Happy Birthday Bitcoin: 13 Years Ago, Satoshi Nakamoto Released Bitcoin’s Whitepaper

The Bitcoin whitepaper was first published on October 31, 2008 by its pseudonymous creator, Satoshi Nakamoto. Since Bitcoin’s immaculate conception, even its creator would have difficulty imagining a world some 13 years later where his creation would become adopted as legal tender in a country.

Bitcoin’s Origins

Shortly after publication, a copy of the whitepaper was distributed to a cryptography mailing list where Satoshi outlined how Bitcoin solved the problem of decentralised parties being able to arrive at consensus without relying on a trusted central party, otherwise known as the “Byzantine General’s Problem“. Satoshi’s lack of trust in centralised institutions was clearly articulated in the whitepaper.

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.

Satoshi Nakamoto, Bitcoin whitepaper

Satoshi noted that the other key problem addressed by Bitcoin was that it solved the “double-spend problem”, an issue that plagued all prior attempts at creating digital cash.

Double-spending is prevented with a peer-to-peer network. No mint or other trusted parties. Participants can be anonymous. New coins are made from Hashcash style proof-of-work. The proof-of-work for new coin generation also powers the network to prevent double-spending.

Satoshi Nakamoto, Bitcoin whitepaper

Bitcoin was later officially launched on January 3, 2009, the date on which the first block of transactions, known as the genesis block, was mined.

Bitcoin 13 Years Later

Close to 13 years after the creation of the genesis block, Bitcoin has become the most valuable and fastest-growing decentralised network on Earth, valued at approximately US$1.2 trillion.

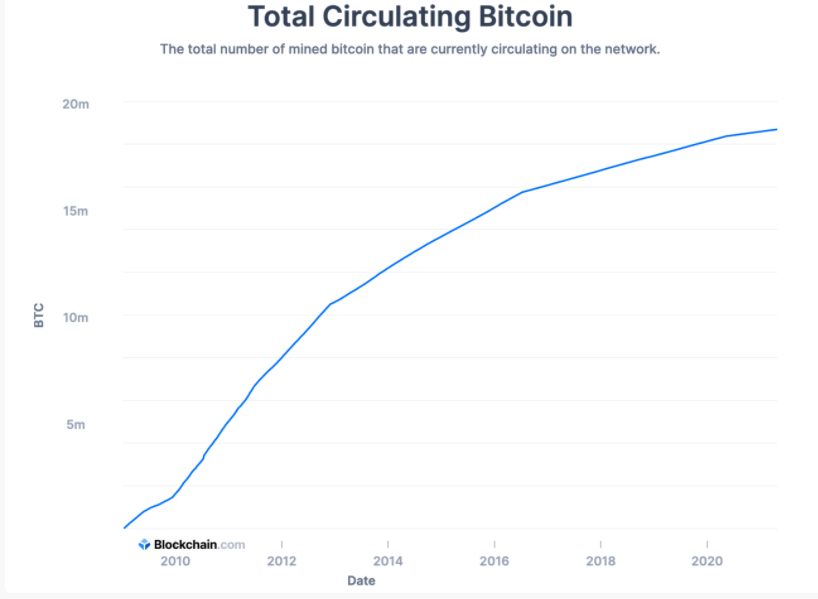

Every day, like clockwork, approximately 900 newly minted bitcoins are created. To date, just under 90 percent of the 21 million hard cap supply has already been mined. Bitcoin’s supply curve is fixed, so the only area for investors left to speculate is its demand.

Bitcoin has already won the “store of value” narrative within the crypto sector and, to an extent, even in traditional finance where some argue that it is eating gold’s market share. Bitcoin prioritised decentralisation and security over speed. At the base layer, it is therefore slow and costly when it comes to transmitting value.

Bitcoin proponents, however, are quick to highlight the parabolic growth in Bitcoin’s layer two solution, the Lightning Network, which enables instantaneous global transfers for fractions of a penny. This is already working in El Salvador, where estimates suggest that this technology could cost Western Union US$400 million in remittance fees.

Even for those who aren’t technically minded, Bitcoin’s number-go-up (NGU) technology, coupled with its efforts to separate the state and money, has led to growing adoption worldwide, which naturally reflects in price growth over time.

Bitcoiners who have been in it for the long haul have witnessed innumerable existential challenges and threats over the years. Fortunately, Bitcoin has proven to be remarkably antifragile, and at present appears to be better placed than ever to capture an even larger share of the estimated US$420 trillion of global wealth.