Crypto Analytics Firm Santiment’s Breakdown of XRP’s Recent Price Explosion

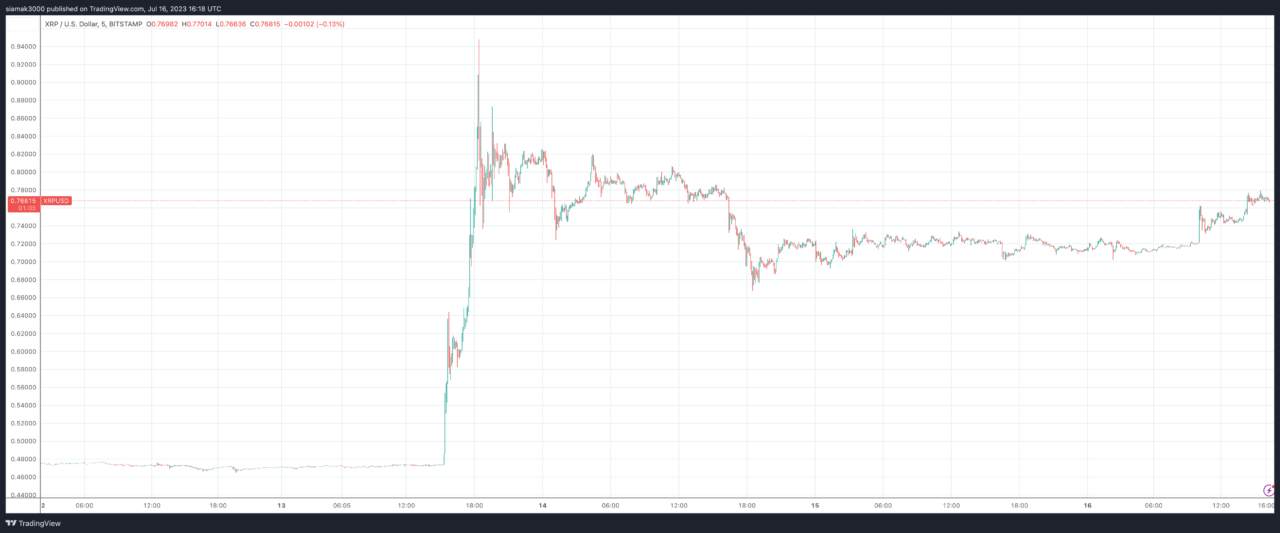

In a recent blog post by blockchain analytics firm Santiment, the crypto world was taken by storm as XRP experienced an astounding 87% surge within just three hours. This significant price increase was accompanied by a notable rise in trading volume and a surge in on-chain metrics for XRP, now the fifth-ranked asset by market cap.

Source: TradingView

Source: TradingView

The trigger for this dramatic price movement, as reported by Santiment, was a court ruling in the ongoing lawsuit between the SEC and Ripple. The court’s decision was that XRP — as sold on crypto exchanges — should not be considered a security in the U.S., a verdict that has sparked excitement within the XRP community. This ruling removes a significant regulatory hurdle for XRP, potentially encouraging more investment due to the financial advantages and increased freedom that come with non-security assets.

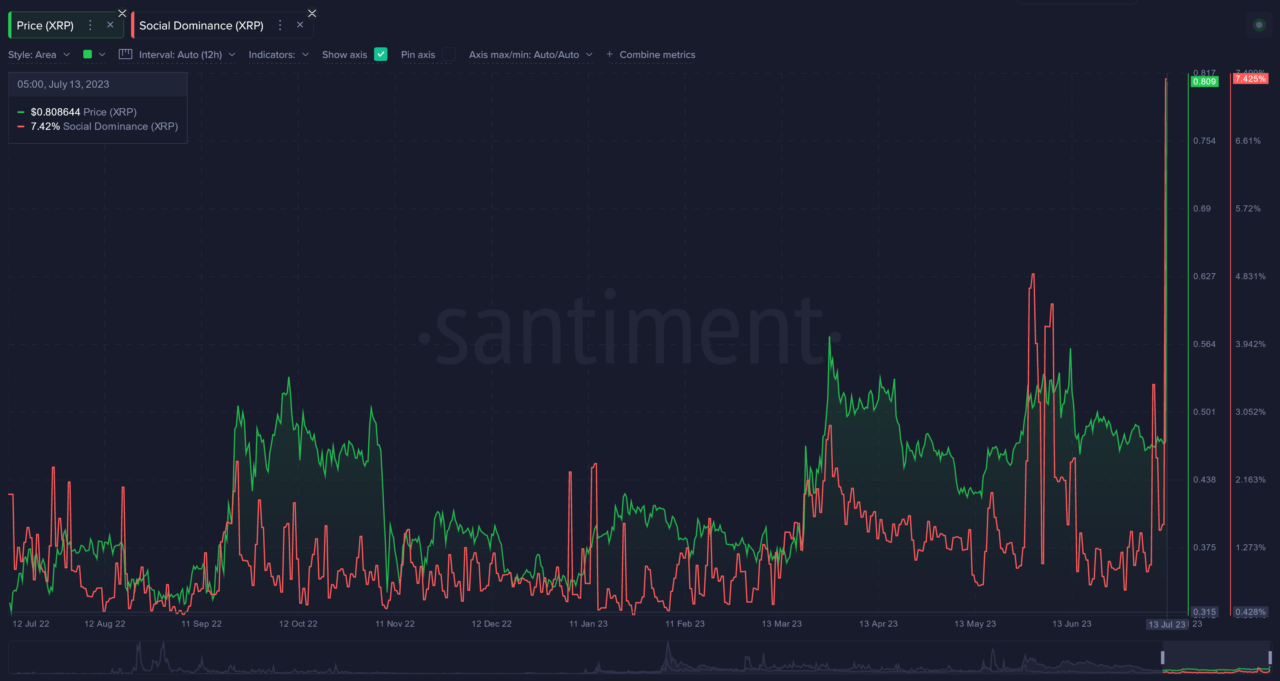

Santiment’s analysis shows that the market’s response to this ruling was immediate and intense. XRP’s social dominance, which measures the percentage of discussions about an asset compared to all top 100 market cap assets, soared to 7.4% of all discussions. This level of attention is the highest it’s been since January 2021. While Santiment expects a cooldown period after such a surge, they suggest that a second pump wave could occur once traders shift their focus elsewhere.

Source: Santiment

Source: Santiment

According to Santiment, whale transactions on the XRP network, those valued at $100,000 or more, also reached their highest level of 2023. A total of 637 such transactions were recorded, indicating that these large transactions were fueling the price pump. Interestingly, Santiment noted a long-standing accumulation trend by these large stakeholders that began back in early May, even before the court ruling.

Santiment also reported that trading volume soared, reaching over 4.46 billion, the highest level seen in over ten months. Active 30-day addresses saw an average trading return of 23.7%, while active 365-day addresses saw an average return of 43.2%. These high returns are expected to normalize without XRP needing to relinquish all or even half of its gains.

While the news of XRP being labeled as a non-security is undoubtedly bullish, Santiment advises caution, suggesting that there is almost always a cool-off period after an initial euphoric rise:

“However, this news of XRP being labeled as a non-security is much more definitive news, so it is still undoubtedly a bullish outcome. But if you’re planning to enter or add on to your position in XRP, just understand that there is almost always a cool-off period after an initial euphoric rise.“