South Korean Exchange Upbit Surpasses Coinbase, OKX in July Trading Volume to Take No. 2 Spot for First Time

The exchange bucked the general market trend that saw a decline in trading volume for most centralized exchanges.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RJZPHTFAERGWZBVO6BUX2LYE6E.png)

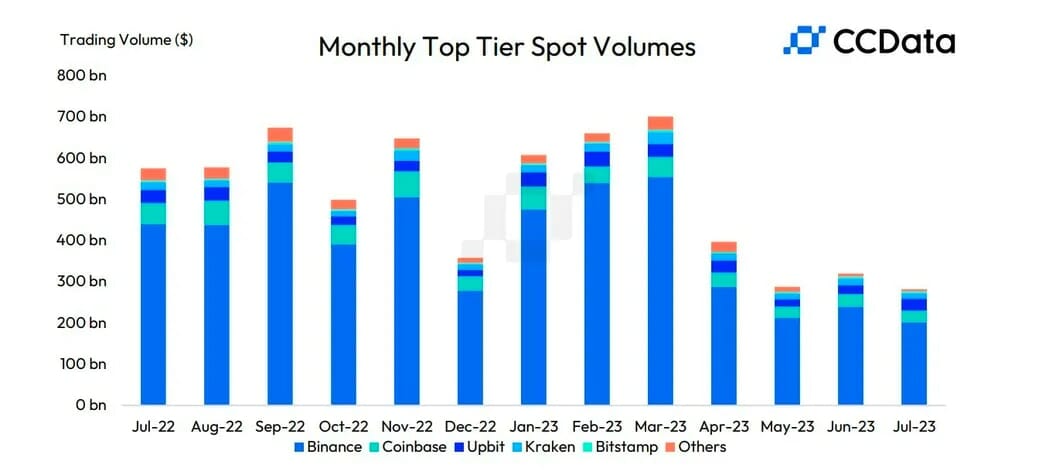

Upbit, a South Korean cryptocurrency exchange, surpassed centralized exchanges Coinbase and OKX in terms of trading volume for the first time in July, according to a report by CCData.

Centralized exchanges Coinbase and OKX saw their trading volume decline in July, with Coinbase’s volumes dropping by 11.6% to $28.6 billion, while OKX witnessed a 5.8% decline to $29 billion.

New Report Takes a Closer Look at Bitcoin Transaction…

Paxful CEO Proposes New Peer-to-Peer Electronic…

Former FDIC CIO on Liquidity Concerns, Banking…

BTC Drops to $42K Resistance as Bond Yields…

Brand Building in the Virtual World

Is Bitcoin an Inflation Hedge or Currency?

Catalysts for Bitcoin’s Recent Price Rally

Russia Reportedly Exploring Stablecoin…

Binance Launches Zero-Fee Bitcoin Trading,…

Upbit bucked the general market trend, witnessing a 42.3% increase in trading volume to $29.8 billion, pushing the exchange beto the second-largest platform by trading volume, after Binance. Coinbase was previously the second largest crypto exchange by trading volume.

Other South Korean exchanges including Bithumb and CoinOne also saw an increase in trading volume across July, the report said.

Although Binance remains the largest platform for spot trading in crypto, recording $208 billion in trading volume in July, the exchange’s market share declined for the fifth consecutive month in July. Binance’s market share now stands at 40.4%, its lowest mark since August 2022.

Recommended for you:

- How the Top 1% Covers Crypto

- Tether Is Going on a Bitcoin Buying Spree, but It Should Be Holding Cash

- DeFi Project Friktion’s Shutdown Said to Stem Partly From Founder Disagreement

Upbit saw the largest market share increase in July, with the exchange now accounting for 5.8% of the trading volumes on centralized exchanges. Huobi Global and Kucoin also saw increases in market share in July.

The decline in market share for Binance comes as the exchange faces continued scrutiny from regulators, with the U.S. Securities and Exchange Commission accusing Binance and its CEO Changpeng “CZ” Zhao of offering unregistered securities to the general public, among other allegations, in June. The exchange also saw at least three of its top executives depart in early July.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Follow @LedesmaLyllah on Twitter

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.