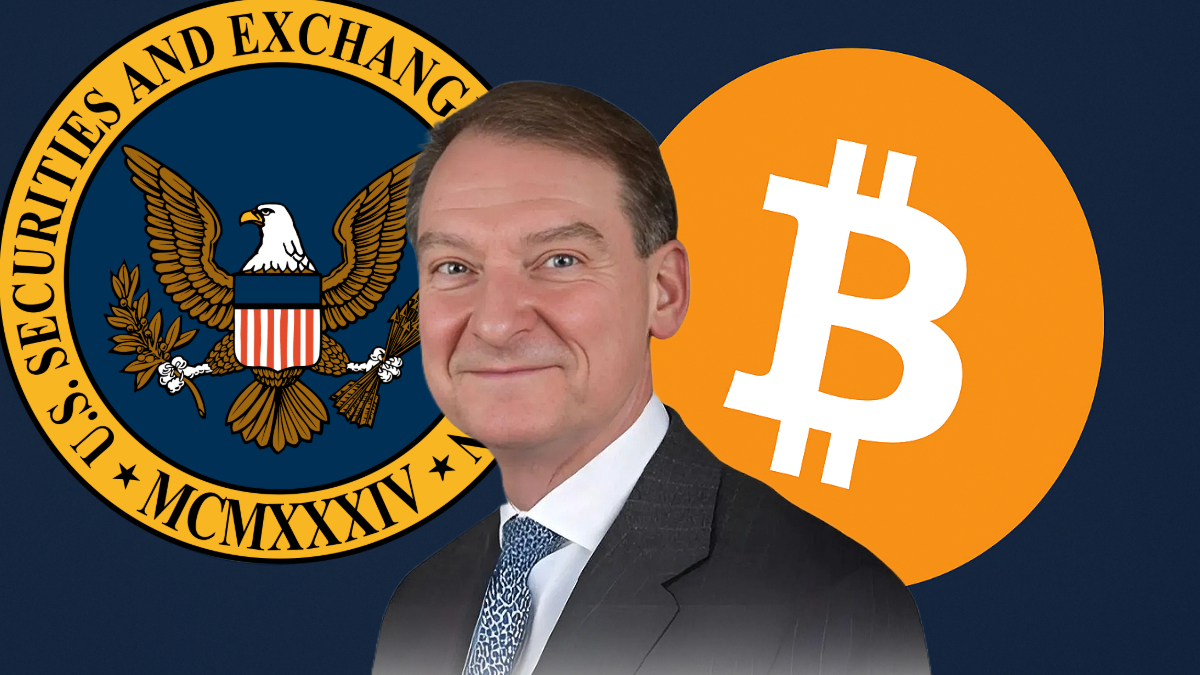

New SEC Chair Pushes for Politics-Free Crypto Regulation

- Paul Atkins, a pro-crypto advocate, has been sworn in as the new SEC Chair this week.

- The new head of the regulatory agency established his commitment to crypto immediately, citing crypto as a top priority under his leadership.

- Atkins’ personal investment in digital assets and advisory roles highlight his alignment with the sector’s growth.

- Recent SEC actions, including dropped lawsuits and advancing stablecoin bills, reflect a broader push for crypto reform under new leadership in the United States.

Exit the Gensler era. Enter the Atkins era.

The Securities and Exchange Commission (SEC) has officially sworn in its newest Chair – prominent pro-crypto businessman Paul Atkins.

Atkins, who was Trump’s pick for the position as head of the SEC, secured victory through the Senate earlier this month and, on his first day, already has the crypto community abuzz.

In fact, his very first press conference included a line that will be music to the ears of the digital assets industry:

One of [my] top priorities is a firm, regulatory foundation for digital assets.

Paul Atkins, SEC Chair

Paul Atkins, SEC Chair Related: Despite Tariff Turmoil, Analysts Make Bullish Case for Bitcoin, Predict Rally Above US$100k Soon

Paul Atkins Confirmed as SEC Chair, Crypto to be a Top Priority

Paul Atkins has enjoyed a lengthy, positive relationship with digital assets, which has businesses in the sector excited about a new regulatory standard for cryptocurrency.

A lack of policy clarity has been one of the industry’s biggest roadblocks to adoption and innovation over the past few years – made worse by Gary Gensler’s love for lawsuits.

But, Atkins’ election was always going to be a coup for crypto bigwigs. The new SEC Chair has a personal digital asset portfolio totalling close to $6 million USD ($9.4 million AUD), while also serving as an advisor for tokenisation business Securitize since 2019.

That said, it was still a relief to hear Atkins double down on his support for digital currencies, stressing the need for ‘rational’ laws around the asset class.

Bitcoin’s number one fan, Michael Saylor, weighed in positively on Atkins’ comments.

SEC Shifts Gears Under New Leadership

Although the market has been slow to kick into gear since Trump’s election, the past month has seen things ramp up from US policymakers.

In March, the Securities and Exchange Commission (SEC) began dropping several major legal cases against some of the industry’s biggest names, such as Coinbase and XRP.

On top of this, several bills targeting stablecoin regulation are moving through the Senate and House of Reps in April, demonstrating the new administration’s commitment to digital asset reform.

However, while Acting Chair Mark Uyeda has made strides toward a harmonious SEC–crypto relationship, the addition of Paul Atkins may take this partnership to the next level.