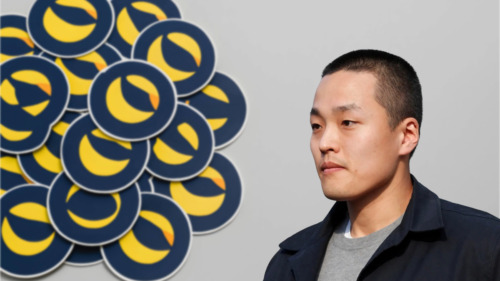

Heartbroken Luna Founder Do Kwon Proposes Terra Revival Plan

Earlier this month, Do Kwon, the outspoken founder of Terraform Labs, said that 95 percent of projects in the crypto space would die, adding that there was also “entertainment in watching companies die”.

As it turns out, his creation may be next:

Do Kwon ‘Heartbroken’

In a tweet thread, Do Kwon has said that he was “devastated” about the much-publicised UST depegging and LUNA collapse, adding he was “heartbroken” about the pain his creations has caused investors.

Not one to go down without a fight, he continued, saying:

I still believe that decentralised economies deserve decentralised money – but it is clear that $UST in its current form will not be that money.

Do Kwon, Terraform Labs

He then pointed to a “revival plan“, begging the question as to how decentralised the ecosystem truly is. Quite expectedly, the crypto community remained highly sceptical:

A Plan to Resuscitate UST and LUNA

Kwon’s plan amounts to a restart of the entire Terra blockchain, with network ownership getting distributed entirely to UST and LUNA holders through 1 billion new tokens as follows:

- 400 million (40 percent) to LUNA holders before the depegging event;

- 400 million (40 percent) to UST holders pro-rata at the time of the new network upgrade;

- 100 million (10 percent) to LUNA holders at the final moment of the chain halt; and

- 100 million (10 percent) to the Community Pool to fund future development.

While a decentralised economy does need decentralised money, UST has lost too much trust with its users to play the role. The blockchain underpinning LUNA and UST was shut down twice by validators over the past day.

Do Kwon, Terraform Labs

UST Debt Holders ‘Deserve to be Compensated’

Kwon added that he did not sell any of his LUNA or UST during the “incident”, continuing: “Even if the [UST] peg were to eventually restore after the last marginal buyers and sellers have capitulated, the holders of Luna have so severely been liquidated and diluted that we will lack the ecosystem to build back up from the ashes.

“UST holders need to own a large share of the network; as the network’s debt holders, they deserve to be compensated for the tokens they have been holding to the end.”

At this juncture, it doesn’t appear as if the market is onboard with the plan. At the time of writing, UST had collapsed to US$0.15, erasing US$30 billion, not to mention LUNA, which has tanked from US$120 in April to $0.0001896.

On the bright side, some have reflected on the potential lessons investors can take away from the whole UST/LUNA saga: