Mooners and Shakers: Bitcoin meanders below $30k as Valkyrie’s BRRR ETF moves under Gensler’s nose

Valkyrie goes BRRR? Something like that. (Pic: Getty Images)

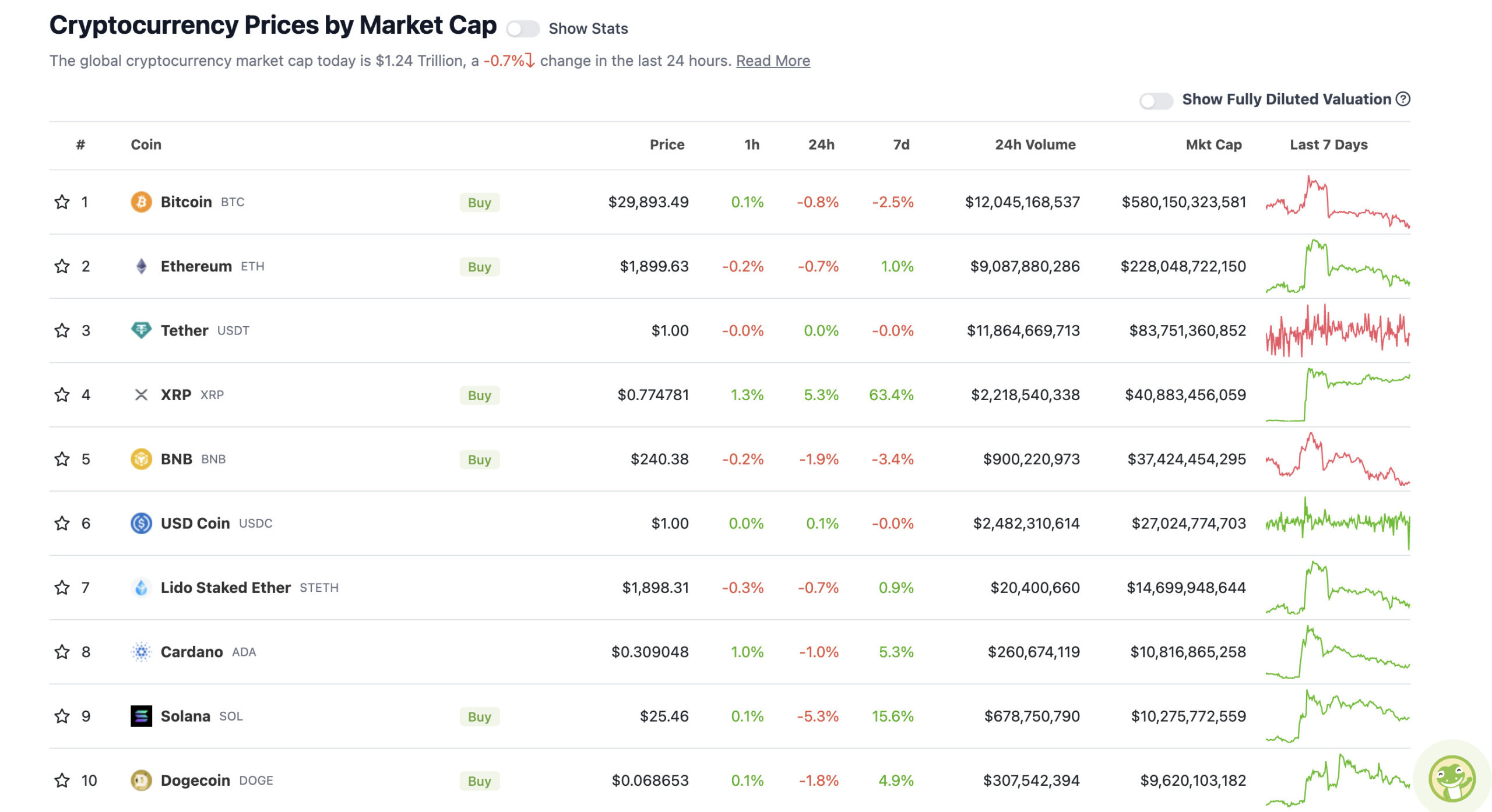

Bitcoin and the crypto market as a whole lost a bit of ground overnight (AEST) with the leading digital asset slipping back under $30k again.

Meanwhile, the spot Bitcoin ETF narrative that crypto hopium-pipe addicts are counting on as a major bull market catalyst keeps on rolling. Albeit with fairly non-news, really. Nevertheless, we’ve bunged it in our headline and it’s still generally a pretty big deal in crypto land, so let’s mention it. Also, we think the name BRRR is slightly amusing.

Following on from the SEC’s acceptance (for review – don’t get too excited) of the , another financial bigwig, Valkyrie, is about to have its version of Bitcoin institutional investment nirvana – BRRR – added to the SEC’s docket. And there are others reportedly waiting in the wings likely to get this level of tray-shifting clearance from Gary Gensler and pals, too.

It’s essentially the start of a lengthy, will-they-or-won’t-they review process that the crypto community and businesses will closely monitor. You can cut the tension over at the SEC headquarters with a spoon. Possibly. It’s a bit like a hyped-up MasterChef finals decision that’s delayed by an ad break that lasts several months.

Bloomberg ETF analysts James Seyffart and Eric Balchunas have certainly been talking it all up in a pretty positive way. That said, they acknowledge that Gary Gensler’s SEC can very easily stamp a big red DENIAL on all of these filings in one fell swoop at pretty much any stage.

Next Steps: BlackRock, Fidelity, Wisdomtree, VanEck, and Invesco will be added to the register tomorrow. Valkyrie will be added to the register on Friday. In the end not the most important of details anymore because SEC can still Deny/Approve en masse if they want. https://t.co/fbt6ilI2rv

— James Seyffart (@JSeyff) July 18, 2023

Proponents of a US spot Bitcoin ETF say it would open the floodgates to a new wave of investors.

Naysayers of a US spot Bitcoin ETF say it would open the floodgates to a new wave of investors. https://t.co/lluUxXJClD

— Jake (@EconomPic) July 18, 2023

But more importantly, what does, um “Naceur Hussein”, who apparently captained England to several losing Ashes Test matches, think about it all?

“This comment period is completely pointless.. the decision is fully at the whim of how Gensler feels about crypto.. eventually he or successor will reverse course, claim market has matured, but its really bc it became politically untenable to reject the ETFs any longer” pic.twitter.com/bVqltV0j2s

— Eric Balchunas (@EricBalchunas) July 18, 2023

Meanwhile, if this Bitcoin/crypto bear market seems to be dragging on just a tad, then you’d be right. It’s officially the longest this market’s ever had, according to various sources. That said, there have been a few extenuating circumstances this time around – pandemic financial fall-out, war, high inflation coming to a head, recession…

But… the longer this bearish/crabbing continues, the closer we all move ahead to a land of sunshine, rainbows, unicorns, chocolate rivers and ridiculous, throw-a-dart-at-a-random-altcoin-and-watch-it-moon season… r…right?

— Mikybull Crypto (@MikybullCrypto) July 18, 2023

It’s just not Bitcoin’s week so far, is it. XRP, though, up 5% over the past 24 hours and 63% over the past week, is still basking in the glow of the recent .

Is there a reason to be concerned about Bitcoin (BTC) dropping further? Always, if you only live in the short term. But, rest assured long-game players, because our mail is that “mature” investors in this space (admittedly, not always easy to identify) are accumulating. So says the blockchain data analytics gurus over at Glassnode…

The #Bitcoin Long-Term Holder Supply remains at an ATH of 14.5M BTC. This suggests mature investors are preferring to accumulate Bitcoin, rather than distribute. pic.twitter.com/VkY9uTAVGG

— glassnode (@glassnode) July 18, 2023

Meanwhile, here’s something of interest for holders of both Bitcoin and Ethereum from Coinshares’ latest Quarterly Digital Asset Fund Manager Survey, shared with Coinhead in an email this morning.

And we quote…

- “Investors believe that Bitcoin has the most compelling growth outlook, with 43% of respondents with this view. This has come primarily at the expense of Ethereum.”

- “Ethereum, despite poorer sentiment in this survey, remains the largest position in investors’ portfolios.”

- “10% of investors are venturing out into “other” altcoins, which has increased from last month, including liquid staking derivatives and Layer 2 solutions.”

- “The key risks for investors remain regulation and the potential for a government ban, this is hardly surprising given the recent saber-rattling from the US SEC.”

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Flex Coin (FLEX), (market cap: US$439 million) +19%

• BitDAO (BIT), (market cap: US$778 million) +8%

• ApeCoin (APE), (market cap: US$751 million) +4%

• Stellar (XLM), (market cap: US$3.6 billion) +2%

• Sui (SUI), (market cap: US$486 million) +2%

PUMPERS (lower, lower caps)

• r/CryptoCurrency Moons (MOON), (market cap: US$37 million) +62%

• Open Exchange Token (OX), (market cap: US$134 million) +25%

• Merit Circle (MC), (market cap: US$73 million) +5%

NEWS: #Crypto exchange @Krakenfx has dropped hints about a potential listing of #MOON, the native token of r/CryptoCurrency on Reddit.

The price of $MOON is up 69% to $0.246 today following the news.

: https://t.co/TAhkTIW1Xv pic.twitter.com/gJb0iiFl24

— CoinGecko (@coingecko) July 18, 2023

SLUMPERS

• GALA (GALA), (market cap: US$641 million) -8%

• Compound (COMP), (market cap: US$488 million) -5%

• Polygon (MATIC), (market cap: US$6.87 billion) -5%

• Algorand (ALGO), (market cap: US$885 million) -4%

• Arbitrum (ARB), (market cap: US$1.58 billion) -4%

SLUMPERS (lower, lower caps)

• STEPN (GMT), (market cap: US$265 million) -15%

• Celo (CELO), (market cap: US$265 million) -11%

• 1INCH (1INCH), (market cap: US$356 million) -11%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Another Coinshares-related snippet here…

JUST IN: #Bitcoin received 99% of fund inflows into cryptocurrency investment products last week, with a total of $140m – CoinShares

— Bitcoin Archive (@BTC_Archive) July 18, 2023

And lookey here… it’s been a while since we’ve mentioned some large crypto funding news in this section, but here’s one.

Venture capital firm Coinfund, a New York-based VC firm with 105 companies in its portfolio, has announced it’s managed to tractor beam in US$152 million in its latest capital-raising round.

“The CoinFund team is proud to head into its ninth investment year after raising over $550M in the last 18 months across venture and liquid investment strategies,” notes… the CoinFund team, which will concentrate on new crypto startups.

Crypto winter… thawing out, perhaps?

Thrilled to share that @coinfund_io has launched our 4th Seed Fund, a $158MM investment vehicle focused on supporting the most innovative and driven builders pushing crypto forward to the next phase of adoption.https://t.co/MYkRSKfJbm

— Austin Barack (@AustinBarack) July 18, 2023

My two scenarios for $BTC.

Red: We form the 1D HS reversal as 31.5k acts as resistance forming our right shoulder. I short this area as long as volume is low.

Green: We invalidate the HS and form a bullish reversal pattern. Confluence w/ $DXY & $SPX#bitcoin #cryptocurrency pic.twitter.com/Tx1Ttvi6TW

— Roman (@Roman_Trading) July 19, 2023

Hmm, Ben Simpson, founder of the Aussie crypto-education outfit Collective Shift, appears to be ready to re-enter the altcoin-buying market. Interesting. We’ll try to catch him soon to learn more about his takes on this…

The time to have an allocation to good altcoins is fast approaching.

We started to accumulate BTC and ETH since Dec, 2022 when BTC was $16k.

I’m about to pull the trigger on my Altcoin allocations (haven’t bought Alts in 2 years)

– BTC dominance

– Most people given up

-…— Ben Simpson (@bensimpsonau) July 18, 2023