Futures Jump As Nvidia Blowout Earnings Spark Tech Rally; Jackson Hole Begins

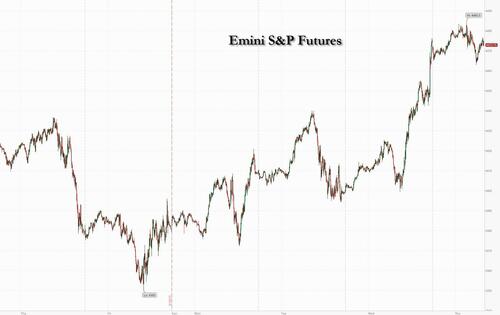

US equity futures and global markets rallied after NVDA’s blowout earnings, which sent the stock to a new record high above $500, gave fresh impetus to the artificial intelligence hype that’s boosting tech stocks this year. As of 7:30am ET contracts on the Nasdaq 100 rose 1.2%, while S&P 500 eminis gained 0.6%. Semiconductor firms gained in Europe, while tech also outperformed in Asia. The Bloomberg Dollar Spot Index rallied from its lows of the day, pressuring all G10 currencies, with the yen undoing all its gains in the past 24 hours. Bond yields are flat-to-lower with the 10Y yield at 4.21%, below the 4.25% support level. Global bonds also rallying in the wake of weaker than expected PMI data. Commodities are higher with Ags continuing to lead; gold advanced for a fourth day, set for its longest winning streak since mid-July. Brent crude climbed for the first time this week, while Bitcoin rose. Today’s macro data focus includes durable goods/cap goods orders, jobless claims, KC Fed, and one Fed speaker. As we prep for Jackson Hole comments, the question is: do we receive another hawkish surprise which sends stocks tumbling anew?

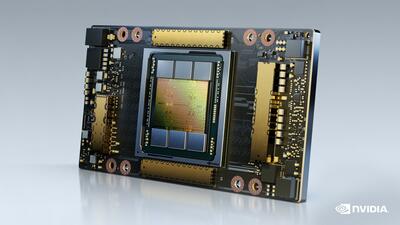

In premarket trading, MegaCap tech traded higher with NVDA up 7.9% after the chipmaker delivered a third straight sales forecast that blew away analysts’ estimates and with its last Sell rating (courtesy of Morningstar) capitulating, the company now has 55 buy ratings, while tech giants such as Apple and Microsoft also rose (TSLA +2%, AMZN +1.4%, MSFT +1.8%, META +2%, GOOG +1.2%). Here are some other premarket movers:

- Boeing shares dropped 2.0% after the aerospace company reported an issue affecting its 737 Max jet, raising concerns about its delivery target. Meanwhile, shares in Boeing supplier Spirit AeroSystems fell 5.9%.

- Guess shares surged 15%, after the apparel retailer’s adjusted earnings per share and net revenue beat expectations in the second quarter.

- Nvidia shares rose 7.7%, on track to hit a fresh record high, after the chipmaker gave a revenue forecast that was much stronger than expected. The outlook indicated that demand for chips used in artificial intelligence computing remains robust.

- Snowflake shares rose 3.6% after the software company reported 2Q results that beat expectations and gave an outlook Evercore said could be conservative.

- Splunk shares jumped 13% after the infrastructure-software company reported second-quarter revenue that beat estimates and raised its full-year forecast beyond expectations.

- US Steel fell 2.9% after Esmark said it’s no longer pursuing a takeover, citing union support for a rival bid from Cleveland-Cliffs Inc.

Nvidia said sales will be about $16 billion in the three months ending in October, blowing past analysts’ estimate of $12.5 billion and above the highest whisper estimate of $15 billion. The outlook underscores Nvidia’s role as the key beneficiary of the AI computing boom. Faced with skyrocketing demand for chatbots and other tools, data center operators are stocking up on the company’s processors, which are adept at handling the heavy workloads AI requires.

“The results are very strong and indicate robust demand for AI processors and infrastructure,” said Janet Mui, head of market analysis at RBC Brewin Dolphin. “I can see a market rally continuing in the near-term as this AI theme is less impacted by the cyclical aspects of the economy.”

Nvidia’s results, along with the AI stock frenzy, are punctuating a week that’s seen broad equity-market gains and renewed risk taking by investors. While worries about rising bond yields dominated the conversation last week, the tone has quickly shifted back to mega-cap tech and whether their earnings can power a stock market that’s been treading water for the past month.

“Nvidia has shown that the demand for AI technology remains strong despite what is going on elsewhere,” said Stuart Cole, chief macro economist at Equiti Capital in London. “The potential remains for equity markets to soften again. But I can easily see AI-related stocks, like Nvidia, and tech shares probably more generally, being seen as a safe haven in the equity world.”

Investors are also looking ahead to the gathering of top central bankers at Jackson Hole which begins later today, where the risk is that Powell repeats last year’s hawkish comments and sends stocks tumbling.

Other pockets of concern also remain for global investors. China’s $2.9 trillion trust industry is showing signs of strain, adding further pressure on the economy, while insiders are also worried that efforts to improve the health of local government financing vehicles may not play out as hoped. Meanwhile, the People’s Bank of China provided further support for the yuan, setting the daily reference rating stronger than estimates.

Europe’s Stoxx 600 is on track for a four-day winning streak with major markets led higher by Spain/Italy. Tech stocks are leading European markets higher as they did in Asia and the US after NVDA’s blowout sales forecast. Here are the most notable European movers:

- ALK-Abello rises as much as 14%, the most since 2020, after the Danish allergy drugmaker reported a robust set of 2Q numbers, and reassured investors of strong Japanese demand for its allergy tablets

- Rate-sensitive European real estate stocks rise amid a broader market rally, with the sector subindex seeing its biggest three-day gain in more than a month as bond yields retreat

- European semiconductor stocks rally after Nvidia provided another strong outlook in a sign of persisting high demand for chips used in AI applications.

- Liontrust jumps as much as 16% after saying it expects to declare its offer for GAM Holding AG unsuccessful on Aug. 29, with Numis noting acceptances fell “a long way short.”

- Swiss Prime shares rise 1% after the real estate investment company reported results in line with expectations. Analysts see the company’s portfolio re-focus as a positive.

- PKO gains as much as 2.1% in Warsaw trading, after earnings from Poland’s biggest lender beat estimates thanks to lower-than-expected cost of risk and stabilization of net interest margin

- Van Lanschot Kempen shares drop as much as 15% after reporting results that missed expectations. The Dutch bank said investment clients face a “persistently challenging” environment

- Tessenderlo falls as much as 5.8%, after the Belgian chemicals company reported 1H adjusted Ebitda that missed estimates. KBC described 1H earnings momentum and the outlook as disappointing

- Crayon Group falls as much as 18%, after the Norwegian IT group reported weaker-than-expected profitability in the second quarter, with DNB attributing raised profit guidance to currency effects

- TIM retreats as much a 6.8% after the company said Poland’s competition watchdog hasn’t approved its takeover by Wurth Group; TIM said the merger deadline has been extended by 4 months

- SoftwareONE falls as much as 4.4%, after adjusted 1H Ebitda from the Swiss software provider missed estimates, weighed down by a slowdown in business with vendors other than Microsoft

Earlier in the session, Asian equities also climbed, set for third successive day of gains, boosted by advances in semiconductor stocks and Chinese technology plays after Nvidia projected better-than-expected revenues for its third quarter. The MSCI Asia Pacific Index is up 0.8% with stocks in Korea, Hong Kong and Taiwan leading. The China/HK move appears to be beta to US move amid seller exhaustion and some positive micro data points; the move higher was done on low volume. A Bloomberg gauge of semiconductor stocks in Asia jumped the most since July 11 on the back of Nvidia’s blowout earnings that comfortably surpassed analysts’ expectations.

- Hang Seng and Shanghai Comp conformed to the upbeat mood in which the Hong Kong benchmark climbed back above 18,000 amid tech strength, although gains in the mainland were limited after the PBoC’s liquidity drain and as participants await more big bank earnings.

- Nikkei 225 extended above the 32,000 level with semiconductor names in Asia riding the Nvidia wave.

- ASX 200 was positive amid the continued influx of earnings and as strength in tech and financials atoned for the underperformance in the defensive sectors.

- KOSPI was boosted with the index unfazed by North Korea’s latest failed ‘satellite’ launch, while the BoK provided no surprises and maintained its base rate at 3.50%, as unanimously expected.

The MSCI Emerging Markets Index jumped 1.5%, the biggest gain in a month. Investors were also taking bullish cues from news that leaders from Brazil, Russia, India, China and South Africa agreed to expand their BRICS group to give it more economic clout.

In FX, the Bloomberg Dollar Spot Index adds 0.1%. USD/JPY up 0.6% to 145.69, boosted over the Tokyo fix as US two-year yields ticker higher initially. EUR/USD little changed on the day at 1.0857; pair bounced off support around its 200-DMA Wednesday

In rates, treasuries edged lower with 10Y TSY yields up 1bp to 4.21%, while German bunds were little changed, after Wednesday’s broad rally in bonds spurred by weak economic data. Gilts rose, led by the 10-year, and money markets pared wagers on further Bank of England tightening for a third day.

In commodities, crude futures advance, with WTI rising 0.2% to trade near $79. Spot gold adds 0.2%. European natural gas prices tumbled more than 11% on signs that a labor dispute at Australia’s biggest liquefied natural gas export plant will be resolved, easing fears about one of three possible strikes in the key exporting nation.

Bitcoin is a touch firmer on the session, holding just below the USD 26.5k mark with specifics light and price action remaining contained/rangebound overall after the pronounced downside seen towards the tail-end of last week.

To the day ahead now, and US data releases include the preliminary July readings for durable goods orders and core capital goods orders, the weekly initial jobless claims, as well as the Kansas City Fed’s manufacturing activity for August. Central bank speakers include the Fed’s Harker and Collins. And today also marks the start of the Kansas City Fed’s annual Economic Policy Symposium at Jackson Hole.

Market Snapshot

- S&P 500 futures up 0.7% to 4,476.50

- MXAP up 1.0% to 160.73

- MXAPJ up 1.5% to 505.15

- Nikkei up 0.9% to 32,287.21

- Topix up 0.4% to 2,286.59

- Hang Seng Index up 2.1% to 18,212.17

- Shanghai Composite up 0.1% to 3,082.24

- Sensex little changed at 65,375.15

- Australia S&P/ASX 200 up 0.5% to 7,182.11

- Kospi up 1.3% to 2,537.68

- STOXX Europe 600 up 0.6% to 456.19

- German 10Y yield little changed at 2.48%

- Euro little changed at $1.0862

- Brent Futures little changed at $83.18/bbl

- Gold spot up 0.3% to $1,921.13

- U.S. Dollar Index little changed at 103.47

Top Overnight News from Bloomberg

- China is attempting to defuse risks from its $9 trillion pile of off balance-sheet local government debt, without resorting to major bailouts.

- Federal Reserve Chair Jerome Powell is expected to map out final steps in the US central bank’s campaign to tame inflation, and reinforce its commitment to finishing the job, when he speaks Friday in Jackson Hole, Wyoming.

- European natural gas prices tumbled on signs that a labor dispute at Australia’s biggest liquefied natural gas export plant will be resolved, easing fears about one of three possible strikes in the key exporting nation.

- Sweden’s housing starts extended a plunge into the second quarter as lower home prices and rising construction costs put the brakes on building activity.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher as the region took impetus from the gains on Wall St. where the Nasdaq led the advances across the major indices as yields declined in the aftermath of weak PMI data and with futures also boosted by strong Nvidia earnings. ASX 200 was positive amid the continued influx of earnings and as strength in tech and financials atoned for the underperformance in the defensive sectors. Nikkei 225 extended above the 32,000 level with semiconductor names in Asia riding the Nvidia wave. KOSPI was boosted with the index unfazed by North Korea’s latest failed ‘satellite’ launch, while the BoK provided no surprises and maintained its base rate at 3.50%, as unanimously expected. Hang Seng and Shanghai Comp conformed to the upbeat mood in which the Hong Kong benchmark climbed back above 18,000 amid tech strength, although gains in the mainland were limited after the PBoC’s liquidity drain and as participants await more big bank earnings.

Top Asian News

- TEPCO began the water release from the Fukushima plant and said no abnormalities were identified with the seawater pump or surrounding facilities. China’s Foreign Ministry said China firmly opposes and strongly condemns Japan’s release of Fukushima water into the sea, while it added that it is a major nuclear safety issue with cross-border implications and that Japan has not proved the legitimacy of the decision.

- BoK kept its base rate unchanged at 3.50% as expected, with the decision unanimous and said it will maintain a restrictive policy stance for a considerable time. BoK noted that the domestic economic growth is expected to improve gradually and it maintained 2023 GDP growth and inflation forecasts at 1.4% and 3.5%, respectively, but cut its 2024 GDP growth forecast to 2.2% from 2.3%. BoK Governor Rhee said 6 out of 7 members wanted to keep the door open for one more hike and that it is too early to talk about a rate cut but does not want to rule out the possibility of a cut within this year. Furthermore, Rhee said uncertainty is very high regarding US monetary policy and that it is undesirable to comment on whether South Korea can cut interest rates before the US, while he also noted Interest rates are at the upper end of the neutral range or higher.

- Chinese President Xi says Chinese financial institutions are about to launch a special USD 10bln fund to implement global development initiative

European bourses remain in the green but have trimmed markedly from initial highs in limited fresh newsflow, Euro Stoxx 50 +0.1%. NQ +1.0% outperforms among US futures alongside the European tech sector after blockbuster earnings from NVIDIA +7.7% pre-market, see below for more detail. Sectors more broadly are in the green, with Real Estate benefitting from the ongoing yield pullback while Basic Resources are pressured. Stateside, futures are in the green with NVDA exerting influence though the session’s focus is switching to Jackson Hole as Fed’s Harker & Collins are due before Chair Powell on Friday, ES +0.4%.

Top European News

- UK NHS senior doctors announced to conduct three consecutive days of strike action during the ruling Tory party’s annual conference in October, according to FT.

- Italy is reportedly preparing a new rule for bad loans, via Bloomberg citing sources; looking to approve a borrower-friendly measure on such loans by end-2023.

FX

- Buck bounces broadly from post-US PMI lows as UST spreads to debt rivals re-widen, DXY towards top of 103.630-270 range

- Kiwi and Aussie lag after recent outperformance on risk and commodity strength, as NZD/USD and AUD/USD drift down from high 0.5900 and 0.6400 levels to straddle 0.5940 and 0.6445.

- Yen unwinds recovery gains between 144.61-145.43 bounds and Euro fades within 1.0876-48 range amidst raft of USD/JPY and EUR/USD option expiries spanning much bigger parameters.

- PBoC set USD/CNY mid-point at 7.1886 vs exp. 7.2791 (prev. 7.1988)

- South African President Ramaphosa says BRICS group will invite Iran, Egypt, Argentina, Ethiopia, Saudi Arabia and UAE to become a new member; says membership of new countries will take effect 1 Jan 2024.

Fixed Income

- Bunds and Gilts push post-PMI boundaries before running out of steam between 133.36-132.69 and 94.95-51 respective ranges.

- T-notes lag within narrow 109-31+/109-24 band pre-US data and Fed commentary and in wake of lacklustre 20 year sale.

Commodities

- Crude benchmarks spent the first half of the session under modest pressure but has lifted into positive territory and remains around session high following the Chevron vote headlines (see below).

- Currently, WTI & Brent Oct are in proximity to their respective highs around USD 78.90/bbl and USD 83.00/bbl respectively.

- Back to Chevron, the update also lifted the nat gas complex; but, benchmarks remain hampered on the session after the update from Woodside around a in-principle agreement before a vote later today.

- Spot gold is mildly firmer despite the stronger USD and comparably contained bond action; technicals feature including the 21- and 50-DMAs at USD 1920/oz and USD 1931.4/oz respectively. Base metals are pressured by the above USD action.

- Woodside Energy (WDS) said it continues to engage actively and constructively in the bargaining process with unions over Australian LNG facilities and substantial progress was made in talks and parties reached an in-principle agreement on a number of issues, while it added that it has not received any notices of protected industrial action. Furthermore, the Australian union said members at Woodside’s LNG facilities will meet today to discuss an in-principle agreement reached with the Co. by their negotiating team and that Woodside made their members a strong offer without industrial action being taken.

- Members of the Woodside (WDS AT) North West Shelf facility are set to vote on the in-principle agreement today at 12:30BST/07:30ET, via Reuters.

- Workers at Chevron’s (CVX) Australian LNG facilities vote to allow unions to call strikes if needed, according to the union cited by Reuters; over 99% of the 433 workers that voted were in favour of taking action.

- NHC says there is a 50% chance of a cyclone forming in the next 48hrs from the storm south of Southern Mexico and a 40% chance from the storm near the Baja California peninsula.

- Hungarian PM Orban’s Chief of Staff says the EU should extend restrictions on the import of Ukrainian grains after September 15th. If this does not occur, prepared to impose unilateral import restrictions beyond September 15th.

Geopolitics

- Russian military said it downed three Ukrainian drones over Russian regions, according to Reuters.

- Russia’s Defence Ministry says they have scrambled a MiG-31 jet to intercept a Norwegian military plane over the Barents Sea, via Reuters citing agencies. Follows similar action earlier in the week.

- North Korea conducted a launch that prompted Japan to issue an emergency warning for the Okinawa prefecture and told residents to take cover indoors or underground. However, Japan’s government later stated that the missile had flown past and towards the Pacific Ocean, while it also lifted the emergency warning for the Okinawa prefecture.

- South Korea’s Foreign Minister spoke with US and Japanese counterparts and they strongly condemned North Korea’s ballistic missile launch which was said to be disguised as a space launch, as well as agreed to consider unilateral sanctions in response, according to Reuters.

- South Korean military said it views North Korea’s launch as a failure and a clear violation of UN resolutions, while it added that joint drills with the US will continue at an intensive level and it will monitor North Korea’s various activities and stay alert to any provocations, according to Reuters.

- Japanese Chief Cabinet Secretary Matsuno said Japan will lodge a protest to North Korea in the strongest possible terms following missile tests and will soon convene a national security committee meeting.

- The White House said President Biden’s national security team is assessing the North Korean situation in close coordination with allies and partners, while it added the door has not closed on diplomacy but Pyongyang must immediately cease provocative actions.

US Event Calendar

- 08:30: Aug. Initial Jobless Claims, est. 240,000, prior 239,000

- Aug. Continuing Claims, est. 1.71m, prior 1.72m

- 08:30: July Durable Goods Orders, est. -4.0%, prior 4.6%

- July Durable Goods-Less Transportation, est. 0.2%, prior 0.5%

- 08:30: July Cap Goods Orders Nondef Ex Air, est. 0.1%, prior 0.1%

- July Cap Goods Shipments Nondef Ex Air, est. 0.1%, prior 0.1%

- 08:30: July Chicago Fed Nat Activity Index, est. -0.22, prior -0.32

- 11:00: Aug. Kansas City Fed Manf. Activity, est. -10, prior -11

DB’s Jim Reid concludes the overnight wrap

Concerns about a hard landing gathered pace over the last 24 hours, which triggered a major rally as speculation mounted that central banks might press pause on their rate hikes. Those fears were driven by several factors, but the biggest were the downside surprises in the flash PMIs, which suggested the global economy was quite a bit weaker in August than previously thought. At the same time, we also found out that US mortgage rates had hit their highest level since 2000, whilst data revisions suggested that nonfarm payrolls were set to be revised lower as well. The main good piece of news (which further boosted equities) came from Nvidia after the US close, who reported another strong outlook thanks to demand for AI processers. That’s meant futures on the NASDAQ 100 are up +1.24% this morning, after the index already rose +1.60% in yesterday’s session.

The mostly downbeat macro newsflow has put a dent in the more optimistic narratives over recent weeks, where promising inflation data had led to growing hopes about a soft landing. It remains to be seen what will happen next, but the big question now is whether this data shows that the fastest monetary tightening in generation is starting to weigh on the economy, or whether this is a more temporary patch of weak numbers like we saw in late 2022. Ifit is a more permanent sign of weakness, and we start to get further downside data surprises, then markets could well prove validated in their view that we’ve likely seen the last rate hike already from the Fed. On the other hand, the consistent surprise of this cycle so far has been just how resilient the major economies have been to all these rate hikes, and central banks like the Fed have repeatedly raised their estimates for the terminal rate as a result.

As we await Fed Chair Powell’s speech at Jackson Hole tomorrow, this challenge means that central bankers have a much harder time relative to last year. Bear in mind that a year ago, CPI inflation in both the US and the Euro Area was still running above 8%, so the way forward was pretty clear for policymakers. But now inflation has fallen by some distance, there’s much more doubt about how sticky it will end up proving, and thus how much more central bankers still need to do.

The first signs of concern yesterday came shortly after the European open, when we had the French and German flash PMIs for August. Both came in beneath expectations, with the French composite PMI unchanged at 46.6 (vs. 47.1 expected), whilst the German composite PMI deteriorated further to 44.7 (vs. 48.3 expected). So both were some way beneath the 50-mark that separates expansion from contraction, and for Germany it was the weakest composite PMI reading since May 2020, back when Europe was still experiencing the initial wave of Covid lockdowns.

After those had come through, it was then little surprise that the overall Euro Area reading deteriorated as well, with the composite PMI falling back to 47.0 (vs. 48.5 expected), its lowest since late 2020. Notably, it was services (-2.6pts to 48.3) that led the decline with the previous resilience from H1 fading. It was a similar story in the UK, where the composite PMI fell to 47.9 (vs. 50.4 expected), which was the first contractionary reading since January. And in turn, that led investors to dial back the amount of rate hikes they were expecting over the coming months. Overnight index swaps moved to price only a 30% chance of another ECB hike at the September meeting, down from a more-likely-than-not 56% the previous day.

Those releases led to a huge rally among sovereign bonds, with yields seeing significant declines on both sides of the Atlantic. In Europe, yields on 10yr bunds (-12.7bps), OATs (-13.0bps) and BTPs (-12.7bps) all fell significantly, whilst UK gilts (-17.4bps) saw an even larger decline. Over in the US, yields also moved further off their recent highs, with the 10yr Treasury yield down -13.2bps to 4.192%, whilst the 2yr yield was down -7.9bps to 4.967%. In FX, the euro fell to a 2-month low of 1.080 against the dollar intra-day, but ended up reversing the decline (+0.12% at the close) as soft US data boosted the rally in Treasuries.

Although yields were moving back down yesterday, we also had fresh evidence that the bond selloff over recent weeks was having an increasing effect on the real economy. For example, the US Mortgage Bankers Association said that the average 30yr fixed-rate mortgage had risen to 7.31% over the week ending August 18, which is its highest level since December 2000. In addition, the index of home-purchase applications fell to its lowest level since 1995, which demonstrates the effect that higher rates have had on housing activity.

When it came to the US economy, sentiment also took a hit from a couple of other indicators. The first was the flash PMIs, where the composite PMI was only barely in expansionary territory at 50.4 (vs. 51.5 expected). And second, we found out from the Bureau of Labor Statistics that nonfarm payrolls through March 2023 were likely to be revised down by -306k, although we won’t get the final revision until the jobs report for January 2024 comes out next February.

Despite the growing signs of economic weakness, equities actually had a pretty good day, although that was in large part as investors grew more confident that central banks would pause their rate hikes, coupled with renewed optimism on tech stocks. By the close of trade, the S&P 500 had advanced +1.10%, and Europe’s STOXX 600 was up +0.39%. A tech rally saw the NASDAQ (+1.59%) post its strongest gain since late July, while the FANG+ index was up +2.31%.

After the close last night, we then heard from Nvidia, which strongly outperformed expectations in Q2 with $13.5bn of revenue and an upgrade to its Q3 revenue expectations to $16bn. Nvidia’s share price was up over +6%% in after-hours trading, and this morning NASDAQ 100 futures are trading +1.24% higher, with those on the S&P 500 up +0.68%.

Overnight in Asia we’ve seen a very similar pattern to the US and Europe. Equities have rallied significantly, with the Hang Seng (+1.91%), the CSI 300 (+0.98%), the Shanghai Comp (+0.47), the Nikkei (+0.51%) and the KOSPI (+1.04%) all seeing a decent advance. Separately, the Bank of Korea left their policy rate unchanged at 3.50%, in line with expectations. But they also said that they would “maintain a restrictive policy stance for a considerable time”, and the won has strengthened +1.29% against the US Dollar this morning.

Looking at yesterday’s other data, US new home sales in July rose to their highest level in 17 months, rising to an annualised rate of 714k (vs. 703k expected). However in the Euro Area, the European Commission’s preliminary consumer confidence reading for August came in at -16.0 (vs. -14.5 expected), falling back from its July level when it reached its highest since Russia’s invasion of Ukraine began.

To the day ahead now, and US data releases include the preliminary July readings for durable goods orders and core capital goods orders, the weekly initial jobless claims, as well as the Kansas City Fed’s manufacturing activity for August. Central bank speakers include the Fed’s Harker and Collins. And today also marks the start of the Kansas City Fed’s annual Economic Policy Symposium at Jackson Hole.

A Crashed 1954 Ferrari Fetches $1.9 Million At Monterey Auction

A Crashed 1954 Ferrari Fetches $1.9 Million At Monterey Auction  Nvidia Erupts To New Record High On Blowout Q2 Earnings, Whisper-Shattering Q3 Guidance, And New $25BN Buyback

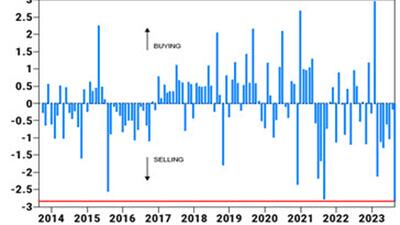

Nvidia Erupts To New Record High On Blowout Q2 Earnings, Whisper-Shattering Q3 Guidance, And New $25BN Buyback  Hedge Funds Dump Record Amounts Of Chinese Stocks In Longest Selling Stretch On Record

Hedge Funds Dump Record Amounts Of Chinese Stocks In Longest Selling Stretch On Record