TradeRoom: Our Weekly Crypto Trades Analysis – Apr 11, 2022

Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

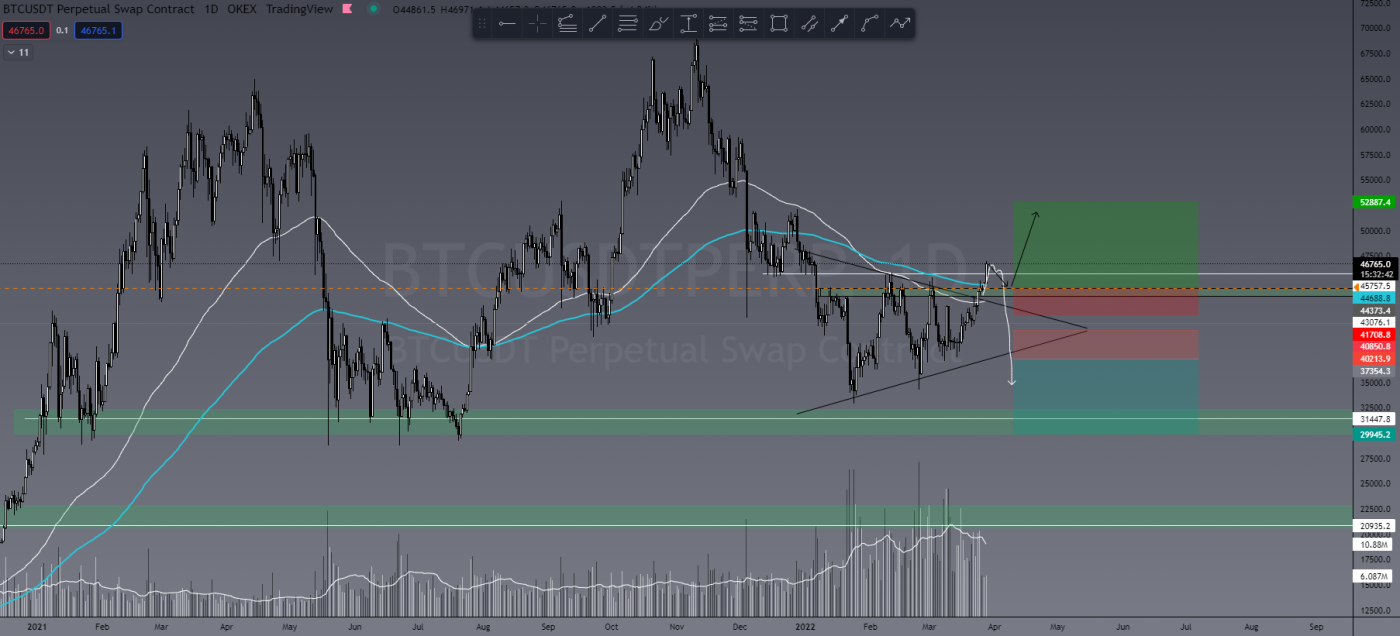

Well I’m back on the charts after two weeks with Covid (not fun!) and straightaway we can see BTC doing exactly what I was concerned about in my last analysis article. She’s broken out to the upside but failed to hold above that very important level of support.

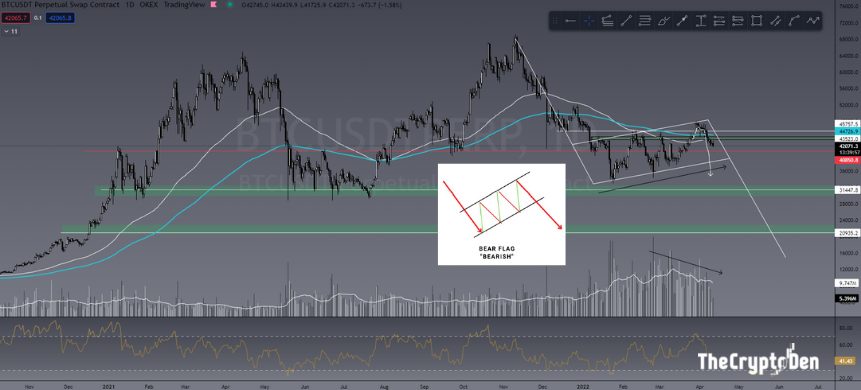

The current price action could simply be painting a retest before continuing up, or we could be seeing a really big bear flag forming. My vote is for the latter. The bear flag price objective is usually the length of the “flag pole”, which would take the BTC price below US$20,000.

The rising price and lowering volume after a 50% market dump is indicative of a bear flag, in my opinion.

So what are we waiting for and how do we trade it? Well, as a price action trader I’m looking for key levels to either hold or break. If US$40,000 fails to hold and we create a lower low below US$37,000, I’d be feeling confident in shorts. If US$40,000 holds as support and we see some great bullish candlestick analysis in the region, I’ll scale into longs.

Again, my bias at this moment is bearish, as it has been since the end of last year. We are back below the daily 200 EMA and 100 EMA. I sure would love to buy more BTC sub-US$20,000!

This Week’s Trades

With a bearish bias, I’m looking for coins that have had recent pumps into key levels which could be setting up for shorts.

KNC/USDT

One I’m watching is KNC. It’s had some nice bullish PA up to its previous ATH exactly a year ago. It’s currently painting a big exhaustion wick on the daily and showing a decent bearish divergence on the 4H chart, all at key resistance.

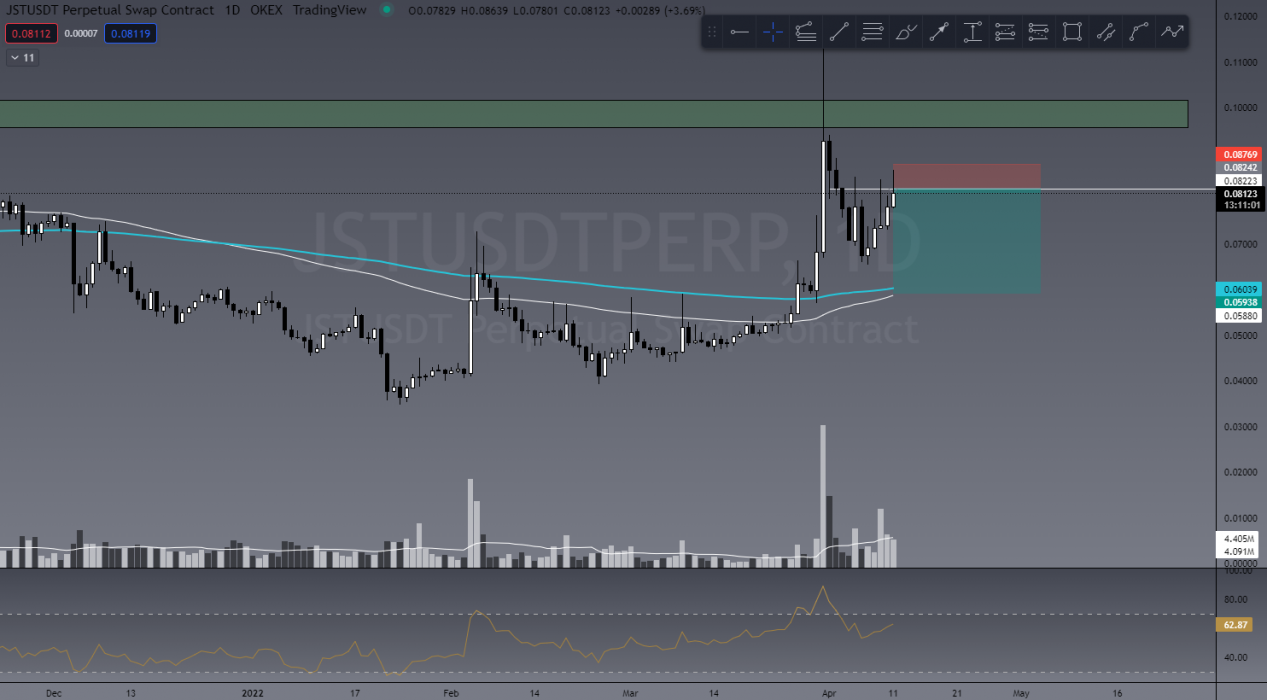

JST/USDT

Watching JST for shorts at the moment, and we can see on the daily some buyer exhaustion on a lower high and with low volume. I’m inclined to short this back to US$0.06. Still 12 hours for daily close, so worth watching in my opinion.

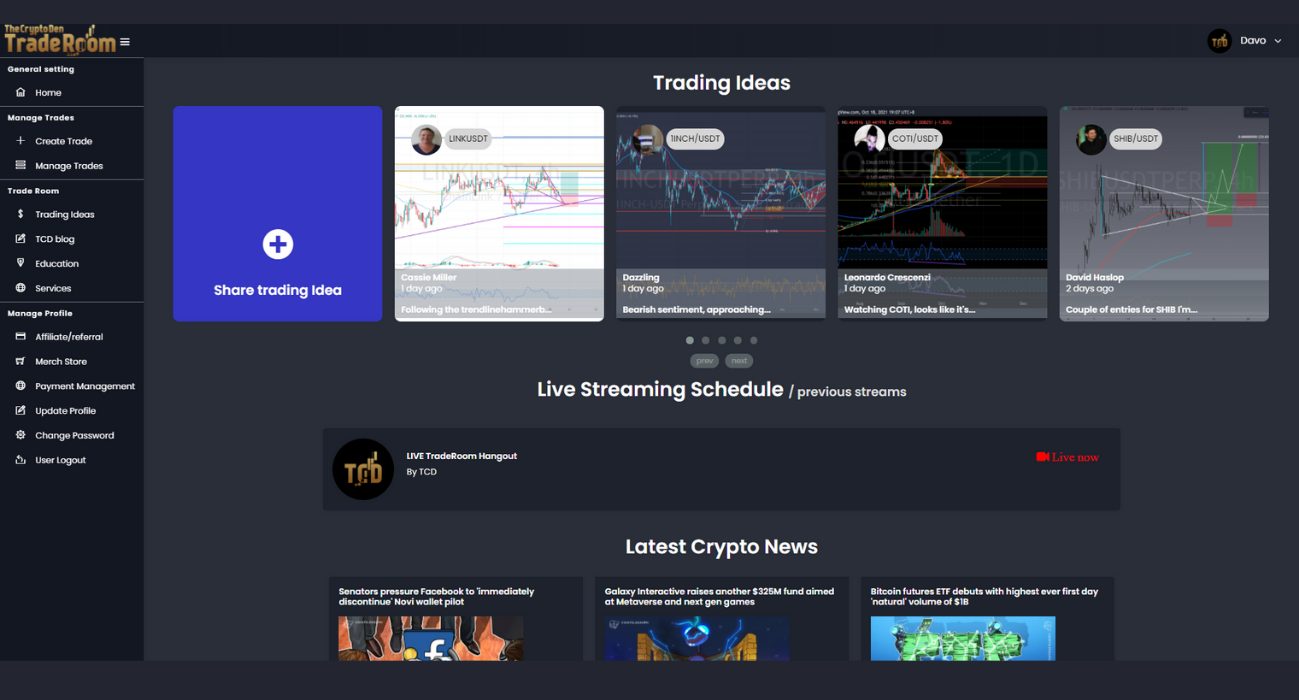

Introducing TCD’s New Social Platform

The Crypto Den now has a FREE purpose-built social platform to share investment ideas, trade chat, connect to like-minded people, share info and more, without the censorship of Facebook. The platform is designed for those more focused on the investment/profitable side of the crypto world.

Are You a Trader?

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom, you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!