Top 3 Coins to Watch Today: AAVE, WOO, DUSK – June 2 Trading Analysis

Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Aave (AAVE)

AAVE is a decentralised finance protocol that allows people to lend and borrow crypto. Lenders earn interest by depositing digital assets into specially created liquidity pools. Borrowers can then use their crypto as collateral to take out a flash loan using this liquidity. AAVE provides holders with discounted fees on the platform, and it also serves as a governance token, giving owners a say in the future development of the protocol.

AAVE Price Analysis

At the time of writing, AAVE is ranked the 42nd cryptocurrency globally and the current price is US$111.09. Let’s take a look at the chart below for price analysis:

AAVE‘s strong downtrend that began during early April has retraced most of its Q2 move, recently sweeping lows near $80.25.

A sweep of the relatively equal lows near $104 into possible support around $95.12, combined with bullish market conditions, could be the catalyst that begins to form a bottom. If this level fails, bulls might buy the monthly gap’s low near $88.45.

The swing high near $130 may form resistance to any sudden pumps as holders unload some of their position. A more substantial move might sweep relatively swing highs into probable resistance near $142, potentially reaching up to the new monthly highs near $155 and $160.

2. WOO Network (WOO)

WOO Network is a deep liquidity network connecting traders, exchanges, institutions and DeFi platforms with democratised access to best-in-class liquidity and trading execution at lower or zero cost. WOO Token is used in the network’s CeFi and DeFi products for staking and fee discounts. Presently, a diverse set of products and services interfacing retail, institutions, CeFi and DeFi have been built. WOO X is a zero-fee trading platform providing professional and institutional traders with best-in-class liquidity and execution. It features fully customisable modules for workspace customisation.

WOO Price Analysis

At the time of writing, WOO is ranked the 152nd cryptocurrency globally and the current price is US$0.1656. Let’s take a look at the chart below for price analysis:

WOO has retraced 80% from its Q1 highs and is currently challenging possible support near $0.1520, between the 71.8% and 78.6% retracement levels.

If this level fails to provide support, the 78.6% retracement, near $0.1451, offers a strong draw for shorts with multiple daily swing lows and an inefficient area.

Continued bearish conditions may cause this level to break, running all swing lows since Q1 2021 into the upper portion of an inefficient region starting near $0.1320. Near the midpoint and bottom of this region, lower timeframes show that $0.1280 and $0.1240 could also provide some sensitivity.

The low of early December’s consolidation, near $0.2517, and the 9 EMA may provide some resistance on any retracements. A continued rally – unlikely unless the overall market’s catalysts drastically shift – could reach over the 2021 open to $0.2927 and possibly $0.3400, where the daily chart shows a head-and-shoulders formation.

3. Dusk Network (DUSK)

Dusk Network describes itself as a blockchain for programmable and confidential securities, powered by Zero-Knowledge proofs and a novel Private PoS leader extraction-based consensus protocol. Dusk Network is a privacy blockchain for financial applications. It is a layer-1 blockchain that powers the Confidential Security Contract (XSC) standard and supports native confidential smart contracts.

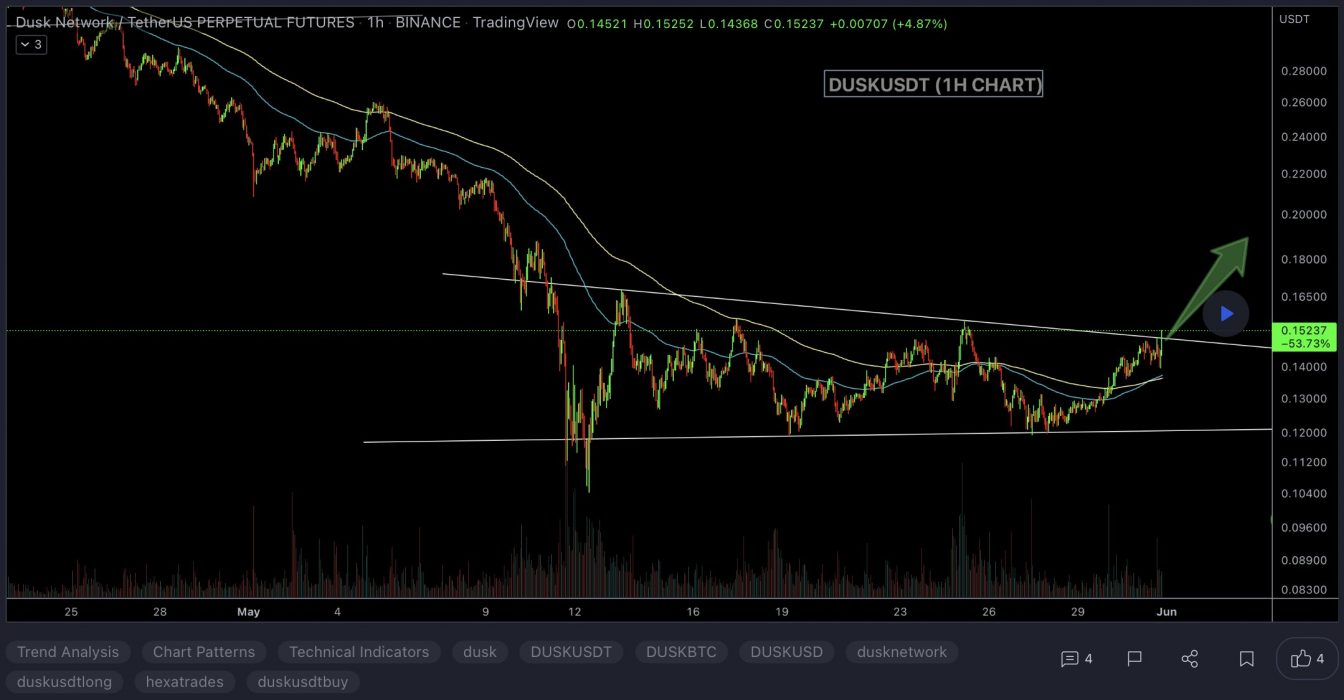

DUSK Price Analysis

At the time of writing, DUSK is ranked the 394th cryptocurrency globally and the current price is US$0.1375. Let’s take a look at the chart below for price analysis:

DUSK shows signs of a more significant bearish reversal after a failed rally in March. An area near $0.2246, which has confluence with the 9 EMA and the most recent consolidation, is likely to provide resistance.

Possible support under a significant recent swing low and the 61.8% retracement, near $0.1285, may be the next bearish target. If this area fails to provide support, an area near $0.1165 may offer the next support and potentially a longer-term bottom. This area has confluence with the 78.6% retracement and the consolidation preceding the sharpest leg of H2’s rally.

If market conditions become more bullish and resistance near $0.1946 breaks, an area near the last down move’s midpoint, around $0.2357, could provide the next resistance.

A more sustained move upward may retest the 2022 open near $0.2856. However, current market conditions reduce the probability of a significant rally.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.