Most Valuation Models Say Ether Is Undervalued, Pointing to Over 60% Upside

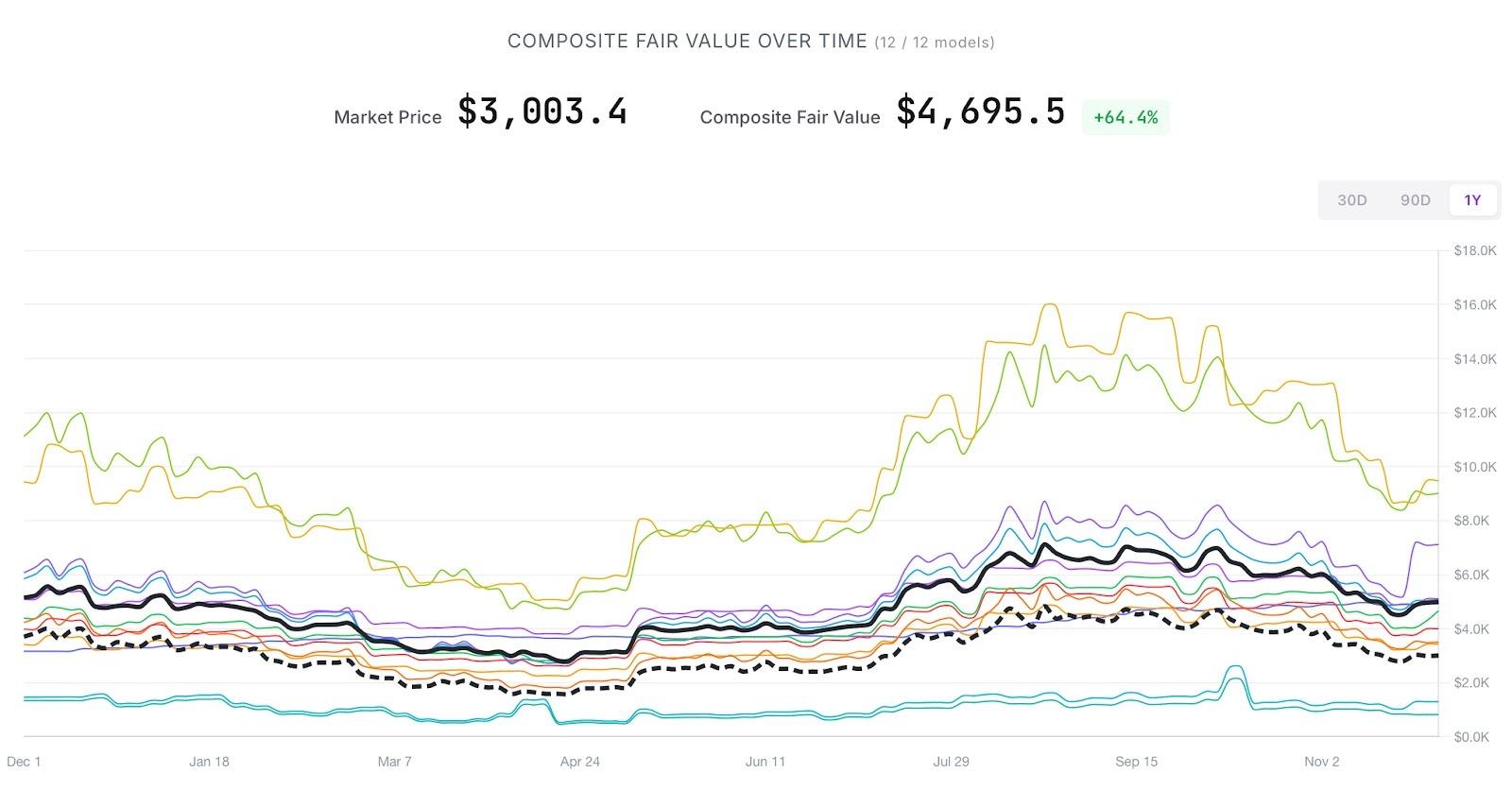

- Ten out of 12 valuation models show that Ethereum’s native cryptocurrency, Ether, is currently undervalued according to valuation website ETHval.com.

- One of the models based on Metcalfe’s Law suggests Ether’s fair price may be over 200% higher than its current market price.

- However, another model often used in TradFi valuations of crypto, the Revenue Yield model, suggests Ether may be overvalued by more than 50%, putting its fair price in the US$1200 range.

Ten out of 12 popular valuation models suggest Ethereum’s native cryptocurrency Ether is currently undervalued, according to the valuation website ETHval.com.

The twelve models vary wildly in their estimate of a fair value for Ether, with some suggesting it could be undervalued by 200% or more, and others saying the cryptocurrency is enormously overvalued by as much as 72%.

Ki Young Ju, the CEO of analytics platform CryptoQuant, commenting on X / Twitter, said all the models were “built by trusted experts across academia and traditional finance,” seemingly indicating he believes they have some predictive value.

One of the models based on Metcalfe’s Law indicates Ether is undervalued by 216% and should have a fair price of US$9,478 (AU$14.4k). Metcalfe’s Law was originally developed as a way of valuing a telecommunications network and states a network’s value is proportional to the square of its number of active users or nodes.

Another model called MC/TVL Fair Value, which ETHval.com describes as a “mean-reversion model assuming Market Cap to TVL ratio returns to historical average of 6x,” suggests Ether is currently only undervalued by 14%.

A composite fair value calculated by combining the fair values of all 12 models suggests Ether is undervalued by 64.4%, putting its current fair value at US$4,695.50 (AU$7.1k). At the time of writing, its actual value was US$3,003.40 (AU$4.5k).

Related: Amundi Launches First Tokenised Money Market Fund Share Class on Ethereum

One Important Model Indicates Ether is Massively Overvalued

In addition to their predictions, the models also include a reliability rating, with eight of the twelve receiving at least a two out of three rating. The reliability rating is made up of three criteria: methodology validation, data objectivity and low assumption sensitivity. Only one model, the Revenue Yield model, received a maximum rating of three out of three.

While most of the models indicate Ether is currently overvalued, the only model with a maximum three out of other reliability ratings — the Revenue Yield model — indicates it’s currently enormously overvalued.

The Revenue Yield model suggests that Ether is currently about 56% overvalued and puts its current fair value at just US$1,231 (AU$1.8k). The model uses a network’s annual percentage rate (APR) — basically its staking yield — and its annual revenue, to calculate a fair price.

Related: Ethereum Whale BitMine Boosts ETH Hoard to 3% of Supply as DAT Stocks Slump

The Revenue Yield model essentially treats Ether as a yield-bearing bond for the sake of its prediction. This model is popular with TradFi and is often used to calculate the fair value of cryptocurrency as an alternative asset class.