Deloitte Claims Bitcoin Could Help Governments Create Cheaper CBDCs

A new report from financial services giant Deloitte has highlighted the potential of Bitcoin to form the base of a cheaper, faster and more secure ecosystem for digital fiat and central bank digital currencies (CBDCs).

Existing Problems Recognised

Deloitte’s report acknowledged the need for a total revamp of the current fiat financial system, suggesting it was “slow, error-prone and expensive relative to performance in other high-tech industries”.

At its core, the report highlights five areas where leveraging the qualities of Bitcoin may be able to improve the current system. In fact, in 2015 the US Federal Reserve released a paper outlining its goal to “improve the speed and efficiency of the payment system from end-to-end over the next decade”. Its key outcomes included:

- speed – ubiquitous, safe, faster electronic solution(s);

- security – very strong security and high levels of public confidence;

- efficiency – reduce the average end-to-end (societal) cost of payment;

- cross-border payments – affordable international transfers; and

- collaboration with other payment participants – widespread participation with all payment participants.

Deloitte Offers Hybrid Solution

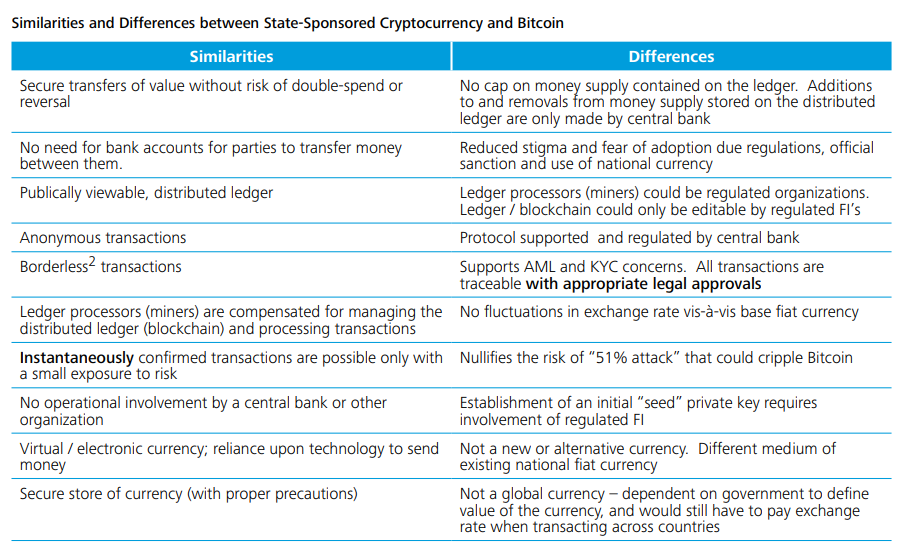

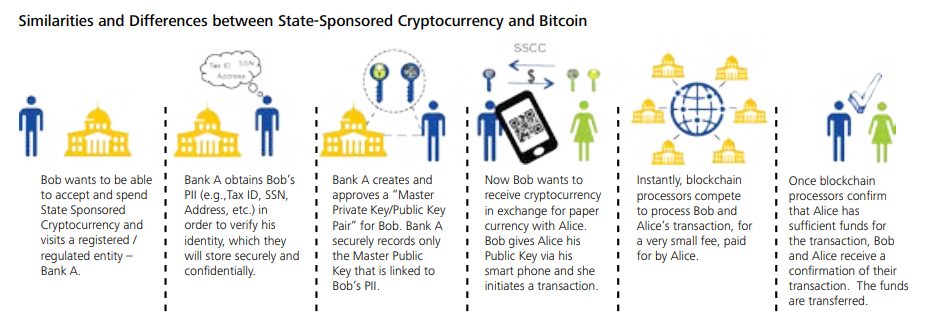

Having identified the problems, Deloitte continues to offer its solution – a blend of the best attributes of Bitcoin and newly established CBDCs and digital fiat.

This, Deloitte argues, would cut costs, reduce errors, increase speed, and simultaneously maintain the privacy and anonymity of user transactions.

Throughout the report, much of the emphasis rested on one of Bitcoin’s most widely acknowledged value propositions – genuine decentralisation:

With the capacity to do so without relying on a centralised entity for day-to-day operations, whether commercial or federal, the effect might be really transformative.

Deloitte report

The report argued that Bitcoin was not a substitute for CBDCs and vice versa – instead, they would co-exist and provide greater consumer choice:

Bitcoin could ultimately spawn a series of new opportunities that would transform the current payments system into one that is faster, more secure, and less expensive to run.

Deloitte report

While this isn’t Deloitte’s first venture in the crypto ecosystem, the report has caused some controversy. How do you integrate the best qualities of a decentralised, uncensorable fixed supply digital asset such as Bitcoin with a centralised, unlimited supply CBDC?

Arguably this is impossible given that in many respects, they represent the antithesis of each other. Well, that seems to be what Bitcoiners think: