Don’t Miss the Bigger Crypto Picture Behind Cancelled Uptober

With a negative return of 3.69%, this year’s Uptober for Bitcoin was cancelled. Since 2013, this marked only the third time October had defied the historical trend. The markets have also seen stark divergence between two currency devaluation hedges – gold and Bitcoin. While gold advanced nearly 59% this year, Bitcoin is barely afloat with an 8.4% return.

And although Bitcoin is still the key driver of the wider altcoin market, there have been plenty of exceptions that defied the trend. The decentralized cloud solution for Web3, Internet Computer Protocol (ICP), has been buoyed over the last month, gaining 74% on its launch of caffeine.ai, especially after the Amazon Web Services (AWS) outage in late October.

Likewise, high-performance decentralized derivatives exchange, Hyperliquid (HYPE), has seen 137% year-to-date gains. In other words, the crypto market should be viewed with a more discerning lens to capitalize on opportunities.

But can we gauge the overall market sentiment moving forward into 2026 and beyond?

Global Investor Sentiment

With Bitcoin’s seasonal rhythm broken and altcoins showing selective strength, it is worth paying attention to structural trends. When President Trump was inaugurated in January, this was a major signal for investors – as a departure from the aggressively hostile Biden administration when it comes to crypto assets.

After all, President Trump was the first to attend crypto-related conferences, not only as a presidential candidate at 2024 Bitcoin Conference in Nashville, but as a sitting president addressing the Blockworks Digital Asset Summit in March.

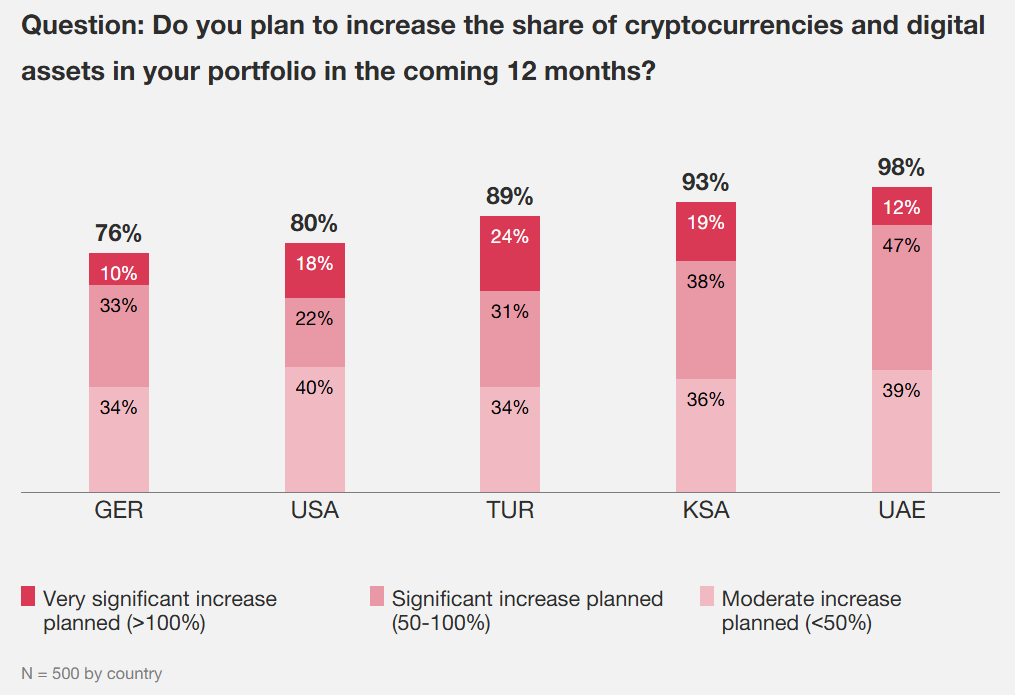

This sentiment was reflected in various surveys. Case in point, for that period, between January 30 to February 11, PwC’s Strategy & Crypto Survey showed significant commitment to digital assets across countries.

The most recent survey by PwC and Alternative Investment Management Association (AIMA) in early November, for the first six months of 2025, showed that 55% of hedge funds hold digital assets, 8% higher from last year. Although over half of funds place their crypto allocations under 2%, the average crypto holdings at 7% still represents a significant interest uptick.

This is especially notable when one considers surveyed AIMA investors are in charge of $982 billion worth of assets. More importantly, the structural rails are being laid out by the institutional stablecoin support—reflecting a broader investment landscape where digital assets increasingly sit alongside traditional instruments such as stocks that pay dividends in diversified portfolios.

Stablecoins as Emerging Blockchain-Native Capital Rails

President Trump’s advisor on all things related to AI and crypto, David Sacks, made it clear last week that crypto market structure legislation is likely, enjoying rare bipartisan support. This is on top of the already passed stablecoin-focused GENIUS Act in July with a 308-122 vote in the House of Representatives.

However, these regulatory tailwinds for the crypto market should not be understood as USG doing the market a favor. Rather, they represent a deliberate step toward a broader monetary objective. This mission became clear once USG, together with the Federal Reserve, abandoned its central bank digital currency (CBDC) plan.

What is this overarching monetary goal that benefits the crypto market?

The Deutsche Bank Research Institute pinned it down in its September 14-page paper titled “STABLECOINS: How the GENIUS Act Strengthenes US Geopolitical Dominance”. In a scenario of a USD-based CBDC, the global market would have become increasingly wary of direct U.S. surveillance over money flows, likely accelerating de-dollarization already pursued by BRICS-aligned nations.

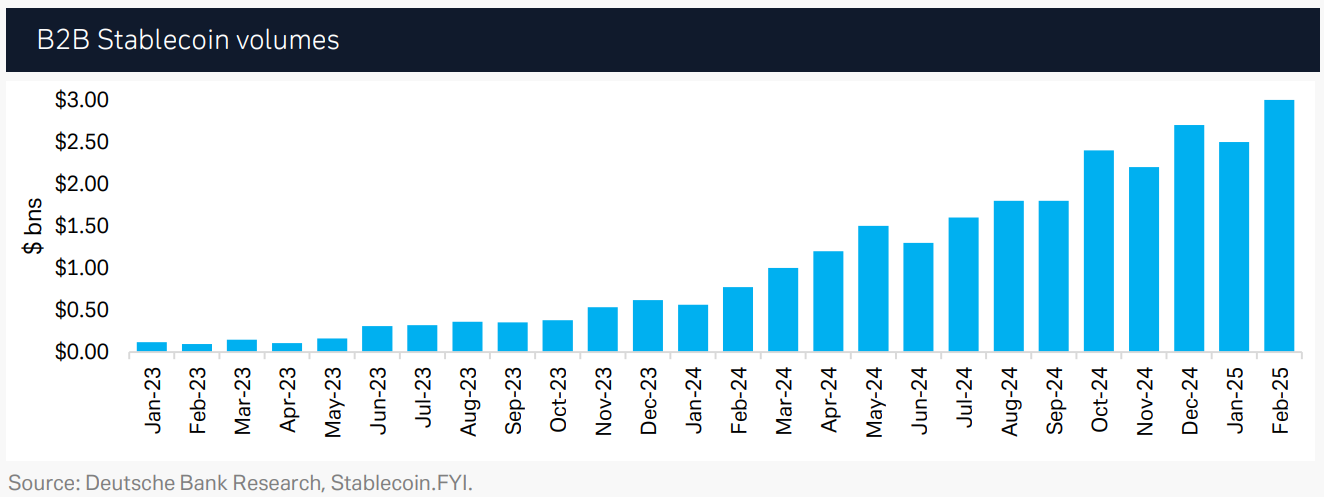

Instead, the powers that be wisely chose a far more adaptable and immediate path – empowering stablecoins. Already, stablecoins have established themselves as near-frictionless payment means when it comes to remittances and B2B payments.

The latest Q3 earnings from Circle Internet Group (NYSE: CRCL), the issuer of stablecoin USDC, further illustrates the rise of stablecoins, as the company’s stablecoin circulation increased 108% year-over-year to $73.7 billion. In fact, Circle’s upcoming Arc Network blockchain is just the beginning for this expansion.

Yet, in addition to boosting USG’s global monetary power by making tokenized USD the default for invoicing, stablecoins serve another great purpose. Namely, be they privately-held like Tether or publicly traded like Circle, these companies back their stablecoins with short-dated Treasuries. This means that USG gains more finance options as the demand for T-bills rises.

Of course, this dynamic then feeds back into USG’s tendency to keep expanding its already astronomic debt load, leaving crypto investors with the following interplay:

- USG digitizes global USD flows with stablecoins.

- The USD gains an even greater global foothold.

- Cementing USD as world reserve currency increases the likelihood for more money printing.

- The central bank’s money printing to monetize debt, which inevitably sustains inflation and fiat erosion, increases demand for capped digital assets.

As this process unfolds, it then becomes much easier for both retail and hedge funds to gain exposure to dollar-denominated yields within the crypto ecosystem itself.

The Bottom Line

Bitcoin veterans have become accustomed to the process of weak hands giving up their assets to strong hands. When Bitcoin crossed the $100k milestone this May, this process became particularly acute. Yet, when it all comes down to it – energy is finite – money printing is not.

Smart money understands this, and all the regulatory barriers are being removed to make smart money flow more efficiently into crypto’s structural foundations. Although speculation plays a part, this is being done more in line for strategic positioning in a digitized monetary future.

In the end, the rebellion against fiat didn’t end money printing – it just made it programmable. Therefore, despite the cancelled Uptober, it would be a mistake for investors to not see how stablecoins and blockchain rails are quietly reshaping global money flows.