MicroStrategy is at it Again, Buying $177 Million Worth of Bitcoin

MicroStrategy, the undisputed king of bitcoin balance sheets, has further entrenched its position with the acquisition of another 3,907 bitcoins. Michael “GigaChad” Saylor, the company’s charismatic CEO and founder, took to Twitter to share the news with the cyber hornets:

MicroStrategy Edges Towards 1% of Total Supply

Following the announcement, MicroStrategy now holds 108,992 bitcoin on its balance sheet at the remarkably low average entry price of US$26,769.

These holdings push the company over 0.5 percent of bitcoin’s entire hardcap supply of 21 million. In reality, it is likely that the actual figure is closer to 1 percent since up to 19 percent may be missing forever. Although the company owns less than 1 percent of total supply, it has the highest amount of bitcoin holdings of any public company.

MicroStrategy Stays True to its Macro Strategy

This news shouldn’t come as a surprise at all, given that Michael Saylor has repeatedly said his company will continue to buy and HODL bitcoin.

There will never be more than 21 million bitcoin, and we feel like there’s a land grab right now to acquire as much as you can.

Michael Saylor, CEO, MicroStrategy on a July earnings call

In a recent interview with CNBC, Saylor shared the news that MicroStrategy’s Q2 earnings had seen an increase of 13 percent, its best Q2 in six years. As long as it would be “accretive to the company’s shareholders”, Saylor suggested he would continue buying bitcoin. Speaking to the company’s bitcoin holdings, he again reiterated his view that it was digital real estate and further commented on how it had boosted the company’s brand:

Bitcoin has elevated our brand by a factor of 100.

Michael Saylor, CEO, MicroStrategy

MicroStrategy – A Proxy for Bitcoin Exposure

Unlike other acquisitions which have been funded with the company’s free cashflow, debt or stock issuance, MicroStrategy raised close to US$177.5 million following the sale of common stock in Jeffries, an ATM facility.

Given the company’s strategy, numerous institutional investors have viewed it as a bitcoin investment proxy – not only do you get the benefit of a profitable cash generative business, but you also gain leveraged exposure to bitcoin since much of the acquisitions have been funded through debt.

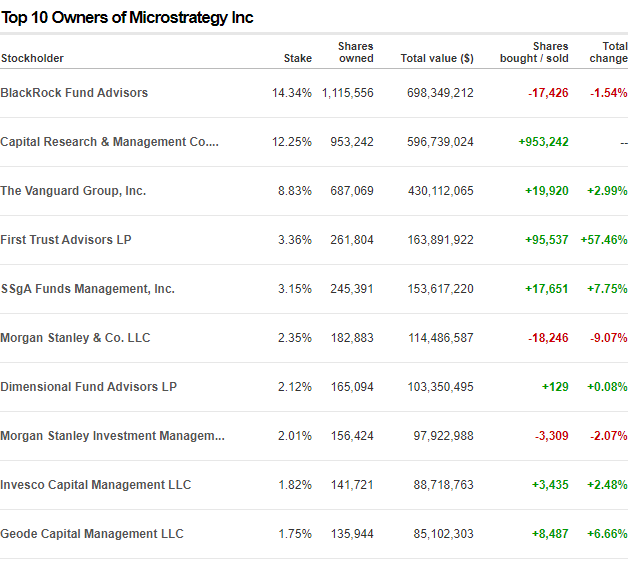

Interestingly, the top ten shareholders of MicroStrategy illustrated in the chart below include the likes of Blackrock and Morgan Stanley, both of whom have expressed negative sentiments about bitcoin. Rather than listening to what they say, it is best to instead focus instead on what they do.

Thus far, MicroStrategy’s strategy has proved to be successful. Whether this turns out to be the greatest macro strategy of all time remains to be seen.