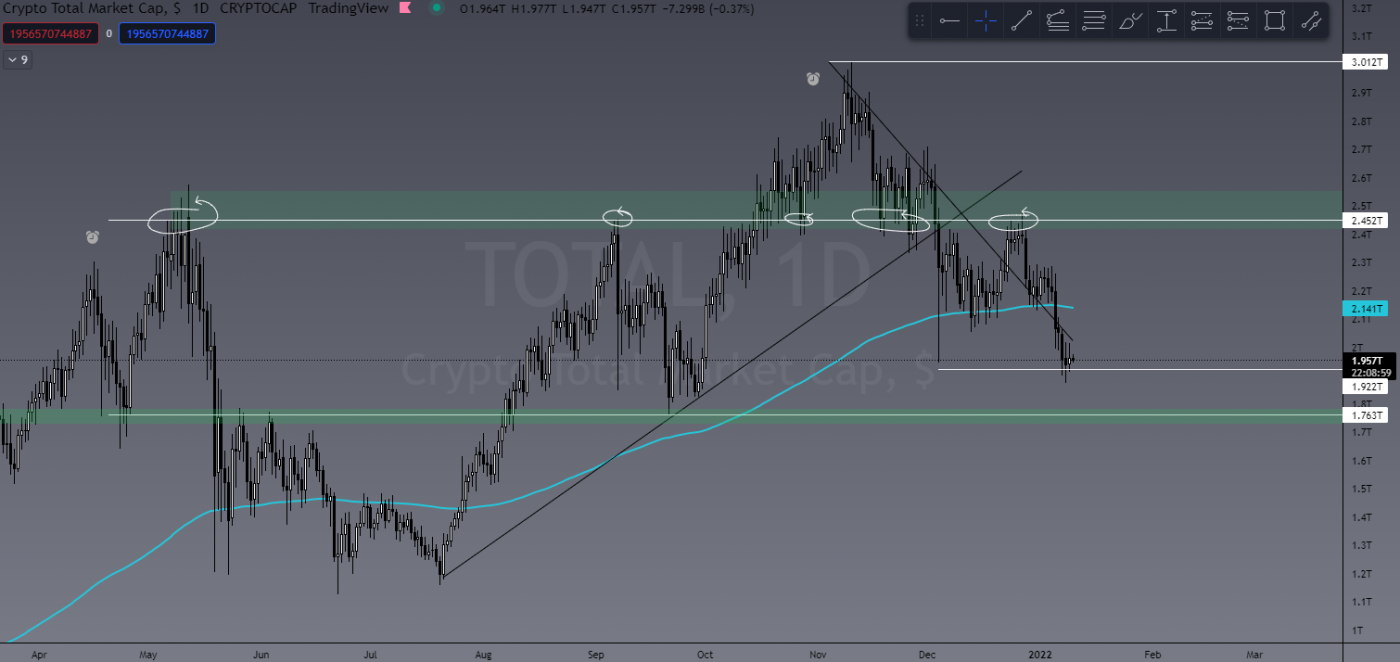

In my last article of 2021, I pointed out that the TOTAL market cap was hitting a key level of resistance and it failed to break through spectacularly, wiping off US$500 billion. There’s a pretty good chance we’ll see some consolidation before more downside to the US$1.7 trillion level.

TOTAL Market Cap

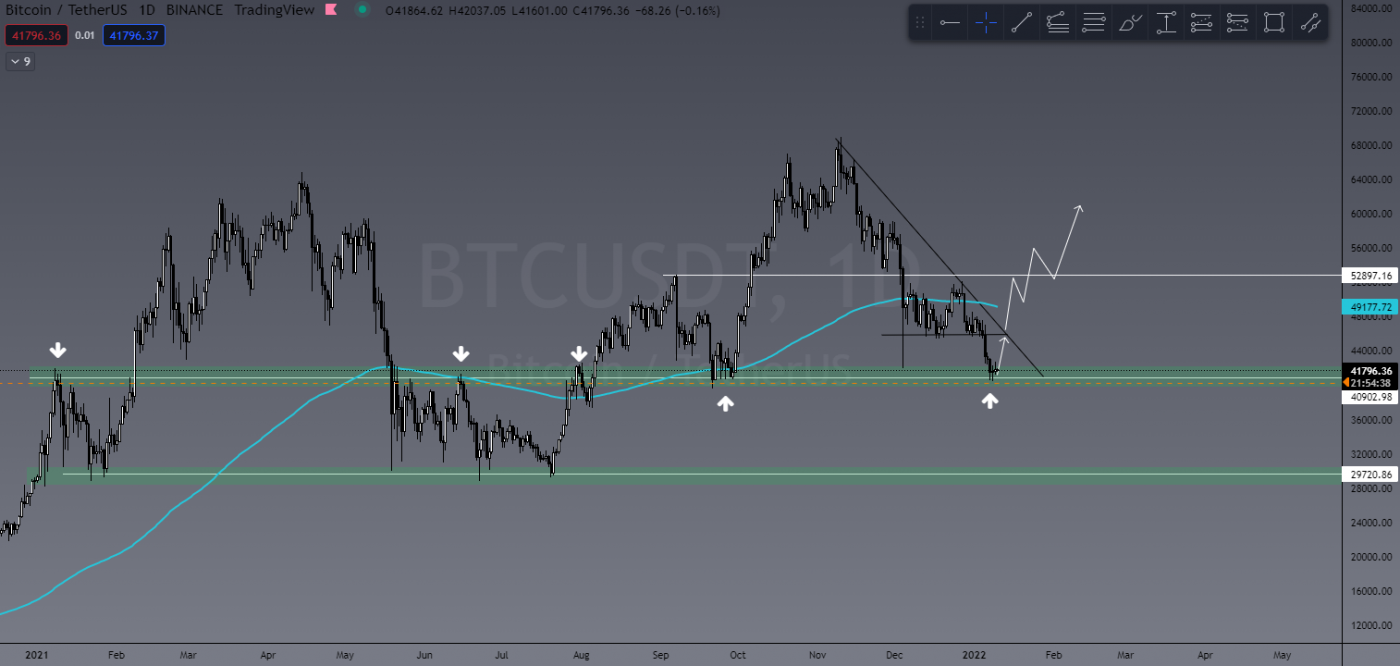

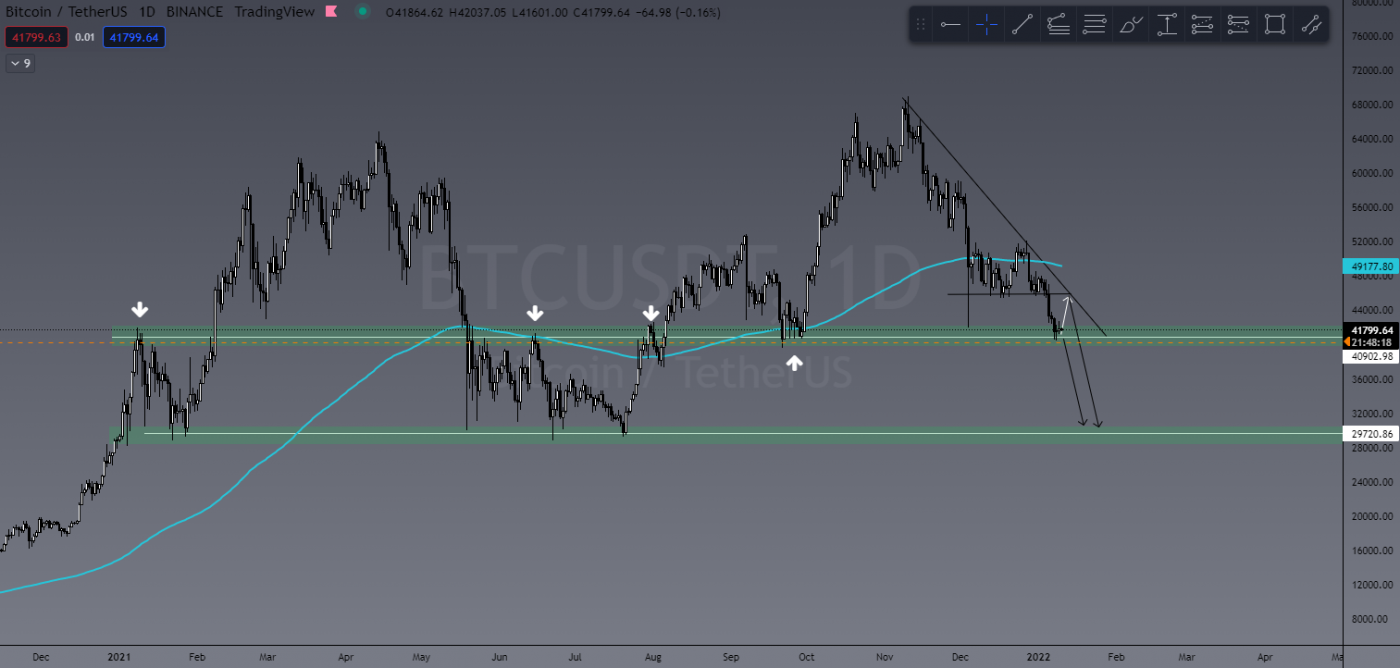

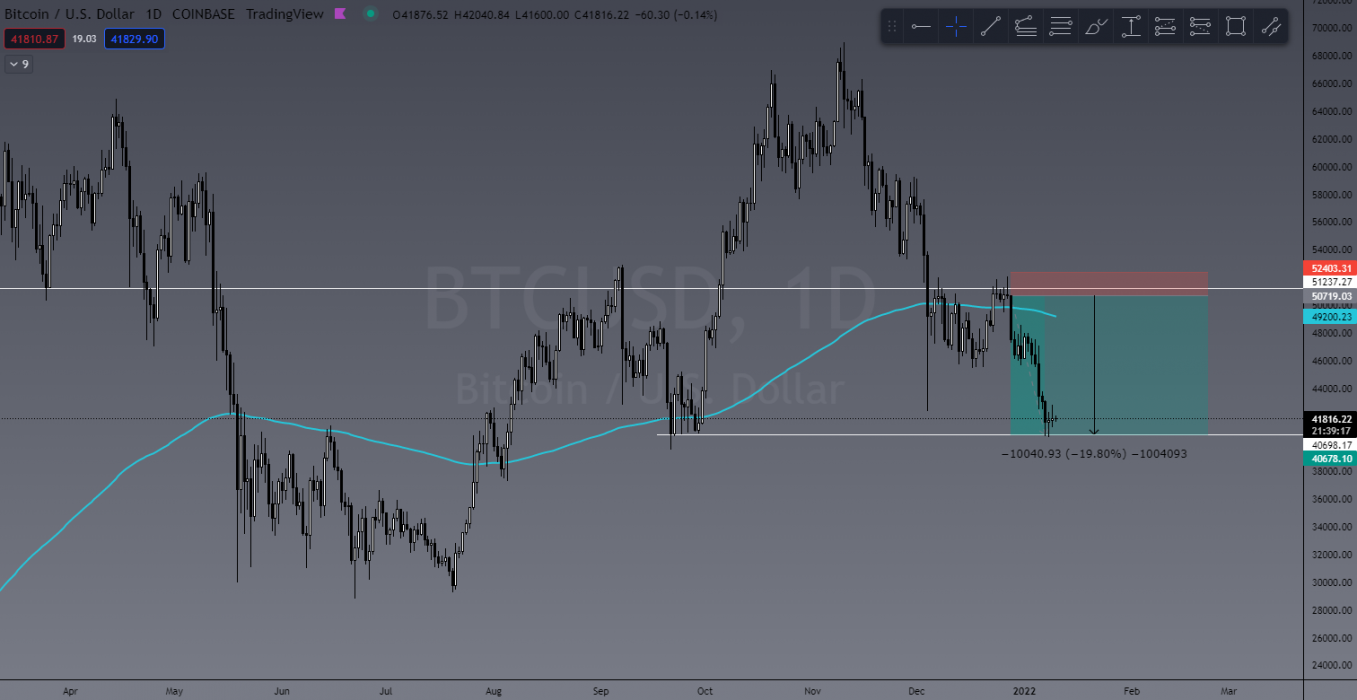

BTC/USD

Keeping it really basic this week, BTC is sitting right on what’s probably the most important level of support/resistance. If this US$40,000 level of support holds, my current analysis shows a bounce in price action to US$45,000, however, and here’s the warning – if there is low volume in such a move, I’d be confident in saying it’s a relief rally before further downside. The only point at which I’ll become full bull again is if BTC breaks and closes above US$53,000. Yep, US$10,000+ trading range needs to be cleared before I’m comfortable with a bullish cycle.

Does this mean I won’t trade within this range? No. As traders we stay fluid and move with the market, and trade the session we are in.

For me at the moment, the two most likely moves we will see from BTC are:

- a relief rally to US$45,000, then a large sell-off of over US$10,000 taking us to US$35,000; or

- this current level of support fails and we go straight to US$35,000-US$30,000.

Regardless, I’m still expecting more downside action.

My game plan? Well, I’m already in short trades on both BTC and ETH so I will keep these open until I see some candlestick analysis suggesting an uptick in price action. I will likely add to my positions if we hit the US$45,000 dead cat bounce.

In short, this level of support at US$40,000 must hold or things will get very red very soon.

Last Week’s Performance

Apart from my two shorts in BTC and ETH, I haven’t really been trading over the Christmas break so I don’t have any to share at this time. So I will share my entries on BTC and ETH:

BTC/USDT

After the first big sell-off from the beginning of December, BTC has seen a bounce in PA back to US$51,000, which was also the 61.8% Fibonacci retrace zone of the previous structure. My reason for entry was the four-day rejection at this key level and buyer exhaustion wicks. On a 20x trade, this short has yielded just under 400% profit in the most recent drop. This is basic price action trading using support and resistance (S&R).

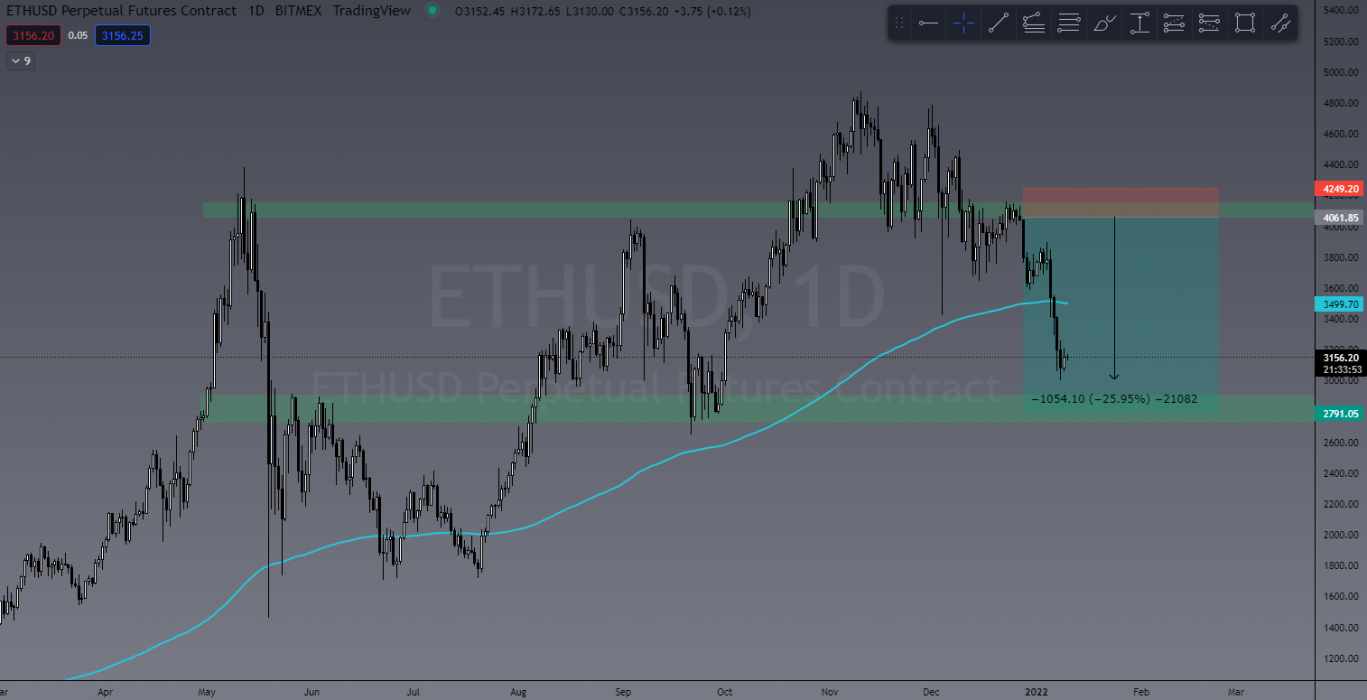

ETH/USDT

Like BTC, my short entry on ETH was based on the basics of S&R and Fibonacci. ETH retraced 61.8% of the previous structure and after four days of bearish candles I entered from a buyer exhaustion wick. This is a 10x trade, currently sitting at 250% profit. The trade is still active.

This outlines the importance of understanding candlestick analysis at key levels of support and resistance and having the patience to wait for the market to come to you.

This Week’s Trades

This week I won’t be sharing any new trade entries. The reason for this is that I believe at this stage the market will see further downside, and most people are buying and selling assets as opposed to trading futures.

I will be keeping my short trades for BTC and ETH open unless candlestick analysis shows me a reason to close them. I might enter ALT short trades if a good setup is there, but that’s a big maybe. The market needs a clear direction first.

Learn to Trade

If you would like to learn how to read, understand and trade these charts, I have good news!

The Crypto Den is holding its first of only two trading courses for 2022 on February 7! That’s right, we will only be running two programs in 2022! What makes us different? Our lessons are LIVE and come with a community where you submit your homework and receive feedback to ensure you understand what we teach!

Duration: 6 week course

Date/Time: Live trading course twice a week on Mon and Wed at 7pm AEST

Frequency: We now run our LIVE course only twice per year

Location: Zoom Webinar

From: February 7 to March 21

The Crypto Den’s Trading Fundamentals trading course is a LIVE interactive course designed to teach you how to trade the crypto markets from absolute beginner level!

Our six-week program teaches you how to set up your trade accounts using reputable exchanges and brokers, how to read the charts using technical analysis, and to protect your capital using effective risk management strategies.

We have taught thousands of students of the past five years how to trade these volatile and highly profitable markets. See our REAL reviews from REAL students.

Using ZOOM twice a week, all of our lessons are LIVE and recorded so you can access them over and over again in our structured course through our website and smartphone app. Lessons come with homework and online quizzes, as well as an amazing online and private community of students.

So what are you waiting for? Join now to start learning!

Already Know How to Trade?

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!