Top 3 Coins to Watch Today: AXS, ATOM, AVAX – August 22 Trading Analysis

Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Axie Infinity (AXS)

Axie Infinity AXS is a blockchain-based trading and battling game that is partially owned and operated by its players. The Axie Infinity ecosystem has its own unique governance token, known as Axie Infinity Shards AXS. These are used to participate in key governance votes and give holders a say in how funds in the Axie Community Treasury are spent.

AXS Price Analysis

At the time of writing, AXS is ranked the 44th cryptocurrency globally and the current price is US$14.39. Let’s take a look at the chart below for price analysis:

AXS‘s relatively small 20% range could suggest that a recovery is setting up in August. Aggressive bulls could look for entries at the most recent area of support formed near $13.34. However, equal lows near $12.32 make a tempting target for a stop run into this support. This move could reach support near $11.90.

A decisive move to the downside could run stops below the second set of relatively equal lows near $10.80, possibly reaching support at an old swing high and a daily gap near $10.00.

A recent level near $18.84 provided resistance and caused a swing high to form near $22.88, offering first targets. A move through this high may arrive at new monthly high levels near $24.40 and $26.13.

2. Cosmos (ATOM)

Cosmos ATOM bills itself as a project that solves some of the “hardest problems” facing the blockchain industry. It aims to offer an antidote to “slow, expensive, unscalable and environmentally harmful” proof-of-work protocols, like those used by Bitcoin, by offering an ecosystem of connected blockchains. ATOM tokens are earned through a hybrid proof-of-stake algorithm and they help to keep the Cosmos Hub, the project’s flagship blockchain, secure. This cryptocurrency also has a role in the network’s governance.

ATOM Price Analysis

At the time of writing, ATOM is ranked the 26th cryptocurrency globally and the current price is US$10.60. Let’s take a look at the chart below for price analysis:

ATOM has been consolidating in a range around Q1 2022’s high. Q2 2022 saw the start of a smaller range inside this larger range. Near the current price, $10.00 or $8.60 could support at least a small move upward. This area is near the local range low, inefficiently traded, and the site of a stop run.

Just above the current price, the 9, 18 and 40 EMAs may provide resistance near $11.86. This level saw consolidation before last week’s downward move.

A move back toward the local range highs could reach possible resistance near $12.65, where bears rejected the recent rally. This level is just above the May monthly open.

A more extended move by bulls may reach the larger range’s rejection area near $13.81. However, a move this far is less likely unless the overall market rallies.

Below the higher timeframe’s range, $8.25 to $7.80 could provide more substantial support to start a longer-term bullish trend. This level is near the 78.6% retracement of the July 2021 to September 2021 rally, shows inefficient trading on higher-timeframe charts, especially between $7.05 and $6.70, and provides a reasonable stop run target.

3. Avalanche (AVAX)

Avalanche AVAX is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol. Avalanche is also low-cost, and green. Any smart contract-enabled application can outperform its competition on Avalanche.

AVAX is the native token of Avalanche. It is a hard-capped, scarce asset that is used to pay for fees, secure the platform through staking, and provide a basic unit of account between the multiple subnets created on Avalanche.

AVAX Price Analysis

At the time of writing, AVAX is ranked the 15th cryptocurrency globally and the current price is US$22.83. Let’s take a look at the chart below for price analysis:

AVAX‘s gains in Q2 ended with an almost 80% retracement as the rest of the altcoin market dropped after May. Bulls stepped in near the 62.8% retracement of Q2’s move, creating a consolidation that ended with the bullish impulse to resistance near $27.30.

With the 9, 18 and 40 EMAs stacked bullish and a bullish higher-timeframe trend, it’s reasonable to anticipate retracement to possible support before further bullish expansion.

Near the 40 EMA, a broad zone from $21.35 to $19.30 could see interest from bulls before further expansion. Bears may capitalise on any sharp moves down in Bitcoin, aiming for possible support near the 75% retracement, at $17.10, and potentially lower to a higher-timeframe support zone between $16.70 and $15.22.

If the higher-timeframe recovery trend resumes and the current resistance near $29.64 breaks, the wicks near $35.14 and the new monthly highs may see profit-taking.

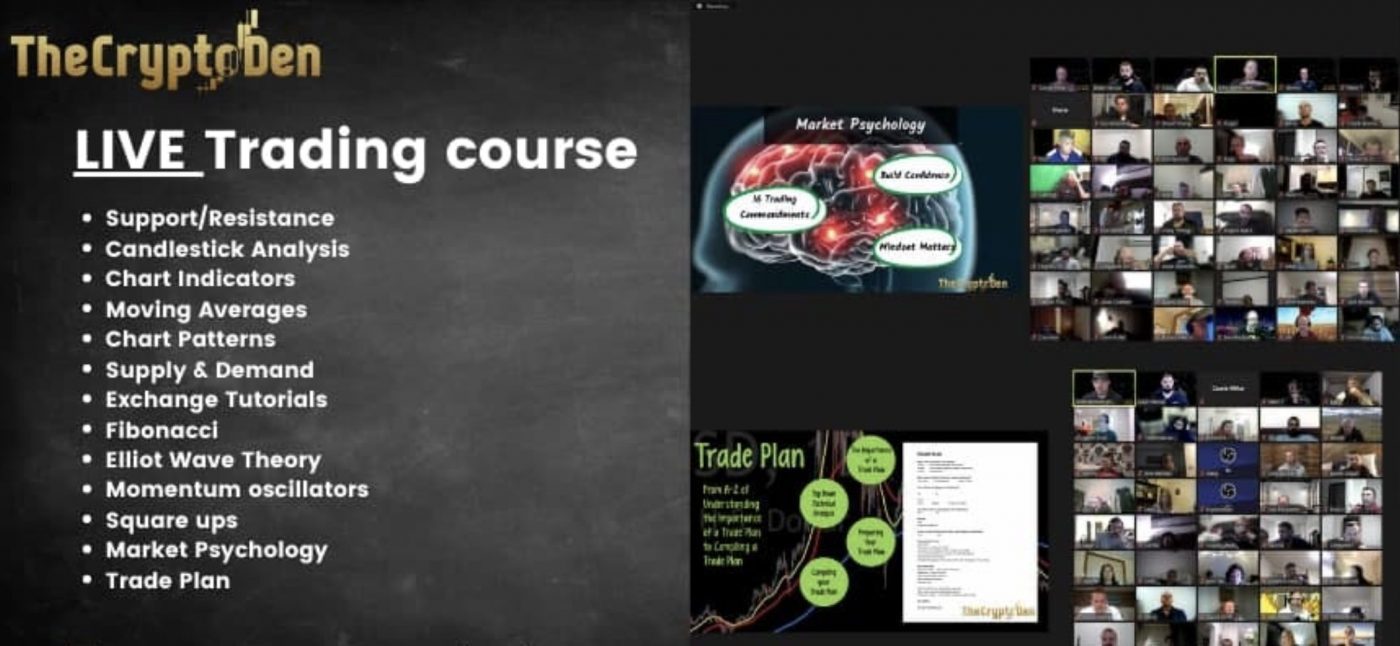

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.