New Crypto Hedge Fund Report Shows Interesting Statistics – $180 Billion AuM

The third annual Global Crypto Hedge Fund report, released on Monday, aims to provide an overview of the global crypto hedge fund landscape. With the majority of the report looking quite bullish for the crypto space, it appears institutions are warming up to crypto.

Crypto hedge funds have heavily increased their Assets under Management (AuM) in the past year. The 39 surveyed funds are currently at $180 billion USD AuM and according to the report, 86% of them are intending to add more capital into the asset class by the end of 2021. This is a massive 4,600% increase from $3.8 billion USD AuM in 2020. The average AuM for this year’s surveyed funds increased from $12.8 million USD to $42.8 million USD.

Some major topics discussed in the report:

- Decentralised Exchanges Usage By Hedge Funds

- Fund Manager Bitcoin Predictions

- Future Fund Intentions

- Reasons and Obstacles to Investing

Decentralised Exchanges Usage By Hedge Funds

DeFi protocols aim to deliver peer-to-peer financial services, which allow cryptocurrency trading, loans, interest accounts without the use of banks or traditional finance intermediaries.

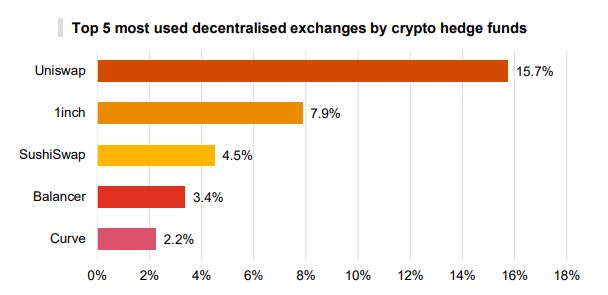

Between April 2020 and April 2021, the trading volume on these platforms grew more than 90-fold, with Uniswap making up for half of the DeFi market volume in April 2021.

Whilst they may be still far from using decentralized applications, many financial institutions are trying to be more educated and try to understand the potential impact that DeFi may have on the future of financial services.

Henri Arslanian, Global Crypto Leader at PwC

Fund Manager Bitcoin Predictions

Data shows that managers remain bullish on Bitcoin, with the median predicted price being estimated at $100,000 USD. In fact, the majority of predictions were in the $50,000 to $100,000 USD range (65%), with another 21% predicting prices would be between $100,000 and $150,000 USD.

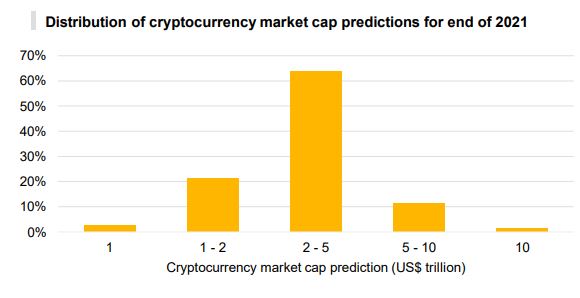

Market cap predictions are also optimistic, with the majority of fund managers estimating the total crypto market capitalisation will be between $2 and $5 trillion USD. Meaning that they see there is still lots of investing to be done in the space before the end of the year.

Future Fund Intentions

The decentralised finance (DeFi) space has gotten a lot of attention in the past year with traditional finance looking at new technologies and adding them to their portfolio. The oracle service Chainlink (LINK) was included in 30% of hedge fund investments, with blockchain interoperability protocol Polkadot (DOT) and liquidity protocol Aave (AAVE) making up 28% and 27%, respectively.

The survey highlights that around a fifth of survey hedge funds are

currently investing in digital assets. And when asked what investment strategies (fundamental, trading, arbitrage, venture, pre/post ICO, passive, other) best describe hedge funds exposure to digital assets, the majority responded with fundamental (57%) and trading (57%).

Reasons and Obstacles to Investing

Reasons given by hedge fund managers for including digital assets

in their portfolio are ‘general diversification’ – as per 57% of respondents. Of the remainder, 29% stated ‘exposure to a new value creation ecosystem’ as the primary reason to invest while 14% suggested that it made for a good inflation hedge.

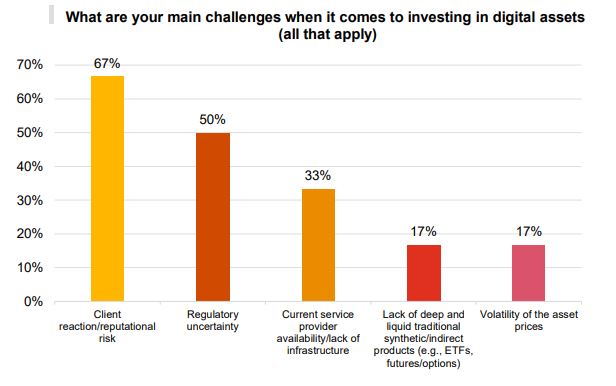

The main obstacles to investing, regulatory uncertainty is by far the greatest barrier (82%). Even those who do invest in digital assets cite it as a major challenge (50%). Client reaction/reputational risk is high (77%) as well as digital assets being outside the scope of current investment mandates (68%).

Around two thirds of Traditional Hedge Funds said that if the main barriers were to be removed they would either actively accelerate investment in digital assets or potentially change their approach and become more involved (64%).

From the findings in this report it’s evident that hedge fund allocations to digital assets continue to gain traction. Diversification and exposure to a new value creation ecosystem are cited as key drivers for investing in digital assets. This is unsurprising given that hedge funds tend to be early adopters, at the forefront of innovation whilst remaining committed to achieving the best performance possible. Further education, regulatory clarity and the evolution of service providers and related market infrastructure could lead to the acceleration of increased investment and further institutionalisation of the industry.

Jack Inglis, CEO of AIMA [source]