Coinbase Unveils Mag7 + Crypto Equity Index Futures

- The Mag7 + Crypto Equity Index Futures will merge leading US technology stocks with crypto ETFs, giving investors concurrent exposure to both traditional equities and digital assets.

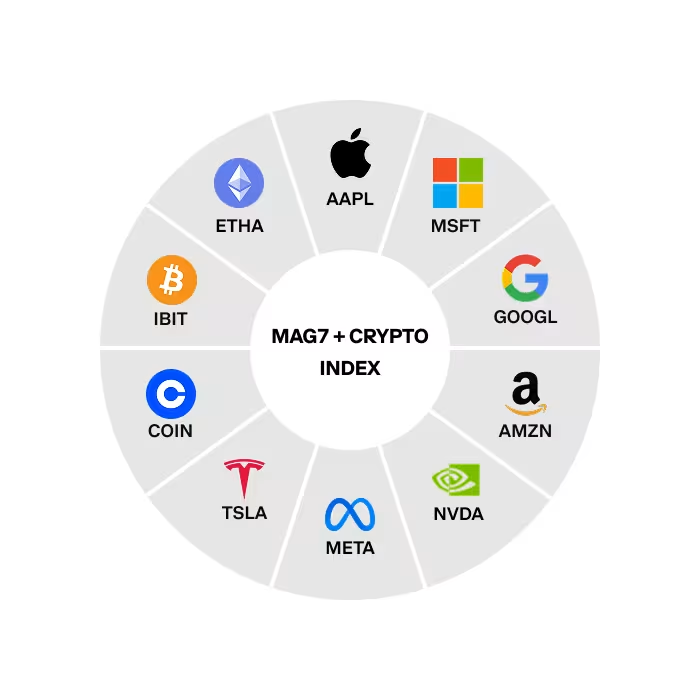

- The index contains ten equally weighted components, including tech giants, Coinbase stock, and BlackRock crypto ETFs, rebalanced quarterly.

- Futures contracts are cash-settled monthly, offering exposure to innovation, diversification, and multi-asset risk management amid declining Q2 trading volumes.

Coinbase is expanding its derivatives platform with the launch of Mag7 + Crypto Equity Index Futures, combining US technology stocks with crypto ETFs for the first time in a US-listed futures product. Trading will begin on 22 September, offering investors exposure to both traditional and digital markets simultaneously.

The index includes the “Magnificent 7” tech giants – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla – alongside Coinbase stock and BlackRock’s Bitcoin and Ethereum ETFs.

The ten components are each weighted at 10% and rebalanced quarterly to maintain parity, with MarketVector serving as index administrator. The product offers thematic exposure to innovation and growth, combining top tech stocks with crypto assets, while supporting portfolio diversification and multi-asset risk management.

Related: Bitcoin Slips Below US$110K as ETH ETFs Outpace BTC Counterparts

How the Futures Work

Contracts will be cash-settled on a monthly basis, with each contract valued at $1 per index point. An index level of US$3,000 (AU$4,605) would translate to a US$3,000 (AU$4,605) notional value per contract.

The product launch coincides with Coinbase’s efforts to stimulate trading activity following a decline in spot trading volumes and revenues in Q2. The exchange has additionally developed a decentralised exchange integration and explored prediction markets to broaden users’ trading opportunities. The Mag7 + Crypto Equity Index Futures reflect a wider industry trend of bridging traditional finance with digital assets, allowing investors to access equities and cryptocurrencies in a single instrument.

By introducing this hybrid futures contract, Coinbase positions itself to offer traders a new avenue for diversified exposure, enabling engagement with both the performance of established tech companies and the evolving crypto ETF market.

Related: Australia’s Monochrome Bitcoin ETF Tops $177M AUM With 1,002 BTC