Crypto Broker ‘Voyager’ Files for Bankruptcy Amid Three Arrows Default

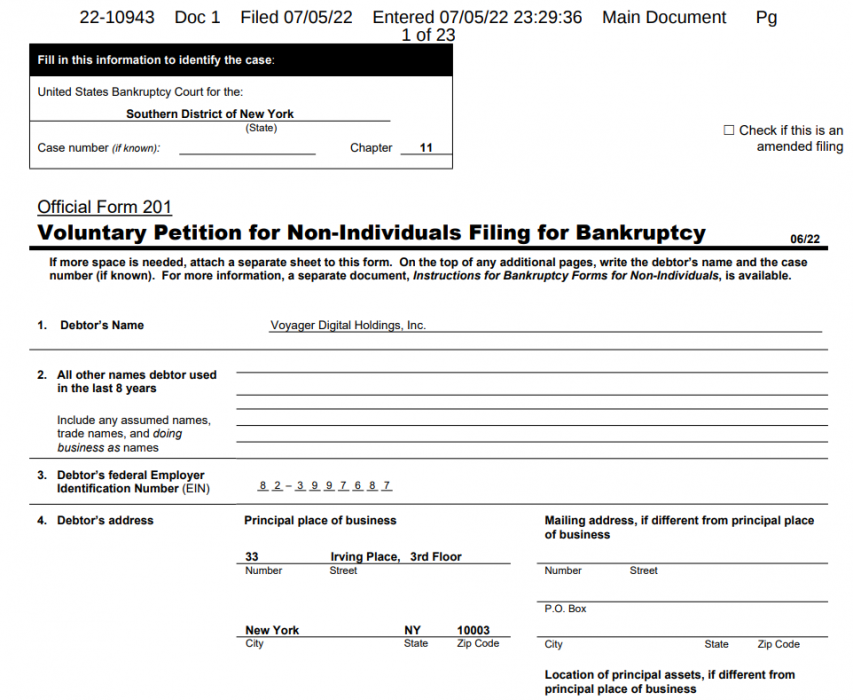

In a move that will surprise no one even remotely invested in the digital assets space, crypto exchange Voyager Digital has this week filed for Chapter 11 bankruptcy as a result of exposure to failed hedge fund Three Arrows Capital (3AC) and a foundering crypto market.

Voyager ‘Has a Plan’

Said to be owing anywhere from US$1 billion to $10 billion in assets to more than 100,000 creditors, Voyager pleads that its voluntary bankruptcy move is part of a “reorganisation plan” that, once implemented, would enable clients to re-access their accounts. In so doing, Voyager says it would “return value to customers”.

Detailing the plan, Voyager CEO Stephen Ehrlich said customers with crypto in their accounts would receive a combination of crypto, proceeds from the 3AC recovery, common shares in the newly reorganised company, and Voyager tokens:

Ehrlich added that customers with US dollars in their accounts would be able to access those funds after a “reconciliation and fraud prevention process is completed with Metropolitan Commercial Bank”.

However, the bank has since clarified that its FDIC (Federal Deposit Insurance Corporation) cover does not apply in the event that Voyager fails:

FDIC insurance coverage is available only to protect against the failure of Metropolitan Commercial Bank. FDIC insurance does not protect against the failure of Voyager, any act or omission of Voyager or its employees, or the loss in value of cryptocurrency or other assets.

Metropolitan Commercial Bank statement

SBF to the Rescue?

Voyager’s announcement comes after trading firm Alameda Research, founded by FTX CEO Sam Bankman-Fried (aka SBF), led a US$60 million fundraising round for the crypto lender in May. Less than a fortnight ago, SBF warned that some “third-tier” crypto exchanges were secretly insolvent. Surely he’d seen the writing on the wall for Voyager?

Earlier this month, Voyager halted all trading and withdrawals on its platform, citing 3AC’s default on a US$650 million loan. In response, Alameda extended to Voyager a massive credit line made up of nearly US$200 million in cash and 15,000 bitcoin. Good money after bad?

Voyager says it intends to pay its employees in the usual manner and continue its “primary benefits and certain customer programs without disruption”. Trading, deposits, withdrawals and loyalty rewards, however, will remain suspended.